Revue des informations non financières et sur la diversité publiées par certains émetteurs en 2018 (uniquement en anglais)

Background

As from 1st January 2017, the Law of 23 July 20161, implementing the European Directive 2014/95/UE*, requires certain large undertakings and groups to provide additional non-financial and diversity disclosures including:

- For public interest entities* which fulfil the conditions listed in paragraph (1) of Article 68bis* of the Law of 19 December 2002* on a non-consolidated basis, or in paragraph (1) of Article 339bis* of the Law of 10 August 1915* on a consolidated basis, a non-financial statement containing information on environmental, social and employee matters, respect for human rights, anti-corruption and bribery matters; and

- For issuers whose shares are admitted to trading on a regulated market and which exceed, at their balance sheet date and during two consecutive financial years, the numerical thresholds of at least two of the three criteria referred to in Article 47 (1)* of the Law of 19 December 2002, a description of the diversity policy applied in relation to the entity’s administrative, management and supervisory bodies with regard to aspects such as, for instance, age, gender or educational and professional backgrounds.

Purposes of the examination

As announced in its press release dated 15 December 20172, the CSSF has carried out an examination of the relevant publications for 2017 of issuers covered by the Law of 23 July 2016 (hereafter referred to as the “Issuers”). The purpose of this examination was mainly to find out how and to which extent those Issuers have complied with the new disclosure obligations.

- In respect of the non-financial statement, a focus has been put on the information the Issuers have chosen to disclose, by topic, as well as on the non-performance indicators presented.

- In respect of the diversity disclosures, the attention was paid on the dissociation of the policies applicable to administrative, management and supervisory bodies from the general diversity policies observed.

This report presents the results of this examination and provides certain recommendations for the preparation of the future non-financial statement and diversity disclosures of the Issuers.

Observations in relation to the non-financial statement

Overall compliance with the provisions of the Law of 23 July 2016 on non-financial statement

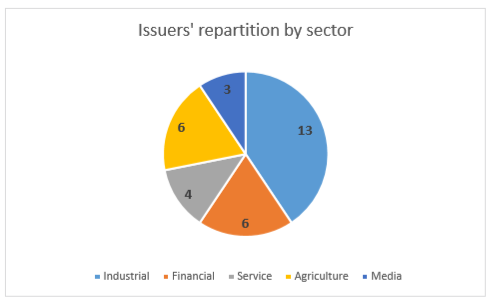

Among the issuers supervised by the CSSF, 32 were subject to the requirements on the publication of a non-financial statement for the 2017 financial year. Among those Issuers, 29 Issuers effectively published, to a certain extent, information on one or more subjects requested by the Law of 23 July 2016.

In this context, it may be pointed out that the 3 Issuers who have not published non-financial statement for the year 2017 were contacted by the CSSF and requested to take adequate corrective actions to respect this legal requirements.

It is also worth noting that 3 Issuers who could have used the exemption to provide such information due to the fact that it is included in the consolidated information published by their parent company have nevertheless not retained this option and decided to disclose, on a voluntary basis, the required information in their management report.

Format of the non-financial statement

The Law of 23 July 2016 allows the non-financial statement to be disclosed either in the management report or in a separate report, under the condition that this separate report is published together with the management report or made available within six months after the balance sheet date on the given entity’s website.

Thus, the CSSF noted that half of the Issuers published the non-financial information in their management report while the other half chose to issue a separate report. These separate reports are generally not published together with the management report but made publicly available on the Issuers’ websites as required by Article 68bis (5) a) of the Law of 19 December 2002 and 339bis (5) a) of the Law of 10 August 1915. Such reports are usually referred to as “Corporate Responsibility Report” or “Sustainability Report”. The CSSF would like to remind Issuers that when they prepare a separate report which is not published together with the management report, such report should be referred to in the management report. Such reference has been omitted by 5 Issuers out of 14.

It should also be noted that certain Issuers have decided, besides providing non-financial information in their management report, to also publish either a separate report containing more comprehensive information or selected information on environmental or social and employee matters on their website.

