Situation globale des organismes de placement collectif à la fin du mois de novembre 2021 (uniquement en anglais)

Communiqué de presse 21/32

I. Overall situation

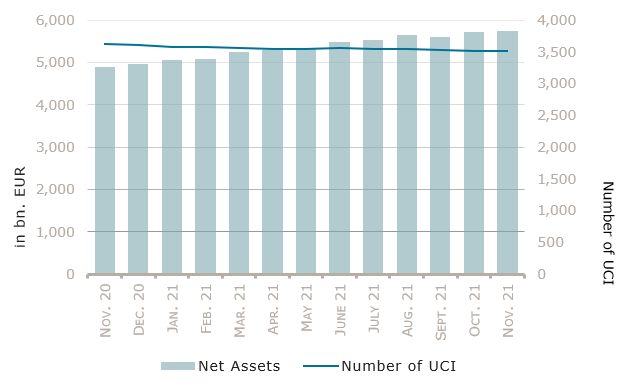

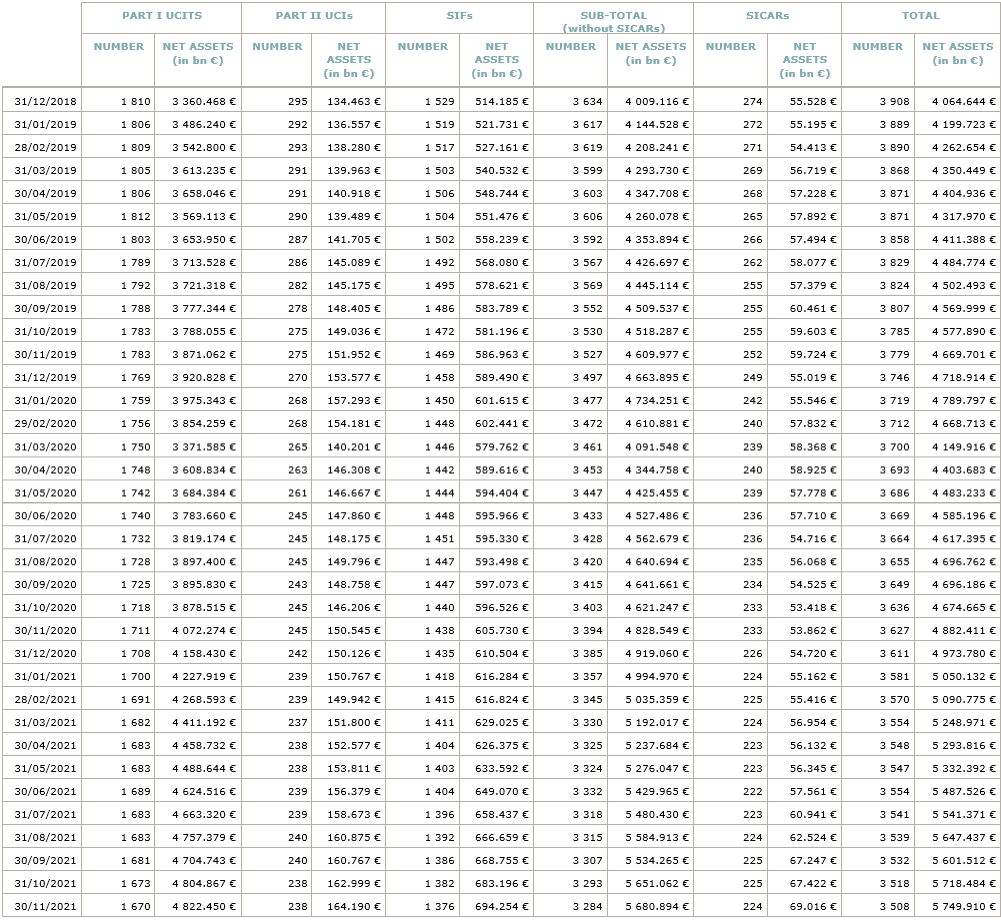

As at 30 November 2021, the total net assets of undertakings for collective investment, comprising UCIs subject to the 2010 Law, specialised investment funds and SICARs, amounted to EUR 5,749.910 billion compared to EUR 5,718.484 billion as at 31 October 2021, i.e. an increase of 0.55% over one month. Over the last twelve months, the volume of net assets rose by 17.77%.

