Entities

Access the database

According to article 21a of Directive (EU) 2019/878 of 20 May 2019 amending Directive 2013/36/EU (CRD) as regards exempted entities, financial holding companies, mixed financial holding companies, remuneration, supervisory measures and powers and capital conservation measures (CRD V), financial holding companies and mixed financial holding companies of certain banking groups ((M)FHCs) are subject to an approval process and to direct supervisory powers. They are however not subject to additional prudential requirements on an individual (solo) basis.

The approval process and direct supervisory powers are set out in Articles 34-1 to 34-3 of the Law of 5 April 1993 on the financial sector (LFS). The purpose is to ensure that (M)FHCs can be held directly responsible for ensuring compliance with consolidated prudential requirements stemming from CRD and Regulation (EU) No 575/2013 (CRR).

A financial holding company is defined under article 4(1)(20) of the CRR as a “a financial institution, the subsidiaries of which are exclusively or mainly institutions or financial institutions, and which is not a mixed financial holding company; the subsidiaries of a financial institution are mainly institutions or financial institutions where at least one of them is an institution and where more than 50 % of the financial institution’s equity, consolidated assets, revenues, personnel or other indicator considered relevant by the competent authority are associated with subsidiaries that are institutions or financial institutions”. They can be (M)FHC when they meet the definition of point (15) of article 2 of Directive 2002/87/EC on financial conglomerates. All terms used in the definition of “financial holding company” under the CRR should also be checked to verify whether a holding qualifies as a (M)FHC.

According to CRD V, the approval procedure applies both to existing and newly established (M)FHCs that are:

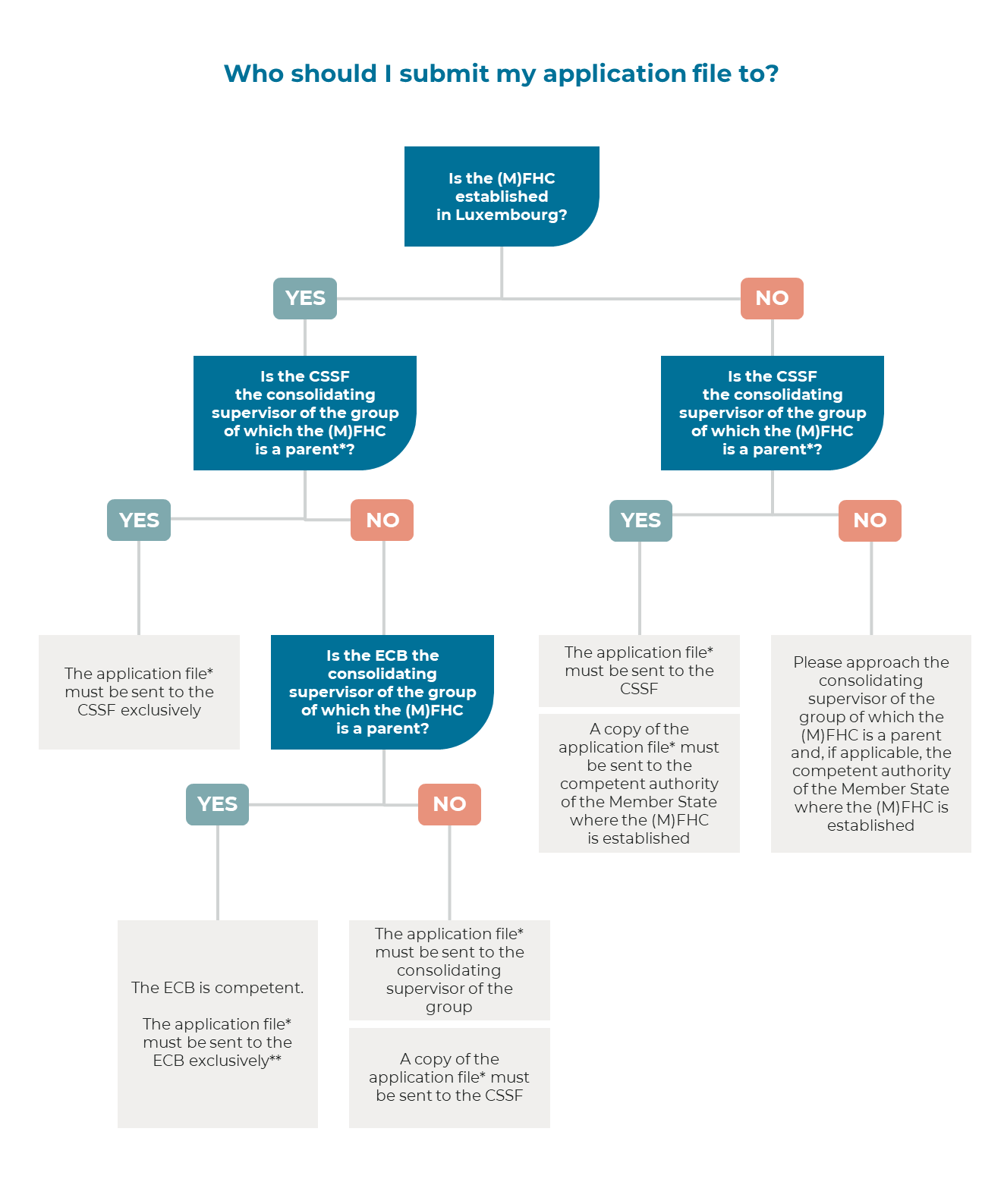

(M)FHCs shall seek an approval and submit the application file, with the supporting documentation as disclosed in Article 21a(2) of the CRD V and in Article 34-2(3) of the LFS, to the competent authority in charge of the supervision of the group on a consolidated basis and, where the (M)FHC is established in a different Member State, also to the competent authority of the Member State where the (M)FHC is established. In this latter case, both the consolidating supervisor and the competent authority of the Member State where the (M)FHC is established shall endeavour to reach a joint decision to approve the (M)FHC.

Where the (M)FHC is established in the Banking Union and is part of a significant supervised group subject to the direct supervision of the European Central Bank (ECB), the application file and the supporting documentation are to be provided to the ECB exclusively, which is competent to grant the approval.

Where the (M)FHC is not established in the Banking Union but the (M)FHC is part of a significant supervised group subject to the direct supervision of the ECB, the application file and the supporting documentation are to be provided to the ECB, as well as to the competent authority of the Member State where the (M)FHC is established.

The decision tree set out below may be used as a guidance to determine the relevant authorities to whom the application for an approval must be submitted.

Any application file for an approval must be sent to banking_license@cssf.lu

There are situations where a (M)FHC is not required to be approved, in particular when it does not engage in taking management, operational or financial decisions affecting the group or its subsidiaries that are institutions or financial institutions. Such exemption is however subject to the fulfilment of the conditions set out in article 34-2(6) of the LFS.

The decision tree set out below may be used as a guidance to determine the relevant authorities to whom the application for an exemption must be submitted.

An application file for an exemption must be sent to banking_license@cssf.lu

According to Article 67 of the LFS, (M)FHCs that already existed on 27 June 2019 have benefitted from a transitional period but were required to apply for approval (or for an exemption) by 28 June 2021.

For future (M)FHCs, the (M)FHC approval procedure will also trigger a qualifying holding procedure (see Article 22 of the CRD) where the (M)FHC becomes a parent shareholder of an institution. In this case, the qualifying holding “assessment period”, as referred to in the second sub-paragraph of Article 22(3) of the CRD, will be suspended for a period exceeding 20 working days until the approval/exemption procedure is completed. This means that the qualifying holding procedure cannot be approved until the (M)FHC procedure has been concluded. The approval of both the (M)FHC and the qualifying holding assessment will be based on the criteria applicable to the respective procedure.

Approved and exempted (M)FHCs are required to continuously comply with the conditions on which the approval or exemption has been granted. The consolidating supervisor monitors compliance on an ongoing basis based on Article 21a(5) of the CRD V and to Article 34-2(5) of the LFS. The (M)FHC concerned should provide the consolidating supervisor with the information required to monitor compliance.

Failure to timely apply for the approval/exemption may lead to the imposition of supervisory measures, as mentioned in Article 21a(6) of the CRD V and 34-2(8) of the LFS, and to administrative penalties or other administrative measures foreseen as set out in Article 63-1 of the LFS.

For any question relating to (M)FHCs, please contact: crd_referentiel@cssf.lu

* An application file must be submitted for both an approval and an exemption of approval.

** The ECB is competent as consolidating supervisor and as competent authority of the (M)FHC.