Résultats de l’enforcement de l’information financière 2018 publiée par les émetteurs soumis à la Loi Transparence (uniquement en anglais)

Press release 20/06

Introduction

In the context of its mission of supervising securities markets, the CSSF is in charge of examining the financial information published by issuers of securities. Through this activity, generally known as enforcement, the CSSF ensures that the financial information complies with the relevant reporting framework, i.e. the applicable accounting standards. Beyond the legal and regulatory requirements, the examination of the financial information contributes to the investors’ protection and confidence in the financial markets.

The matters raised in this document derive from a combination of:

- financial reporting issues identified during the CSSF’s examinations undertaken during 2019;

- matters identified in the course of the CSSF’s work on these subjects but not raised with specific issuers;

- the CSSF’s expectations of issuers with regard to future financial reports.

The purpose of this document is to assist the issuers’ management and those charged with governance in the preparation of financial reports by offering observations on selected topics. This document may also provide users of financial statements with some useful information on which they may wish to focus when using those financial statements.

Enforcement activities in 2019

In the context of our examination process, we identify the most efficient way to enforce financial information. The examination programme, defined every year for the selected issuers, notably includes:

- unlimited scope examinations: evaluation of the entire content of the financial information of an issuer in order to identify issues/areas that need further analysis and to assess whether the financial information is compliant with the relevant financial reporting framework; and

- focussed scope examinations: evaluation of pre-defined issues in the financial information of an issuer and the assessment of whether the financial information is compliant with the relevant financial reporting framework in respect of those issues. This type of examination covers, in particular, thematic examinations during which we review the practices followed by a sample of issuers concerning specific issues.

The selection of the issuers which are examined each year is based on a mixed model whereby a risk-based approach is combined with a sampling and rotation approach. The risk-based approach adopted considers the risk of misstatements and the possible impact of such a misstatement on the financial markets.

Following this model, the examinations performed in 2019 covered 26% of the issuers falling within the scope of enforcement of financial information. This coverage rate implies an actual average rotation period of 4 years for each issuer, which conceals various effective rotation periods depending on our risk-based approach.

Unlimited scope examinations

In 2019, the unlimited scope examinations covered 16% of the issuers (against 19% in 2018). As the graphs below show, those examinations covered different categories of issuers and accounting standards, and thus a significant sample of the population of issuers supervised by the CSSF.

Examinations by accounting standards used by the issuers for 2019 and 2018

Examinations by type of securities admitted and country for 2019 and 2018

Following these unlimited scope examinations, we concluded that certain specific accounting treatments did not comply with the relevant reporting framework and had to take actions vis-à-vis certain issuers, aiming to either correct the identified errors or amend and improve the subsequent published financial statements.

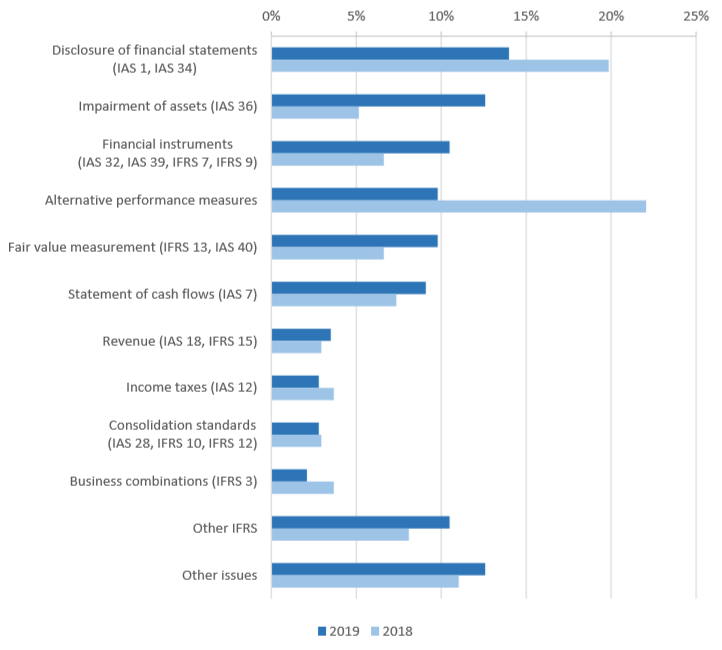

Breakdown by topic of notifications issued to issuers following the examinations carried out during the last two years

Focussed scope examinations

Two focussed scope examinations were carried out on different samples of issuers during the 2019 campaign. The purpose of the first examination was to review the implementation of some aspects of IFRS 9 Financial Instruments for a selection of banking issuers. In a second focussed scope examination, we reviewed the statements published by issuers in accordance with the Law of 23 July 2016 on the disclosure of non-financial and diversity information by certain large undertakings and groups. A dedicated report dated 17 February 2020 setting out the main conclusions of this review was published by the CSSF and is available on its website (Supervision > Securities markets > Enforcement of financial information).

