Global situation of undertakings for collective investment at the end of October 2020

Press release 20/25

I. Overall situation

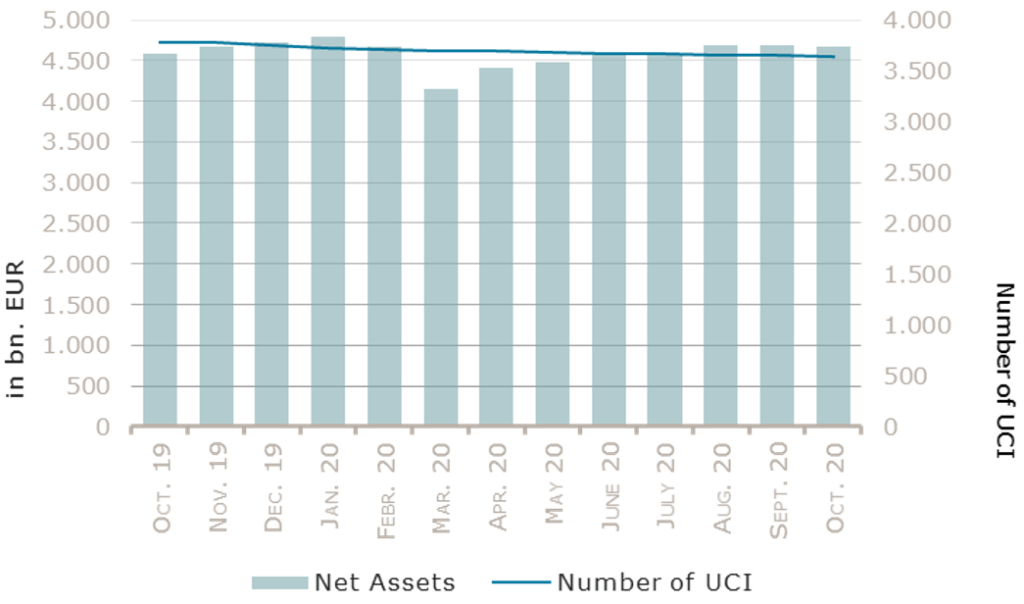

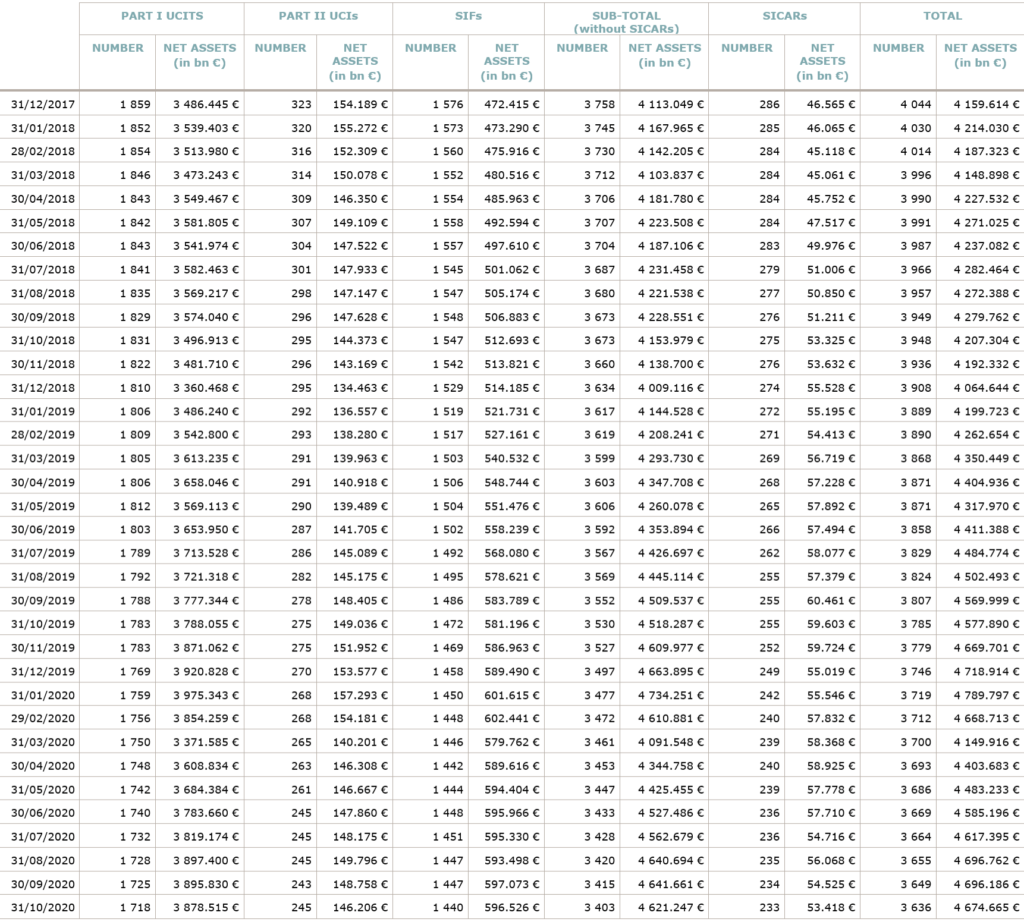

As at 31 October 2020, the total net assets of undertakings for collective investment, comprising UCIs subject to the 2010 Law, specialised investment funds and SICARs, amounted to EUR 4,674.665 billion compared to EUR 4,696.186 billion as at 30 September 2020, i.e. an decrease of 0.46% over one month. Over the last twelve months, the volume of net assets rose by 2.11%.

The Luxembourg UCI industry thus registered a negative variation amounting to EUR 21.521 billion in October. This decrease represents the sum of positive net capital investments of EUR 3.375 billion (+0.07%) and of the negative development of financial markets amounting to EUR 24.896 billion (-0.53%).

The development of undertakings for collective investment is as follows:

The number of undertakings for collective investment (UCIs) taken into consideration totalled 3,636, against 3,649 the previous month. A total of 2,390 entities adopted an umbrella structure representing 13,353 sub-funds. Adding the 1,246 entities with a traditional UCI structure to that figure, a total of 14,599 fund units were active in the financial centre.

