Global situation of undertakings for collective investment at the end of September 2022

Press release 22/26

I. Overall situation

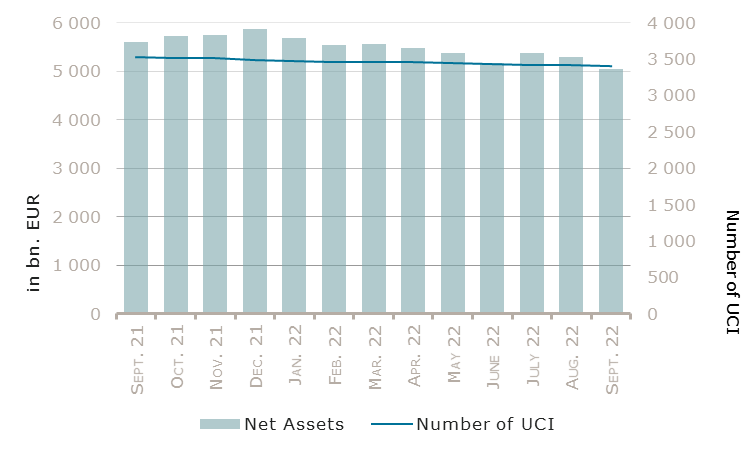

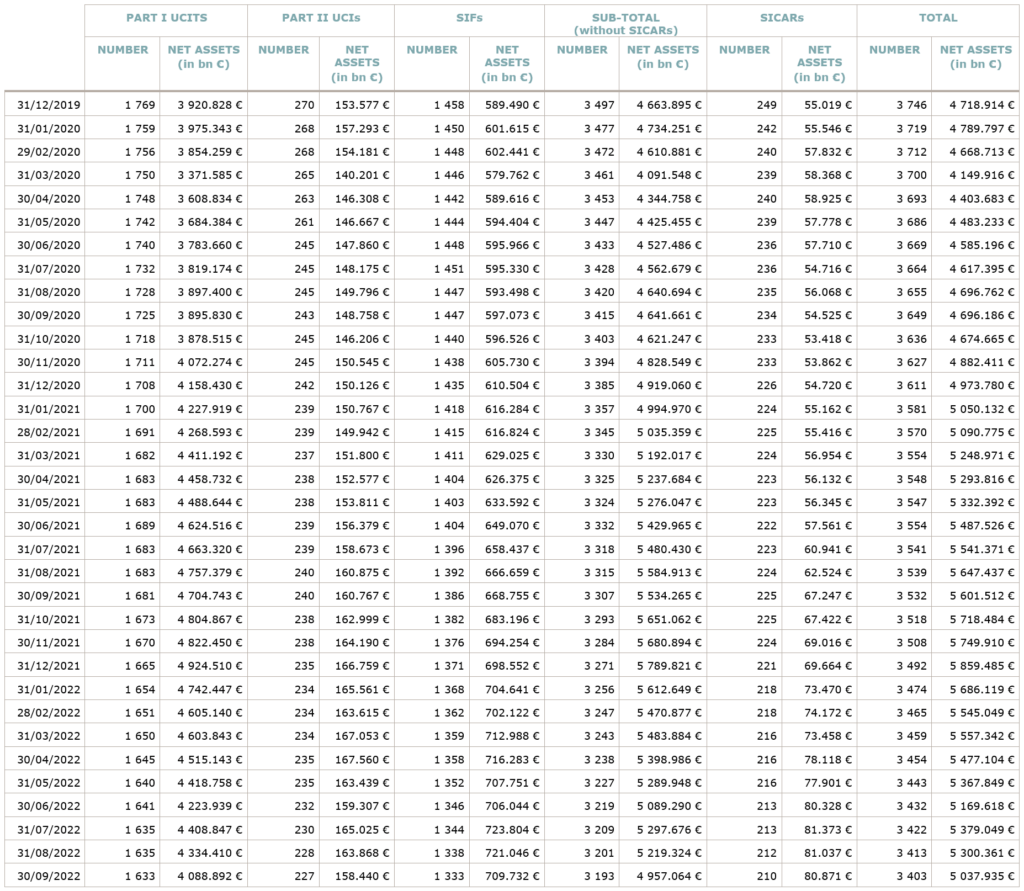

As at 30 September 2022, the total net assets of undertakings for collective investment, comprising UCIs subject to the 2010 Law, specialised investment funds and SICARs, amounted to EUR 5,037.935 billion compared to EUR 5,300.361 billion as at 31 August 2022, i.e. a decrease of 4.95% over one month. Over the last twelve months, the volume of net assets decreased by 10.06%.

The Luxembourg UCI industry thus registered a negative variation amounting to EUR 262.426 billion in September. This decrease represents the sum of negative net capital investments of EUR 40.926 billion (-0.77%) and of the negative development of financial markets amounting to EUR 221.500 billion (-4.18%).

The development of undertakings for collective investment is as follows:

The number of undertakings for collective investment (UCIs) taken into consideration totalled 3,403, against 3,413 the previous month. A total of 2,221 entities adopted an umbrella structure representing 13,186 sub-funds. Adding the 1,182 entities with a traditional UCI structure to that figure, a total of 14,368 fund units were active in the financial centre.

As regards the impact of financial markets on the main categories of undertakings for collective investment and the net capital investment in these UCIs, the following can be said for the month of September.

September saw a decline of all UCI equity categories in a context marked by the Ukraine crisis, high inflation and the rise of interest rates by major Central banks as well as a globally deteriorated economic climate. Credit spreads and bond yields continued to rise.

Concerning developed markets, the European equity UCI category registered a negative performance amid a deterioration of most indicators in the face of the energy crisis, a dropdown in consumer confidence, higher inflation and a rise of interest rates by the European Central Bank (ECB). The US equity UCI category declined as well in a context marked by monetary policy tightening, high inflation figures and a strong dollar, despite an overall economic outlook remaining more positive in the US and better economic indicators. The Japanese equity UCI category followed the downward trend in equity markets on the back of higher inflation, rising interest rates and the tensions between China and Taiwan.