Main findings of the 2019 campaign

During the 2019 campaign, special attention was paid to the application of the new standards (IFRS 9, IFRS 15 Revenue from contracts with customers, and IFRS 16 Leases (when first applied in the 2019 interim financial statements)). Moreover, significant findings were also noted during this campaign on measurement and disclosure issues related to assets impairment tests. Finally, for the third year running, we also scrutinised the good use of Alternative Performance Measures (APMs) outside the financial statements, namely in management reports and press releases of issuers.

IFRS 15 Revenue from contracts with customers

As IFRS 15 became mandatory for annual periods beginning on or after 1 January 2018, we paid particular attention during the 2019 campaign to its correct application and to its new disclosure requirements.

While we were pleased to find that, in general, issuers seriously assessed the impact of IFRS 15 on their revenue recognition policies and possibly on their systems, disclosures of information related to revenue recognition sometimes proved to be disappointing and insufficient.

We notably encountered issues in relation to the disaggregation of revenue.

An entity shall disaggregate revenue recognised from contracts with customers into categories that depict how the nature, amount, timing and uncertainty of revenue and cash flows are affected by economic factors.

Note: IFRS 15.114

This requirement leads, in practice, to various impacts on disclosures depending on the entities: for some of them, the segment information disclosed on revenue already adequately fulfills the disaggregation obligation, while for others a need for new revenue disclosure arises, sometimes adding more than one type of category.

In addition, an entity must disclose sufficient information to enable users of financial statements to understand the relationship between the disclosure of disaggregated revenue and the revenue information that is disclosed for each reportable segment.

Useful disclosures were for example a matrix of revenues by operating segment disaggregated by business/therapeutic area disclosed by a biotech and pharmaceutical group, or a disaggregation of revenues by type of projects (lumpsum/daily-rate projects) for a provider of projects and services for the industry.

Other issuers included information on disaggregated revenue that was previously presented outside the financial statements. For example, a specialist in residential real estate disclosed the revenue from sale of apartments separately, whereas this information was only presented in the management report in the previous annual reports of the company.

However, some issuers have not properly assessed the facts and circumstances that pertain to their contracts with customers and have either not disaggregated the revenue or disaggregated it in inappropriate or insufficient categories.

Note: We recommend issuers to consider the opportunity brought by IFRS 15 in the context of disaggregation of revenue to provide additional disclosure presenting a comprehensive information regarding type of products or services sold

We note that these infringements were also encountered at the European level as ESMA has decided to include the issue in its 2020 ECEP1. For more details, please refer to the press release dated 19 December 2019 on the CSSF priorities for the enforcement of 2019 financial information.

IFRS 9 Financial Instruments

IFRS 9 became effective on 1 January 2018 and, during the year 2019, the first annual reports prepared under this new standard were published. We followed up on the implementation of this standard through a specific focussed scope examination for a selection of banking issuers but also through the review of non-banking issuers from a variety of sectors. The principal findings of the review are set out below.

Banking issuers

During the focussed scope examination, we reviewed disclosures made by a sample of banking issuers in their first annual report and accounts following the adoption of IFRS 9. Our review mostly considered the comprehensiveness and quality of the disclosures against the requirements of IFRS 9 and IFRS 7 Financial Instruments: Disclosures, and the judgement and estimates requirements in IAS 1 Presentation of Financial Statements.

Even though no material irregularity has been noted during this review, we deem appropriate to present the main findings and to indicate some improvements to be made to information in relation to the following subjects:

- Transition disclosures were generally sufficient and clear enough to understand the impact of adopting IFRS 9. Where the impact was material, specific and disaggregated disclosures have been provided to adequately present the impact of the application of classification, measurement and impairment requirements.