The Luxembourg UCI industry thus registered a positive variation amounting to EUR 31.426 billion in November. This increase represents the sum of positive net capital investments of EUR 29.802 billion (+0.52%) and of the positive development of financial markets amounting to EUR 1.624 billion (+0.03%).

The development of undertakings for collective investment is as follows:

The number of undertakings for collective investment (UCIs) taken into consideration totalled 3,508, against 3,518 the previous month. A total of 2,303 entities adopted an umbrella structure representing 13,250 sub-funds. Adding the 1,205 entities with a traditional UCI structure to that figure, a total of 14,455 fund units were active in the financial centre.

As regards the impact of financial markets on the main categories of undertakings for collective investment and the net capital investment in these UCIs, the following can be said for the month of November:

The emergence of a new Covid-19 variant and the more persistent than expected inflation in the US and Europe weighted on investor sentiment. Against this backdrop, equity markets fell over the month while government bonds rallied.

Concerning developed markets, the European equity UCI category registered a negative performance in a context marked by rising hospitalisations and new restrictions induced by the fourth Covid-19 wave in several European countries, a higher inflation rate in the euro area as well as the persistent supply chain shortages. While US shares declined in November amid concerns about the Omicron variant of Covid-19 and the possibility of a swifter tapering of the asset purchases by the Federal Reserve (Fed) in light of the sharp pick-up of inflation, the strong appreciation of the USD against the EUR shifted the US equity UCI category into positive territory. The Japanese equity UCI category fell as well in consequence of the short-term uncertainty over the new Covid-19 variant, despite a substantial fiscal stimulus package initiated by the new Japanese government and the strong appreciation of the Yen against the EUR.

As for emerging countries, the Asian equity UCI category declined overall under the impulse of concerns that the emergence of the Omicron variant could hurt global economic recovery and falling Chinese equity markets amid fears of new lockdown measures as this new COVID-19 variant spreads rapidly in China, a slowing property market and ongoing regulatory scrutiny of the internet industry. The Eastern European equity UCI category was sharply lower, mainly on the back of falling oil prices and a resurgence in COVID-19 cases in the Czech Republic, Hungary and Poland. The Latin American equity UCI category realised in overall a negative performance in November largely due to a decline of the Brazilian and Mexican equity markets on the grounds of higher inflation.

In November, the equity UCI categories registered an overall positive net capital investment, mainly driven by inflows in the Global market equity UCI category.

Development of equity UCIs during the month of November 2021*

| Market variation in % | Net issues in % | |

| Global market equities | -0.52% | 1.30% |

| European equities | -1.35% | 0.08% |

| US equities | 1.30% | 0.06% |

| Japanese equities | -0.94% | 1.40% |

| Eastern European equities | -7.90% | -8.26% |

| Asian equities | -0.96% | -0.45% |

| Latin American equities | -2.85% | 0.23% |

| Other equities | -1.65% | -1.35% |

* Variation in % of Net Assets in EUR as compared to the previous month

Concerning the EUR and USD denominated bond UCI categories, the long-term yields of government bonds declined (i.e. bond prices increased) as demand for safe-haven assets surged amid higher Omicron-related uncertainty. While the European Central Bank (ECB) will take a decision on the continuity of its “Pandemic Economic Purchase Program” (PEPP) in December, the US Federal Reserve (Fed) considers accelerating the pace of tapering. Against this backdrop, US and European investment grade corporate bonds tracked sideways. Overall, the EUR and USD denominated bond UCI categories finished the month in positive territory. The USD denominated bond UCI category was further supported by the appreciation of the USD against the EUR.

The emerging market bond UCI category recorded negative returns, under the impulse of the US Fed’s shift toward a more hawkish stance, concerns that the spread of the new COVID-19 variant could have an adverse effect on global supply chains and idiosyncratic risks in some emerging markets.

In November, fixed income UCI categories registered an overall positive net investment, mainly driven by the EUR and USD money market UCI categories.