As for emerging countries, the Asian equity category saw a sharp sell-off in consequence of the ongoing strict zero-COVID policy and the slowdown in the property market in China as well as the decline in global trade. The Eastern European equity UCI category experienced a fall as the region continued to suffer from the contagion of the Ukraine crisis and the consequences of the energy crisis. While some Latin American countries saw growth and inflation improving, the Latin American equity UCI category globally followed the downward trend and ended the month in negative territory.

In September, the equity UCI categories registered overall a negative net capital investment, mainly driven by outflows in the Global market equity UCI category.

Development of equity UCIs during the month of September 2022*

|

Market variation in % |

Net issues in % |

|

| Global market equities |

-6.47% |

-0.54% |

| European equities |

-6.71% |

-1.11% |

| US equities |

-6.93% |

-0.62% |

| Japanese equities |

-6.66% |

-0.28% |

| Eastern European equities |

-2.95% |

-0.47% |

| Asian equities |

-8.34% |

-1.07% |

| Latin American equities |

-1.16% |

-1.41% |

| Other equities |

-7.42% |

-1.64% |

* Variation in % of Net Assets in EUR as compared to the previous month

On both sides of the Atlantic, high inflation rates induced interest rate hikes by Central Banks, despite recession fears. The ECB decided unanimously to increase its three key interest rates by 75bps, while the US Federal Reserve (Fed) decided in September a third consecutive 75 bps hike, bringing the Fed Funds rate to 3.25%. Against this backdrop, long term interest rates and credit spreads were rising across all bond categories, pushing the EUR and USD UCI categories in negative territory despite the strong appreciation of the USD.

The Emerging Market bond UCI category fell in September as well, largely due to the stronger USD and higher US interest rates as well as to the weaker global growth.