Content of the non-financial statement

Key principles

While the format of the non-financial statement is not prescribed, its content is clearly defined in paragraph (2) of article 68bis of the Law of 19 December 2002 (respectively article 339bis of the Law of 10 August 1915). Undertakings are there required to report on matters relating to, as a minimum, environment, social and employee, respect for human rights, anti-corruption and bribery, including a description of their business model, the policies related to those matters together with their outcomes, the related principal risks and relevant non-financial key performance indicators.

If undertakings are free to structure their non-financial information, the Law of 23 July 2016 requires that when certain matters are not covered by a specific policy, this fact should be disclosed and substantiated, and if some regulatory frameworks are followed, those should also be disclosed.

In that context, the European Commission issued non-binding Guidelines* in June 2017 aiming to help undertakings concerned to publish non-financial information in a relevant, useful, consistent and more comparable manner by providing them with guidance to apply the key principles of Directive 2014/95/UE. Those key principles intend to disclose information that is, among others, material, fair, balanced and understandable, forward-looking and stakeholders oriented, as well as consistent with other elements of the management report or financial statements.

The Guidelines also provide examples and key performance indicators that an entity may consider in relation to these principles. Key principles such as materiality, understandability and consistency should also be observed by the Issuers in the selection and presentation of examples and Key Performance Indicators (hereafter referred to as “KPIs”).

Reference to the financial statements

The Law also requires the non-financial statement to include references to, and additional explanations of, amounts reported in the annual financial statements. However, only one third of the Issuers provided such references. In this context, the CSSF would like to point out that Issuers must, as far as practicable, establish links between financial and non-financial information in order to size the economic effects of the policies applied.

Preparation of the non-financial statement

For the preparation of the non-financial statement, Issuers may rely on national, European Union-based or international frameworks. Such frameworks, when relied on, must be specified. Thus, 60 percent of the Issuers disclosed this information and made reference to one or more frameworks.

Some frameworks cover a broad variety of sectors and thematic issues while others are sector or thematic issue-specific. Some focus solely on the disclosure of non-financial information while others refer to transparency in a broader context. Amongst the available frameworks, it is worth outlining the main categories which can be identified: Integrated Reporting frameworks, Standards setting organisations frameworks and International frameworks. One or more frameworks can be utilised by Issuers depending on the area covered. During the course of our examination, we have noted that Issuers commonly use or refer to:

- Integrated Reporting frameworks: those frameworks are published by independent organisations and aimed to promote integrated non-financial reporting. Amongst those framework, GRI Standards* have been largely embraced by Issuers with 10 out of 11 Issuers which make a reference to a reporting framework. GRI Standards are focused on sustainable reporting and may be followed by Issuers with regards to the environmental as well as on social and employee related matters. An alternative framework is the “International Integrated Reported Framework” which provide principles and concepts in line with the Law of 23 July 2016.

- Standards setting organisations primarily develop and issue technical standards. Issuers particularly make reference to ISO*, in particular ISO 14001 “Environmental management” and ISO 9001 “Quality management”; or to standards OHSAS* 18001 “Occupational Health and Safety Management System”.

- The use of such references by Issuers aim to draw attention of users of information to strict adherence to processes but is generally not sufficient to properly cover the matters to be addressed by the Law of 23 July 2016.

- International frameworks, which include, principles, non-binding guidelines or pacts, such as The Guidelines for multinational enterprises* or The Ten Principles of the UN Global Compact*, provide recommendations and take into account fundamental responsibilities of business in the areas covered by the Law of 23 July 2016.

The CSSF reminds Issuers that the Guidelines include also a more comprehensive list of frameworks on which the information can be built upon, and that the framework used must be specified in the non-financial statement.

Topics covered by the non-financial statement

Our examination was also intended to understand how Issuers had developed the thematic aspects which must be covered as a minimum. When presenting the information on each of these subjects, Issuers should normally include a brief description of the policies (including the diligence processes implemented) and the outcome of these policies as well as the principal risks related to those matters. Finally, non-financial key performance indicators must be presented.

1.Environmental matters

This topic appears of an increased importance and covers multiple and diversified aspects. Accordingly, the recitals of the Directive 2014/95/UE mention that the statement should contain, as regards environmental matters, details of the current and foreseeable impacts of the undertaking’s operations on the environment, and, as appropriate, on health and safety, the use of renewable and/or non-renewable energy, greenhouse gas emissions, water use and air pollution.