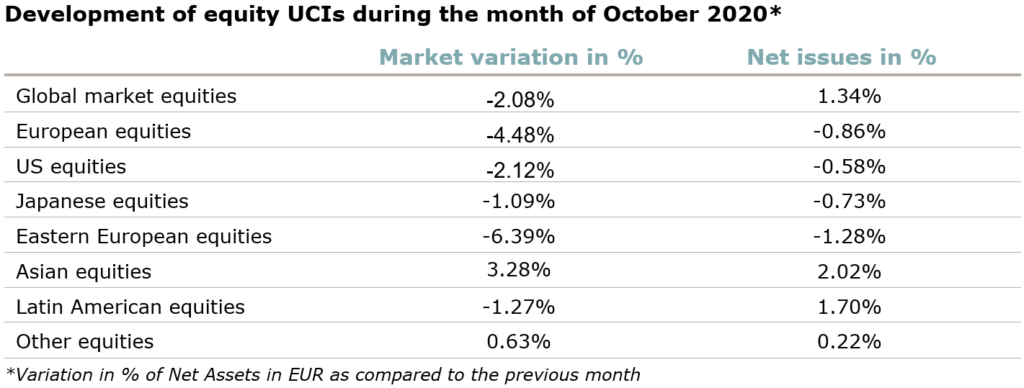

As regards the impact of financial markets on the main categories of undertakings for collective investment and the net capital investment in these UCIs, the following can be said for the month of October:

As far as developed countries are concerned, the European equity UCI category has registered negative returns on the grounds of a deteriorating economic outlook resulting from a sharp resurgence in COVID-19 infection rates and the reintroduction of lockdown measures in several European countries. The US equity UCI category saw a decline as well amid the political disagreement on new fiscal stimulus measures, rising infection rates in many US states and uncertainties over the upcoming presidential election, in spite of a better-than-expected third-quarter corporate reporting season and improving economic data. While the COVID-19 virus remained more contained in Japan and despite better economic data, the Japanese equity UCI category fell largely due to concerns on a renewed economic downturn particularly in the US and Europe.