In September, fixed income UCI categories registered an overall negative net capital investment, mainly driven by the USD money market category.

Development of fixed income UCIs during the month of September 2022*

|

Market variation in % |

Net issues in % |

|

| EUR money market |

-0.10% |

1.90% |

| USD money market |

2.61% |

-4.59% |

| Global money market |

-1.22% |

-0.16% |

| EUR-denominated bonds |

-3.42% |

-0.60% |

| USD-denominated bonds |

-2.52% |

0.67% |

| Global market bonds |

-3.58% |

-1.39% |

| Emerging market bonds |

-4.14% |

-2.06% |

| High Yield bonds |

-3.43% |

-2.33% |

| Others |

-3.19% |

0.08% |

* Variation in % of Net Assets in EUR as compared to the previous month

The development of net assets of diversified Luxembourg UCIs and funds of funds is illustrated in the table below:

Development of diversified UCIs and funds of funds during the month of September 2022*

|

Market variation in % |

Net issues in % |

|

| Diversified UCIs |

-4.15% |

-0.44% |

| Funds of funds |

-3.01% |

-0.03% |

* Variation in % of Net Assets in EUR as compared to the previous month

II. Breakdown of the number and net assets of UCIs

During the month under review, the following five undertakings for collective investment have been registered on the official list:

UCITS Part I 2010 Law:

- BICE INVERSIONES, 6A, rue Gabriel Lippmann, L-5365 Munsbach

- ONEMARKETS FUND, 8-10, rue Jean Monnet, L-2180 Luxembourg

UCIs Part II 2010 Law:

- PRIVATE EQUITY (LUX) EVERGREEN SECONDARY FUND, 33A, Avenue J.F. Kennedy, L-1855 LUXEMBOURG

SIFs:

- AIM MASTER FUND SICAV-FIS, 30, Boulevard Royal, L-2449 Luxembourg

- WRE INTERNATIONAL INVESTMENTS XI, 42-44, avenue de la Gare, L-1610 Luxembourg

The following fifteen undertakings for collective investment have been deregistered from the official list during the month under review:

UCITS Part I 2010 Law:

- FOCUS FUNDS, 5, allée Scheffer, L-2520 Luxembourg

- HERITAM SICAV, 15, avenue J-F Kennedy, L-1855 Luxembourg

- OGF INTERNATIONAL, 4, rue Jean Monnet, L-2180 Luxembourg

- UNIGARANTTOP: EUROPA V, 3, Heienhaff, L-1736 Senningerberg

UCIs Part II 2010 Law:

- VARIUS, 12, rue Eugène Ruppert, L-2453 Luxembourg

- VIMCO ATLANTIC VALUE FUNDS, 2, rue Edward Steichen, L-2540 Luxembourg

SIFs:

- AB CUSTOM ALTERNATIVE PROGRAM, 80, route d’Esch, L-1470 Luxembourg

- GLORIA CAPITAL SICAV-FIS, S.A., 18, boulevard Royal, L-2449 Luxembourg

- GREEN UTILITY (I) FEEDER SICAV-SIF, 15, boulevard Friedrich Wilhelm Raiffeisen, L-2411 Luxembourg

- PRIVATE STRATEGIES (LUX), 11-13, boulevard de la Foire, L-1528 Luxembourg

- REDLINE CAPITAL FUND, 26, avenue Monterey, L-2163 Luxembourg

- SBI VOSKHOD CAPITAL SICAV-SIF, 6, rue Eugène Ruppert, L-2453 Luxembourg

- VINTHEDGE SICAV-SIF S.C.A., 30, boulevard Royal, L-2449 Luxembourg

SICARs:

- MANGROVE III S.C.A. SICAR, 4, rue Robert Stumper, L-2557 Luxembourg

- PARTNERS GROUP DISTRESSED U.S. REAL ESTATE 2009 S.C.A., SICAR, 35D, avenue J-F Kennedy, L-1855 Luxembourg