A first positive observation is that this topic is unanimously addressed across all Issuers subject to our examination, even if the reported information may significantly differ from one Issuer to another mainly depending on the activity sector it is operating in.

As an example, the most commonly reported subjects relate to energy, greenhouse gas emissions and climate with more than three quarters of Issuers making reference to KPIs in relation to their environmental footprint. Similarly, another key matter addressed in relation to environment is waste management where Issuers both explain their policies in relation to the recycling and the reuse of materials.

Environmental policies are accompanied by non-financial KPIs in order to help Issuers to measure their progress and validate the policies pursued and the due diligence processes implemented. Commonly observed measures include natural resources and energy consumption by type (Electricity, Heating, Diesel, Gas, Water), greenhouse gases emissions (by type), recycled and reused materials against waste disposal.

Another observation is that two thirds of Issuers made reference to certifications they have obtained. While this should not be regarded as a KPI, it provides the reader of the non-financial statements with a view of how entities include and manage their environmental responsibilities in their business operations. Such certifications include ISO 14001, carbon disclosure rating or EPRA sBPR Award.

However, although environmental policies in place and objectives followed are properly addressed, Issuers do not emphasize on the risks related to those matters and on how they are managed or mitigated.

The CSSF encourages Issuers to comply with the requirements of the Law of 23 July 2016 by further disclosing the principal risks related to environment linked to their operations, where consequences could be both of operational and financial nature.

Finally, the CSSF draws the attention of Issuers to the European common enforcement priorities for 2018 annual financial reports where ESMA notes that, when disclosing the financial consequences of climate change, issuers may consider, amongst the different framework available to them, the recommendations and methodology developed by the Task Force on Climate-Related Financial Disclosures.

2.Social and employee matters

This second topic is another pillar of a corporate social responsibility. As regards to social and employee-related matters, the recitals of Directive 2014/95/UE state that the information provided in the statement may concern the actions taken to ensure gender equality, implementation of fundamental conventions of the International Labour Organisation (“ILO”), working conditions, social dialogue, respect for the right of workers to be informed and consulted, respect for trade union rights, health and safety at work and the dialogue with local communities, and/or the actions taken to ensure the protection and the development of those communities.

Again, all Issuers provide information on these matters, with however a significant gap in the level of disclosure from boilerplate or “tick-the-box” information to comprehensive policies and practices covering the relationships under which work is performed for the organisation.

The main information provided by Issuers is general information on employees, from figures on the total number of employees to breakdown of these data by gender and age. A second level of disaggregation provided is the breakdown of employee number by contract type and working-time. While such information could be perceived as generic in the context of the Law of 23 July 2016, it however provides a good indicator of diversity.

Another recurrent topic relates to training and education. Many Issuers recognize that qualified professionals are essential for their organisation. Accordingly, Issuers explain the various training plans in place in order to keep their employees informed of regulatory, technological or even cultural change or to allow professional development.

Further, key information disclosed on social and employee-related matters include information on the following areas:

- Occupational Health and Safety: This is a fundamental right and is addressed, amongst others, in a convention from the ILO. The aim of disclosure by Issuers of their policies is to understand how they prevent accidents and injury to health arising out, linked with or occurring in the course of work.

This topic has been highly considered by Issuers in the preparation of their financial statements with 70 percent of them addressing safety as a priority. There is an evident gap however in the way industrial companies are addressing this priority as compared to financial entities. This is a good example of how Issuers address a risk with relevance and proportionality. Common non-financial measures include Lost Time Incident Frequency, Severity rate, Fatalities or Accidents. - Relations with employers: This refers to the right of employers and workers to form, to join and to run their own organisation without prior interference. Freedom of association and right to organise as well as collective bargaining are fundamental conventions set out by ILO and such reference is also made in the human right chart.

Only 30 percent of Issuers have considered this topic as being of a significant importance, mainly those operating internationally, with subsidiaries amongst others in Africa, Asia, South America or the Middle East. Disclosures principally bring light on rights of workers to negotiate their working conditions and on the entity’s consultative practices. Such rights are considered essential for a sustainable business.

