Global situation of undertakings for collective investment at the end of August 2020

Press release 20/19

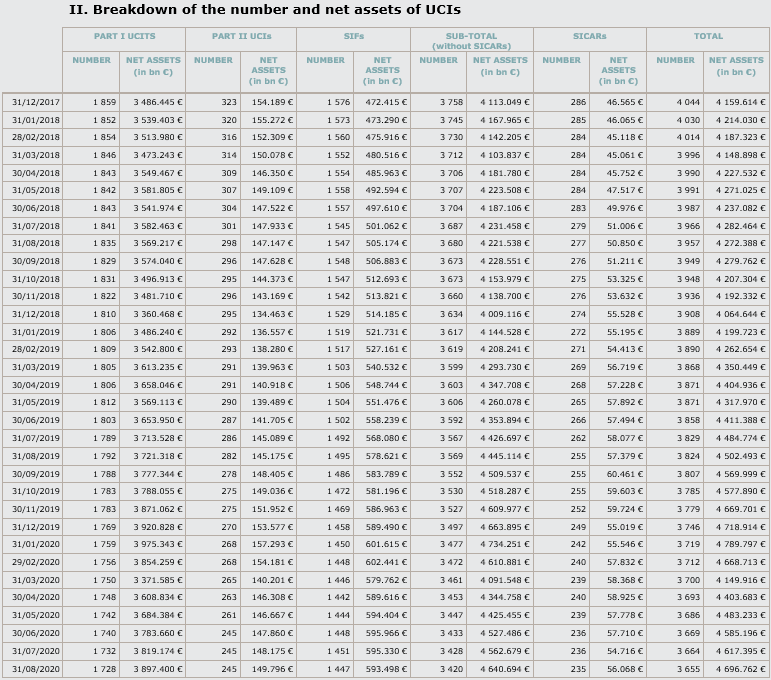

I. Overall situation

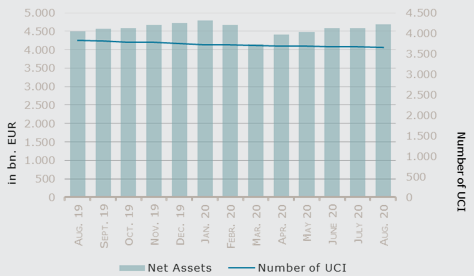

As at 31 August 2020, the total net assets of undertakings for collective investment, comprising UCIs subject to the 2010 Law, specialised investment funds and SICARs, amounted to EUR 4,696.762 billion compared to EUR 4,617.395 billion as at 31 July 2020, i.e. an increase of 1.72% over one month. Over the last twelve months, the volume of net assets rose by 4.31%.

The Luxembourg UCI industry thus registered a positive variation amounting to EUR 79.367 billion in August. This increase represents the sum of positive net capital investments of EUR 13.276 billion (+0.29%) and of the positive development of financial markets amounting to EUR 66.091 billion (+1.43%).

The development of undertakings for collective investment is as follows:

The number of undertakings for collective investment (UCIs) taken into consideration totalled 3,655, against 3,664 the previous month. A total of 2,396 entities adopted an umbrella structure representing 13,427 sub-funds. Adding the 1,259 entities with a traditional UCI structure to that figure, a total of 14,686 fund units were active in the financial centre.

As regards the impact of financial markets on the main categories of undertakings for collective investment and the net capital investment in these UCIs, the following can be said for the month of August:

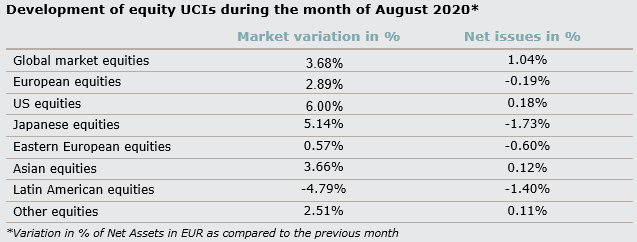

Globally, a better-than-expected second-quarter earnings season in a context marked by the COVID-19 pandemic, sustained accommodative monetary policies among major central banks, rising hopes for a Covid-19 vaccine and the search for riskier assets by investors provided support for equity markets in August.

As far as developed countries are concerned, the European equity UCI category has registered positive returns amid better economic indicators, corporate earnings faring better than expected in Q2, the continuous monetary and budgetary support and the progress made in the development of a COVID-19 vaccine, despite of a resurgence in infection rates across several European countries. The US equity UCI category showed a strong performance on the month under review, mainly driven the better-than-expected earnings season, improved economic indicators and the adoption of an “average inflation target” by the US Federal Reserve (Fed) rising expectations of continued monetary support from the Fed. While the Japanese equity market rallied in August on the grounds of better economic data, a stabilisation of the infection rates in Japan and a continued expansive monetary policy, the depreciation of the Yen against the EUR partly reduced the gains of the Japanese equity UCI category.

As for emerging countries, the Asian equity UCI category enjoyed an overall positive performance aided by robust economic projections, the USD weakness and the prospect for a vaccine against the coronavirus. The Eastern European equity UCI category globally rose in August following from the positive returns generated in several equity markets of the region like Russia, Poland and the Czech Republic, amid improved global economic indicators, the rising energy prices and the authorisation of a COVID-19 vaccine in Russia. While August saw mixed developments in Latin America’s equity markets, the negative performance in countries like Brazil and Chile in combination with the depreciation of some South American currencies pushed the Latin American equity UCI category globally into negative territory.