- Classification and measurement. On the whole, Banking issuers have provided sufficient and comprehensive information in relation with the classification categories and measurement of financial instruments in its accounting policies. However, we expect that issuers:

- avoid using boilerplate, generic language or language directly quoted from the standard; and

- provide more entity-specific information in this area.

- Disclosure of the key inputs into the calculation of the Expected Credit Losses (ECL) was often confusing, incomplete or omitted.

Issuers should ensure to provide good disclosure which should include explanations on:- qualitative and quantitative indicators used to determine whether there has been a significant increase in credit risk;

Note: Due to the high level of judgement implied in the ECL determination, issuers should perform and, where relevant, disclose sensitivity analyses of staging and calculation of ECL - the relationship between staging, forbearance and cure periods;

- how forward-looking information is taken into account in the ECL models, and main assumptions underlying the scenario(s) used;

- whether and how management adjustments are applied.

- qualitative and quantitative indicators used to determine whether there has been a significant increase in credit risk;

- ECL allowance: appropriate information has generally been provided on the movements occurred during the period, including disaggregation. However, we regret that reconciliation of the disclosed information to relevant disclosures was sometimes unclear, and as a result, obscured the understanding of the information provided in the financial statements.

Non-banking issuers

In general, as regards financial asset’s classification, the new applied standard has not had a major effect on non-banking issuers, which mainly hold cash and trade receivables for collection. For one issuer reviewed, some trade receivables were classified as fair value through other comprehensive income, as its policy was to sell some receivables and to hold others for collection. However, measuring these financial assets at fair value did not have a material effect.

With regard to hedge accounting, the non-banking issuers which were reviewed mainly chose to remain with IAS 39 hedging requirements rather than adopting the new, more flexible IFRS 9 hedging requirements. Finally, in relation to the simplified approach to determine the ECL allowances for trade receivables, contract assets and lease receivables, when non-banking issuers use a provision matrix as permitted, it should be borne in mind that information should be provided on credit risk exposure and may be based on that matrix.

Note: IFRS 7.35M

IFRS 16 Leases

The CSSF reviewed the 2019 interim disclosure of 13 issuers impacted by IFRS 16 as lessees. Some disclosures were good, notably with respect to the transition period. However, we noted that there is some room for improvement and we expect issuers to do better in the annual disclosure.

- Disclosure of judgements and assumptions made when determining the lease term and the discount rate were most of the time incomplete and boilerplate.

An entity shall disclose (…) the judgements (…) that management has made in the process of applying the entity’s accounting policies and that have the most significant effect on the amounts recognised in the financial statements.

Note: IAS 1.122

Entity-specific disclosures are notably expected from issuers on the following topics:

Note: We will continue to challenge the relevance of disclosure on judgements and assumptions

-

- Assessment whether a contract is, or contains, a lease;

- Assessment of the extension and termination options in the determination of the lease term; and

- Discount rate used to measure the present value of the lease liability.

- Recognition exemptions and other practical expedients are largely used among the issuers reviewed and were generally clearly disclosed.

- Disclosure requirements for lessees were unevenly applied, which may however be due to the condensed form of the interim financial statements.

The objective of the disclosures is for lessees to disclose information in the notes that (…) gives a basis for users of financial statements to assess the effect that leases have on the financial position, financial performance and cash flows of the lessee.

Note: IFRS 16.51

Examples of good disclosures encountered notably included:

-

- The carrying amount of right-of-use assets disaggregated by class of assets at closing date, additions of the period and depreciation charge;

Note: Disclosures in a tabular format are considered good practice - Expenses related to short-term leases and to low value leases (separately); and

- A maturity analysis of lease liabilities (separately from other financial liabilities).

- The carrying amount of right-of-use assets disaggregated by class of assets at closing date, additions of the period and depreciation charge;

- Transition disclosures have been overall deemed satisfying. All the issuers reviewed used the modified retrospective approach. Most of them disclosed:

- The incremental borrowing rate(s) applied;

Note: The previous accounting policy should also be disclosed in the period of first application - The practical expedients used, if any; and

- The effect of IFRS 16 application on each financial statement line item affected.

- The incremental borrowing rate(s) applied;

However, we also expect issuers to explain, at the date of initial application, the differences between operating lease commitments previously disclosed applying IAS 17 and lease liabilities recognised according to IFRS 16. When provided in the interim financial statements, the numeric reconciliations disclosed in a tabular format were clear and helpful.