Non-financial KPIs in this area include amongst others the number of meetings held between employers and trade unions, syndication rate or the number of strikes. - Local communities: According to GRI Standards, local communities are defined as persons or groups of persons living and/or working in any areas that are economically, socially or environmentally impacted (positively or negatively) by an organisation’s operations.

The social impact of an entity in the area(s) it operates has been largely identified as an important topic by Issuers. Thus, more than two thirds of the Issuers explained their relations with local communities or describe the partnerships with schools or municipals. Such interaction with local communities can take many forms: employment, education or development of infrastructures.

Indicators provided in that context include amounts of expenditures, concrete actions undertaken in the development of schools, hospitals or roads, or the time spent by the Issuers’ personnel for charities.

As for environmental matters, Issuers do not emphasize on the risks in relation to those matters and on how they are managed or mitigated. Furthermore, the outcome of the policies are not clearly explained. The Guidelines highlight that relevant disclosures on outcomes of policies may provide useful information on the company’s strengths and vulnerabilities. Outcomes should not been confounded with the presentation of non-financial indicators but could be a narrative explanation to present the results of operations and activities. Accordingly, the CSSF urges Issuers to properly address those elements in their non-financial statement.

3. Respect for human rights

With regard to human rights, the non-financial statement should include information on the prevention of human rights abuses and entities are expected to disclose material information on potential and actual impacts of their operations on right-holders.

While it is considered best practice for a company to express its commitments to human rights, it appears that based on our examination, one third of Issuers do not make any reference to human rights.

The CSSF reminds Issuers that the Law of 23 July 2016 specifies that if entities do not pursue policies in relation to one (or more) matter(s) that is (are) not relevant for them, the non-financial statement shall provide a clear and reasoned explanation for not doing so. Thus, the CSSF urges issuers to make a proper statement on respect of human rights, whether by disclosing relevant policies and practices in place, or by substantiating the absence of such policies.

For Issuers disclosing information on human rights, we observe again a large scale in the information provided. Half of them disclose at least general statements, mentioning that they have signed protocols or committed themselves to support and respect the protection of internationally proclaimed human rights or they make sure that they are not complicit in any human right abuses.

Issuers from industrial and agricultural sectors, with expanded international operations, provide further information on ethics in conducting business and address topics like forced or compulsory labor, child labor as well as elimination of discrimination in respect of employment and occupation.

Approximately 30 percent of those Issuers indicate having incorporated whistleblowing mechanisms in their code of conduct to foster employees to denounce irregular practices or breach of human rights or policies in place.

Finally, several issuers also provided details on the respect for freedom of association, which is another good example provided by the Guidelines.

4. Anti-corruption and bribery matters

With regard to anti-corruption and bribery, the non-financial statement should include information on instruments in place to fight corruption and bribery and companies are expected to disclose material information on how they manage anticorruption and bribery matters.

Indeed, many ethics violation scandals have eroded the confidence of investors and other stakeholders, and entities may experience that they can be held responsible for not granting enough attention to the actions of their employees or business partners.

Accordingly, more than 80 percent of Issuers have considered this topic in their non-financial statement. Key information disclosed relates to anti-corruption policies or standards in place, and attention is brought for instance on lobby activity, gifts and donations.

KPIs observed in relation to those matters include the number of employees having received appropriate training in their respect, the number of cases reported or under investigation and the number of actions taken.

However, information and KPIs disclosed in relation to the aforementioned matters often remain limited and Issuers are encouraged to review the Guidelines in order to provide more relevant information in their respect. The Guidelines thus include examples of information that could be disclosed such as the criteria used in corruption-related risk assessments, the internal control processes and resources allocated to prevent corruption and bribery or the number of pending or completed legal actions on anti-competitive behaviour.