In August, equity UCI categories registered an overall positive net capital investment.

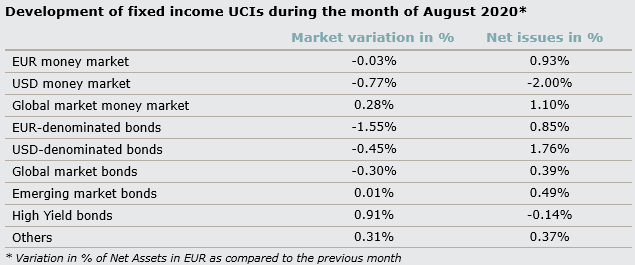

On both sides of the Atlantic, the yields of highly rated government bonds increased in a context marked by better macroeconomic data, the progress made in the development of a vaccine against the coronavirus as well as expectations of higher long-term inflation in the US following from the Fed decision to switch from a fix to an average inflation target. Investment grade corporate bonds followed the upward movement in interest rates, but at the same time registered lower spreads amid an increased risk appetite. As a result of rising yields leading to negative returns on bond prices, the EUR-denominated and USD-denominated bonds UCI categories both saw a decline in August.

In overall, the Emerging market bonds UCI category tracked sideways, under the impetus of increasing interest rates in the United States, a reduction in risk premiums on emerging market bonds and mixed performances in emerging market currencies.

In August, fixed income UCI categories registered an overall positive net capital investment.

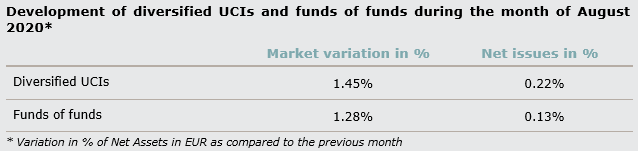

The development of net assets of diversified Luxembourg UCIs and funds of funds is illustrated in the table below:

II. Breakdown of the number and net assets of UCIs

During the month under review, the following eight undertakings for collective investment have been registered on the official list:

UCITS Part I 2010 Law:

- ALLIANZ ADVANCED FIXED INCOME EURO AGGREGATE, Bockenheimer Landstraße 42-44, 60323 Frankfurt am Main1

- MANAGER SELECT, 15, avenue J-F Kennedy, L-1855 Luxembourg

- PING AN OF CHINA ASSET MANAGEMENT FUND, 16, Boulevard d’Avranches, L-1160 LUXEMBOURG

UCIs Part II 2010 Law:

- SF (LUX) GLOBAL PROPERTY FUND, 43, boulevard du Prince Henri, L-1724 Luxembourg

SIFs:

- 3J FUND FCP-SIF, 9A, rue Gabriel Lippmann, L-5365 Munsbach

- ARENA INVEST SICAV-SIF, 2B, rue Albert Borschette, L-1246 Luxembourg

- CACIK FUND, 42, rue de la Vallée, L-2661 Luxembourg

- FONDACO CORPORATES CAPITAL STRUCTURE, 146, boulevard de la Pétrusse, L-2330 Luxembourg

The following seventeen undertakings for collective investment have been deregistered from the official list during the month under review:

UCITS Part I 2010 Law:

- BUILDERS UNION SICAV, 15, avenue J-F Kennedy, L-1855 Luxembourg

- CONCEPT I SICAV, 15, rue de Flaxweiler, L-6776 Grevenmacher

- KEYLUX UMBRELLA, 5, allée Scheffer, L-2520 Luxembourg

- KRUSE & BOCK KOMPASS STRATEGIE, 4, rue Thomas Edison, L-1445 Strassen

- MAP FUND MANAGEMENT, 15, avenue J-F Kennedy, L-1855 Luxembourg

- MOVESTIC SICAV, 12, rue Gabriel Lippmann, L-5365 Munsbach

- UBS (LUX) MONEY MARKET INVEST, 33A, avenue J-F Kennedy, L-1855 Luxembourg

UCIs Part II 2010 Law:

- JINIFE GLOBAL EQUITY FUND – SICAV, 1C, rue Gabriel Lippmann, L-5365 Munsbach

SIFs:

- AZ FUND K, 35, avenue Monterey, L-2163 Luxembourg

- BEGO ALTERNATIVE ASSETS FUND III S.A., SICAV-FIS, 15, rue de Flaxweiler, L-6776 Grevenmacher

- CIVETTA FUND SICAV SIF S.A., 2, boulevard de la Foire, L-1528 Luxembourg

- NEXT ESTATE INCOME FUND, 10, rue Edward Steichen, L-2540 Luxembourg

- NIATROSS INVESTMENTS SICAV-SIF, 58, rue Charles Martel, L-2134 Luxembourg

- SOPAI SIF SICAV, 1C, rue Gabriel Lippmann, L-5365 Munsbach

- VIY GREATER EUROPE HOSPITALITY FUND SICAV-SIF, 5, rue Goethe, L-1637 Luxembourg

- VIY GROWTH FUND-SICAV-SIF, 5, rue Goethe, L-1637 Luxembourg

SICARs:

- RB INTERNATIONAL DEVELOPMENT FUND I S.C.A. SICAR, 5, Heienhaff, L-1736 Senningerberg

1 Undertaking for collective investment for which the designated management company was authorised by the competent authorities of another Member State in accordance with Directive 2009/65/EC.