Development of fixed income UCIs during the month of November 2021*

| Market variation in % | Net issues in % | |

| EUR money market | -0.06% | 3.55% |

| USD money market | 2.47% | 2.02% |

| Global money market | -0.37% | 1.50% |

| EUR-denominated bonds | 0.45% | -0.04% |

| USD-denominated bonds | 1.74% | 2.30% |

| Global market bonds | 0.64% | 0.09% |

| Emerging market bonds | -0.85% | 0.20% |

| High Yield bonds | -0.16% | -0.55% |

| Others | 0.32% | 0.48% |

* Variation in % of Net Assets in EUR as compared to the previous month

The development of net assets of diversified Luxembourg UCIs and funds of funds is illustrated in the table below:

Development of diversified UCIs and funds of funds during the month of November 2021*

| Market variation in % | Net issues in % | |

| Diversified UCIs | 0.16% | 0.45% |

| Funds of funds | 0.46% | 1.00% |

* Variation in % of Net Assets in EUR as compared to the previous month

II. Breakdown of the number and net assets of UCIs

During the month under review, the following seven undertakings for collective investment have been registered on the official list:

UCITS Part I 2010 Law:

- ALIAS FUND, 4, rue Robert Stumper, L-2557 Luxembourg

- BERESFORD LUX SICAV, 19, rue de Bitbourg, L-1273 Luxembourg

- METAGESTIÓN SICAV, 14, Porte de France, L-4360 Esch-sur-Alzette

- NACHHALTIGKEIT – STIFTUNGEN, 4, rue Thomas Edison, L-1445 Luxembourg-Strassen

- RIGSAVE FUND SICAV, 2, rue d’Alsace, L-1122 Luxembourg

UCIs Part II 2010 Law:

- MUZINICH EUROPEAN LOANS 4 ELTIF SICAV, S.A., 12E, rue Guillaume Kroll, L-1882 Luxembourg

SIFs:

- EURAZEO EUROPEAN REAL ESTATE II ELTIF PRIVATE FUND, SCSP SICAV-SIF, Boulevard Royal, 25C, L-2449, Luxembourg

The following seventeen undertakings for collective investment have been deregistered from the official list during the month under review:

UCITS Part I 2010 Law:

- DEUTSCHE MAG FI SICAV, 1C, rue Gabriel Lippmann, L-5365 Munsbach

- DIAMOND I SICAV, 5, allée Scheffer, L-2520 Luxembourg

- GREEN ASH SICAV, 33A, avenue J-F Kennedy, L-1855 Luxembourg

- S&P GSCI ENERGY & METALS CAPPED COMPONENT 35/20 THEAM EASY UCITS ETF, 10, rue Edward Steichen, L-2540 Luxembourg

- SEB STRATEGY FUND, 4, rue Peternelchen, L-2370 Howald

- UNIEXTRA: EUROSTOXX 50, 3, Heienhaff, L-1736 Senningerberg

- VON DER HEYDT STRATEGIEFONDS, 17, rue de Flaxweiler, L-6776 Grevenmacher

- WARBURG – L – FONDS, 2, place François-Joseph Dargent, L-1413 Luxembourg

UCIs Part II 2010 Law:

- NIKKO SKILL INVESTMENTS TRUST (LUX), 2, rue Hildegard von Bingen, L-1282 Luxembourg

SIFs:

- BOURNE PARK CAPITAL (LUX) S.A., SICAV-SIF, 2-4, rue Eugène Ruppert, L-2453 Luxembourg

- CLARION FUND S.C.A. SICAV-SIF, 10, rue Antoine Jans, L-1820 Luxembourg

- M&G UK PROPERTY FUND FCP-FIS, 16, boulevard Royal, L-2449 Luxembourg

- MOUNTAIN FUND SICAV-SIF, 4, rue Robert Stumper, L-2557 Luxembourg

- NORAMA REAL ESTATE FUND S.C.A., SICAV-SIF, 46A, avenue J-F Kennedy, L-1855 Luxembourg

- THISER S.C.A., SICAV-FIS, 1B, rue Jean Piret, L-2350 Luxembourg

- TRANSITION, 44, avenue J-F Kennedy, L-1855 Luxembourg

SICARs:

- OCEAN GROUP CAPITAL S.C.A., SICAR, 8, rue Lou Hemmer, L-1748 Senningerberg