As for emerging countries, the Asian equity UCI category generated a positive return, supported by the V-shaped recovery of the Chinese economy, robust corporate earnings and considerably lower infection rates in Asia compared to Europe and the US. Against the backdrop of rapidly rising infection rates in Eastern Europe, the lockdown measures envisaged in some Eastern European countries and falling oil prices, the Eastern European equity UCI category saw a decline in October. Overall Latin America’s equity markets followed the downward trend on global equity markets, pushing the Latin American equity UCI category into negative territory.

In October, equity UCI categories registered an overall positive net capital investment.

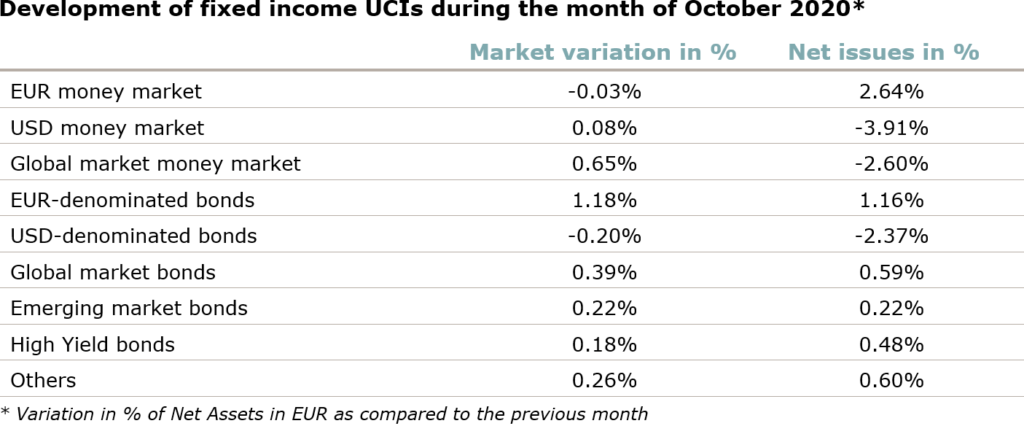

As for the EUR-denominated bond UCIs, the yields of long term highly rated government bonds decreased (i.e. prices increased) in reaction mainly to the deterioration in the economic outlook due to the resurgence of infection rates and new lockdown measures taken in several EU countries. The yields of lower-rated Government bonds of peripheral countries fell as well, supported by the anticipated implementation of the European Recovery Fund and the expectation of additional monetary policy measures. Investment grade corporate bonds followed this downward movement in interest rates, while risk premiums increased moderately due to a higher risk aversion. All over, the EUR-denominated bond UCIs category registered a positive performance.

Despite a prevalence of the pandemic in the US and the resulting uncertainty on US equity markets, the yields of USD-denominated government bonds slightly rose as polls indicated an increased likelihood of a Democratic win in the upcoming presidential election, raising hopes for an extensive fiscal stimulus package. The yields of US investment grade corporate bonds followed this upside movement, shifting the USD-denominated bonds UCI category in slightly negative territory.

The Emerging market bonds UCI category tracked more or less sideways overall, in a context marked by the uncertainties concerning the US elections, the resurgence of the infection rates in many emerging countries and the divergent evolution of emerging market currencies.

In October fixed income UCI categories registered an overall negative net capital investment, mainly driven by outflows in the USD money market UCI category.

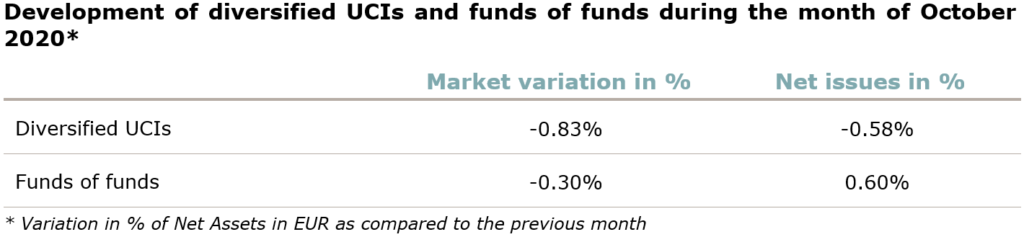

The development of net assets of diversified Luxembourg UCIs and funds of funds is illustrated in the table below:

II. Breakdown of the number and net assets of UCIs

During the month under review, the following nine undertakings for collective investment have been registered on the official list:

UCITS Part I 2010 Law:

- ABARIS BIOTECHNOLOGY OPPORTUNITIES, 1C, rue Gabriel Lippmann, L-5365 Munsbach

- DEKA-NACHHALTIGKEIT EINKOMMENSSTRATEGIE, 6, rue Lou Hemmer, L-1748 Findel

- INVL FUND, 1C, rue Gabriel Lippmann, L-5365 Munsbach

- LONVIA, 5, allée Scheffer, L-2520 Luxembourg

- ROWE PRICE FUNDS B SICAV, 6C, route de Trèves, L-2633 Senningerberg

UCIs Part II 2010 Law:

- ASSENAGON BALANCED EQUIVOL, 1B, Heienhaff, L-1736 Senningerberg

- KLIMAVEST ELTIF, 25, rue Edward Steichen, L-2540 Luxembourg

- PARTNERS GROUP PRIVATE MARKETS ELTIF SICAV, 35D, avenue J-F Kennedy, L-1855 Luxembourg

SIFs:

- EUROPEAN IMPACT PROPERTY FUND S.C.A., SICAV-SIF, 10, rue Edward Steichen, L-2540 Luxembourg

The following twenty-two undertakings for collective investment have been deregistered from the official list during the month under review:

UCITS Part I 2010 Law:

- ACCESS FUND, 80, route d’Esch, L-1470 Luxembourg

- FIDES, 4, rue Thomas Edison, L-1445 Luxembourg-Strassen

- FONDACO ROMA FUND, 146, boulevard de la Pétrusse, L-2330 Luxembourg

- H & A INTERNATIONAL FUND, 1C, rue Gabriel Lippmann, L-5365 Munsbach

- H & A UNTERNEHMERFONDS EUROPA, 1C, rue Gabriel Lippmann, L-5365 Munsbach

- JABCAP (LUX), 20, rue de la Poste, L-2346 Luxembourg

- LGLOBAL FUNDS, 60, avenue J-F Kennedy, L-1855 Luxembourg

- LIAM € 12,5 CORPORATE BOND FUND, 22, boulevard Royal, L-2449 Luxembourg

- MACROEQUITY GLOBAL INVESTMENTS, 17, rue de Flaxweiler, L-6776 Grevenmacher

- MERCURIO SICAV, 19-21, boulevard du Prince Henri, L-1724 Luxembourg

- NHS-SICAV, 1, rue du Potager, L-2347 Luxembourg

- VALLBANC INVESTMENT FUND, 88, Grand-Rue, L-1660 Luxembourg

- VI VOLA LONG, 1C, rue Gabriel Lippmann, L-5365 Munsbach

SIFs:

- ACCENDO CAPITAL, 14, Porte de France, L-4360 Esch-sur-Alzette

- ALTICREST S.C.A., SICAV-SIF, 68-70, boulevard de la Pétrusse, L-2320 Luxembourg

- APOLLO REAL ESTATE INVESTMENT, SICAV-SIF S.C.S., 1C, rue Gabriel Lippmann, L-5365 Munsbach

- BANK CAPITAL OPPORTUNITY FUND, 49, avenue J-F Kennedy, L-1855 Luxembourg

- BANTLEON SIF SICAV, 15, rue de Flaxweiler, L-6776 Grevenmacher

- EC PRIVATE EQUITY FUND OF FUNDS SICAV-FIS, 49, avenue J-F Kennedy, L-1855 Luxembourg

- EEM – EUROPEAN EQUITY MULTI-STRATEGY S.A. SICAV SIF, 88, Grand-rue, L-1660 Luxembourg

- INFINITY B S.C.S. SICAV-SIF, 1C, rue Gabriel Lippmann, L-5365 Munsbach

SICARs:

- GINKGO FUND S.C.A., SICAR, 20, boulevard Emmanuel Servais, L-2535 Luxembourg