Global situation of undertakings for collective investment at the end of May 2020

Press release 20/14

I. Overall situation

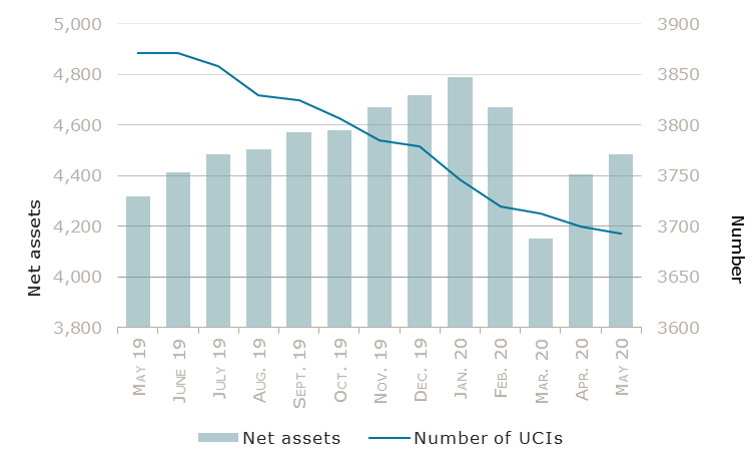

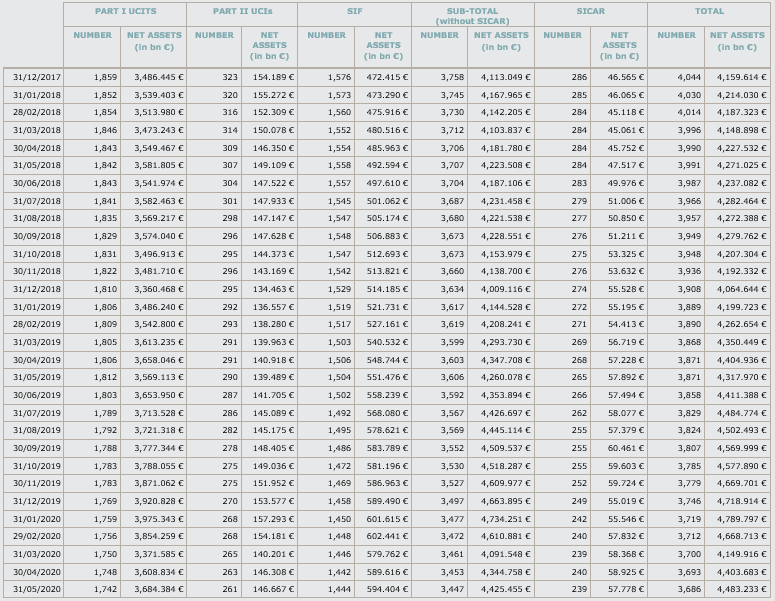

As at 31 May 2020, total net assets of undertakings for collective investment, including UCIs subject to the 2010 Law, specialised investment funds and SICARs, amounted to EUR 4,483.233 billion compared to EUR 4,403.683 billion as at 30 April 2020, i.e. a 1.81% increase over one month. Over the last twelve months, the volume of net assets rose by 3.83%.

The Luxembourg UCI industry thus registered a positive variation amounting to EUR 79.550 billion in May. This increase represents the sum of positive net issues of EUR 36.462 billion (+0.83%) and of the positive development in financial markets amounting to EUR 43.088 billion (+0.98%).

The development of undertakings for collective investment is as follows:

The number of undertakings for collective investment (UCIs) taken into consideration totalled 3,686 as against 3,693 in the previous month. A total of 2,414 entities adopted an umbrella structure, which represented 13,455 sub-funds. When adding the 1,272 entities with a traditional structure to that figure, a total of 14,727 fund units were active in the financial centre.

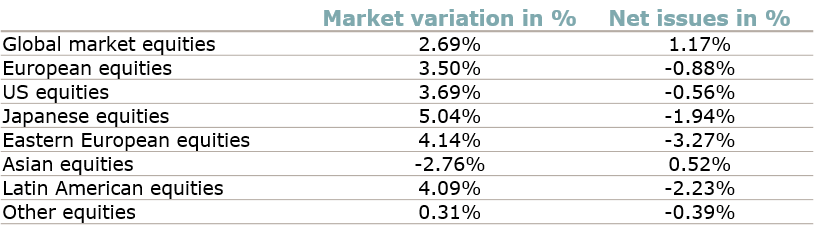

As regards, on the one hand, the impact of financial markets on the main categories of undertakings for collective investment and, on the other hand, the net capital investment in these UCIs, the following can be said about May.

Following the rebound of stock prices in April, equity markets recorded an overall positive trend during the month under review, influenced, notably, by the easing of the lockdown measures which has begun in many developed countries and by the monetary and budgetary support policies. This positive trend has led to decreased volatility in financial markets and to an improvement in bond market liquidity, without achieving to revert to pre-crisis levels.

As far as developed countries are concerned, the European, US and Japanese equity UCI categories have recorded a significant positive performance owing to the budgetary support measures, the continuity of accommodating monetary policies and the gradual easing of the lockdown measures initiated in many developed countries, despite the negative impacts of the health crisis on the economic activity, leading to rather bleak economic indicators as a whole.

As for emerging countries, Eastern European and Latin American equity UCI categories have, globally, followed this rising trend, supported by increasing oil and other raw material prices. However, an opposite trend has been registered for Asian equity UCIs, which ended the month in negative territory, mainly as a consequence of the resurfacing tensions between the US and China as well as the conflicts linked to the situation in Hong Kong.

In May, equity UCI categories registered an overall positive net capital investment.