Conclusion

As regard the non-financial statement, based on the different observations made in this report and taken into consideration the Recitals of the Directive 2014/95/UE, while recognizing that this was the first exercise where such a statement was required, improvements are expected in order for Issuers to fully comply with the Law of 23 July 2016. Thus, the CSSF expects Issuers to review the future information disclosed and, beyond the remarks and recommendations made in this report, to pay particular attention to the following when preparing their future non-financial statement:

- Issuers should avoid publishing boilerplate information, as a key principle of the Law of 23 July 2016 is to disclose information that is material and specific. The criteria of materiality is measured by its impact on the company’s activity, whether positive or negative, direct or indirect, but also its impact on products, services and commercial relations;

- Issuers should provide further information on the outcome of their policies. An outcome is relevant information which provides useful evidence on the company’s strengths and vulnerabilities. In particular, companies are expected to consider the relationship between financial and non-financial outcomes;

- Finally, information should articulate around the principal risks that face the company. Issuers should provide adequate information in relation to matters that stand out as being most likely to bring about the materialisation of principal risks with severe impacts, along with those that have already materialised.

Observations in relation to diversity information

The CSSF also performed an examination of the compliance with the new article 68ter g) of the Law of 19 December 2002 on the diversity policy applied in relation to an entity’s administrative, management and supervisory bodies. The number of Issuers subject to our examination was similar to that of issuers subject to the publication of the nonfinancial statement, with the exception that these disclosure requirements concerning management bodies’ diversity apply only to large listed entities. Accordingly, the scope of this review included 29 entities. Overall, the mains observations arisen from our examination are:

- The concerned issuers generally publish recurring information required by the other points of the article 68ter of the Law of 19 December 2002, including but not limited to reference to the corporate governance code to which the entity is subject, and the composition and operation of the administrative, management and supervisory bodies and their committees; or

- If information on diversity issues, such as gender diversity and equal treatment in employment and occupation (including age, gender, sexual orientation, religion, ethnic origin and other relevant aspects) may be disclosed, however, it is not always specific to the administrative, management and supervisory bodies or committees.

Based on these observations, we estimate that, except for a few issuers, information is too often boilerplate, and when it includes, for instance, diversity information on age, gender, or educational and professional backgrounds, it does not clearly specify the diversity policy in place.

Accordingly, the CSSF requests the concerned Issuers to improve the information provided and to provide to the users of the financial report with improved information on administrative, management and supervisory bodies diversity.

1 The terms followed by an asterisk are defined in Appendix A

2 Press release 17/43

Appendix A – Definitions

| Law of 23 July 2016 | The Law of 23 July 2016 on disclosure of non-financial and diversity information for certain large undertakings and groups. |

| Directive 2014/95/UE | Directive 2014/95/UE of the European Parliament and of the Council of 22 October 2014 amending Directive 2013/34/EU as regards disclosure of non-financial and diversity information by certain large undertakings and groups. |

| Public interest entities (PIE) | Directive 2013/34/UE defines PIE as entities governed by the law of a Member State and whose transferable securities are admitted to trading on a regulated market of any Member State, credit institutions and insurances undertakings. |

| Law of 19 December 2002 | The Law of 19 December 2002 on the register of commerce and companies and the accounting and annual accounts of undertakings. |

| Law of 10 August 1915 | The Law of 10 August 1915 on commercial companies. |

| Article 47 (1) of the Law of 19 December 2002 | Undertakings which on their balance sheet do not exceed the limits of at least two of three of the following criteria:

Balance sheet total : 20 million euros Net turnover : 40 million euros Average number of full-time staff employed during the financial year : 250 |

| Guidelines | The European Commission issued in June 2017 non-binding Guidelines aiming to help companies concerned to publish nonfinancial information in a relevant, useful, consistent and more comparable manner. |

| GRI Standards | Global Reporting Initiative (“GRI”) Standards help businesses, governments and other organisations understand and communicate the impact of business on critical sustainability issues. |

| ISO | International Organization for Standardization |

| OHSAS | Occupational Health and Safety Assessment Series |

| The Guidelines for multinational enterprises | The OECD Guidelines for Multinational Enterprises are recommendations addressed by governments to multinational enterprises operating in or from adhering countries. They provide non-binding principles and standards for responsible business conduct in a global context consistent with applicable laws and internationally recognised standards. |

| The Ten Principles of the UN Global Compact | The Ten Principles of the United Nations Global Compact are derived from the Universal Declaration of Human Rights, the International Labour Organization’s Declaration on Fundamental Principles and Rights at Work, the Rio Declaration on Environment and Development, and the United Nations Convention Against Corruption. |