Note: IFRS 16.C12.b

We also reviewed, for a number of issuers, the internal assessment of the impacts of applying IFRS 16. We are pleased that explanations received have been generally satisfying. In particular, the assessment of whether a contract is or contains a lease, and the separation of the service and lease components have been correctly treated by most issuers under review.

IAS 36 Impairment of assets

Impairment tests are usually carefully reviewed during our examinations because of the number and materiality of judgements and estimates involved. Some of the issues dealt with during the 2019 campaign are illustrated below.

- Cash flows projections not based on reasonable and supportable assumptions

In measuring value in use an entity shall base cash flow projections on reasonable and supportable assumptions that represent management’s best estimate of the range of economic conditions that will exist over the remaining useful life of the asset. Greater weight shall be given to external evidence.

Note: IAS 36.33.a

Several issuers for which the projections made by their management were highly above past actual outcomes or projections of external analysts were not able to satisfactorily substantiate them when we requested them to do so.

Note: When assumptions include a high degree of judgement, a sensitivity analysis is expected

Moreover, we had to remind several issuers that they must assess the reasonableness of the assumptions on which the current cash flow projections are based by examining the causes of the differences between past cash flow projections and actual cash flows.

Note: IAS 36.34

Issuers must be able to provide us with a reconciliation of financial budgets/forecasts with actual results for the past few years. When significant differences between forecasts and actual results arise, they should be clearly explained and the causes of differences should be quantified.

- Evolution of Capital expenditure (Capex) were often not in line with the evolution of the revenues in the estimates of future cash flows of an issuer.

Note: Cash outflows necessary to improve or enhance assets should be considered along with the cash inflows generated by the assets

Estimates of future cash flows include future cash outflows necessary to maintain the level of economic benefits expected to arise from the asset in its current condition.

Note: IAS 36.49

We recommended issuers to adapt the level of Capex with the level of increase in the activity when performing its future value in use calculation.

- Misstatements in discount rate calculations

We also noted various inaccuracies when determining the discount rate used in the impairment test of a Cash Generating Unit, among which the use of inappropriate tax rate and risk-free rate. Basic computations mistakes are also regularly encountered. We urge issuers to carefully assess the relevance of assumptions used in the discount rate determination and to use a systematic method in order to avoid miscalculations.

Alternative Performance Measures

Since the entry into force of the ESMA Guidelines on Alternative Performance Measures (APMs) in 2016, the CSSF has carried out regular examinations to see how the principles of these guidelines are respected by the issuers. For 2019, we note significant improvements in several areas while misstatements or omissions continue to exist for quite a few principles.

Thus, amongst the eight principles developed in those guidelines, most of the issuers examined now comply with the requirements regarding Definitions, Balanced/unbiased measures, Labels, Comparatives and Consistency. There is, however, room for improvement concerning the aspects linked to the Reconciliations, Explanations or Prominence concepts.

The most common errors identified during the 2019 campaign cover:

- Reconciliation:

- No reconciliation provided for each APM disclosed, for instance ratios are often omitted; and

- No explanation provided for reconciliation items which are not directly extracted from the financial statements.

- Explanation:

- No explanation provided as issuers consider that the measures are well-known by the market; and

- Boilerplate or poor quality information provided in order to justify the use of the APM.

- Prominence:

- Some issuers reviewed present a majority of APMs at the top of their press releases, for instance in a “Highlights” section. Issuers should take care not to disclose APMs with more prominence than measures stemming from the financial statements.

We also underline that compliance with the ESMA Guidelines on APMs is generally better in management reports than in press releases.

During our work, we encountered an example of good practice where one of the issuers presented all the information relating to the APMs as required by the guidelines on a dedicated page of its website.

Note: Compliance with ESMA Guidelines on APMs should be improved for press releases

Next steps

On 19 December 2019, the CSSF has released its priorities in relation to the enforcement of financial information for 2019 financial statements. In that context and along with other priorities for the year, the CSSF will notably focus on measurement and disclosure issues related to IFRS 16 and follow up on the application of IFRS 9 and IFRS 15.

More information on examinations by the CSSF within the framework of its mission under Article 22 (1) of the Transparency Law is available on the CSSF’s website (Supervision > Securities markets > Enforcement of financial information).

1 European common enforcement priorities for 2019 annual financial reports (ESMA32-63-791 of 22 October 2019)