Development of equity UCIs during the month of May 2020*

* Variation in % of Net Assets in EUR as compared to the previous month

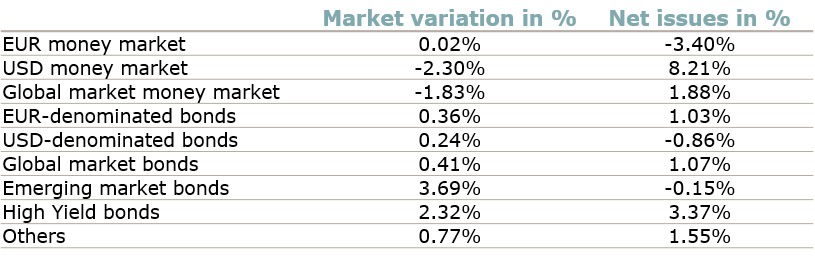

In the euro area, the easing of the lockdown restrictions in many countries following the decline in new COVID-19 cases and a reduced number of downgrades of companies to speculative grade resulted in a renewed interest in risky assets, leading to falling prices for high-rated government bonds and fostering price increases for corporate bonds, associated with a reduction in risk premiums. The prices of low-rated euro-area government bonds also appreciated, supported by the perspective of a large economic recovery plan (“Next Generation EU”) which has been announced by the European Commission. As a consequence, EUR-denominated bond UCIs ended the month in positive territory during the month under review.

In the United States, government bonds remained relatively stable during the month under review due to the stabilising effect of the asset buy-back programme of the Federal Reserve, whereas corporate bonds recorded price increases as a consequence of renewed investor risk appetite. USD-denominated bond UCIs thus recorded price increases for the month of May, partly compensated by the depreciation of the USD against the EUR.

As regards emerging country bonds, the significant price increases recorded by the emerging country bond UCI category can be explained by the renewed appetite for riskier assets, the reduction in risk premiums on these bonds and the key interest rate reductions by many central banks of emerging countries, despite persistent idiosyncratic risks in some emerging countries.

In May, fixed-income UCI categories registered an overall positive net capital investment, UCIs investing in USD and High Yield money market having recorded the highest net subscriptions.

Development of fixed-income UCIs during the month of May 2020*

* Variation in % of Net Assets in EUR as compared to the previous month

The development of net assets of diversified Luxembourg UCIs and of funds of funds is illustrated in the table below.

II. Breakdown of the number and net assets of UCIs

During the month under review, the following nine undertakings for collective investment have been registered on the official list:

UCITS Part I 2010 Law:

- ADITUM INVESTMENT FUNDS, 3, rue Gabriel Lippmann, L-5365 Munsbach

- DEKA-NACHHALTIGKEIT IMPACT AKTIEN, 6, rue Lou Hemmer, L-1748 Findel

- DEKA-NACHHALTIGKEIT IMPACT RENTEN, 6, rue Lou Hemmer, L-1748 Findel

UCIs Part II 2010 Law:

- –

SIFs:

- CBRE GLOBAL ALPHA U.S. TAX EXEMPT PARALLEL FUND FCP-SIF, 177, rue de Luxembourg, L-8077 Bertrange

- EURAZEO CAPITAL III SCSP, 25C, boulevard Royal, L-2449 Luxembourg

- FRANKLIN TEMPLETON SOCIAL INFRASTRUCTURE FUND, S.C.A. SICAV-SIF, 5, Heienhaff, L-1736 Senningerberg

- LONGHORN REF X INTERNATIONAL INVESTMENTS, 42-44, avenue de la Gare, L-1610 Luxembourg

- SWISS LIFE HEALTH CARE DEUTSCHLAND V S.C.S., SICAV-SIF, 4a rue Albert Borschette, L-1246 Luxembourg

- WREF X INTERNATIONAL INVESTMENTS, 42-44, avenue de la Gare, L-1610 Luxembourg

SICARs :

- –

The following 16 undertakings for collective investment have been deregistered from the official list during the month under review:

UCITS Part I 2010 Law:

- AQC 1 SICAV, 287-289, route d’Arlon, L-1150 Luxembourg

- DEKA-EUROGARANT 3, 6, rue Lou Hemmer, L-1748 Luxembourg-Findel

- DWS GLOBAL, 2, boulevard Konrad Adenauer, L-1115 Luxembourg

- MODULOR, 4, rue Thomas Edison, L-1445 Luxembourg-Strassen

- PARWORLD, 10, rue Edward Steichen, L-2540 Luxembourg

- PICTET SELECT, 15, avenue J-F Kennedy, L-1855 Luxembourg

- SAVILLS IM REAL ESTATE SECURITIES INCOME FUND, 5, allée Scheffer, L-2520 Luxembourg

- SSIAM UCITS, 4, rue Jean Monnet, L-2180 Luxembourg

- UNIEURORENTA UNTERNEHMENSANLEIHEN 2020, 308, route d’Esch, L-1471 Luxembourg

- WOODPECKER CAPITAL, 2, place de Metz, L-1930 Luxembourg

UCIs Part II 2010 Law:

- ALCYONE INVESTMENT SICAV, 12, rue Eugène Ruppert, L-2453 Luxembourg

SIFs:

- BI-INVEST COMPARTMENT FUND, SICAV SIF, 23, avenue Monterey, L-2163 Luxembourg

- BI-INVEST ENDOWMENT FUND, SICAV SIF, 23, avenue Monterey, L-2163 Luxembourg

- BI-INVEST MASTER FUND, SICAV SIF, 23, avenue Monterey, L-2163 Luxembourg

- MERIT CAPITAL SICAV-SIF, 1B, rue Jean Piret, L-2350 Luxembourg

SICARs:

- DIAROUGH S.C.A. SICAR, 412F, route d’Esch, L-2086 Luxembourg