Situation globale des organismes de placement collectif à la fin du mois d’août 2022 (uniquement en anglais)

Communiqué de presse 22/25

I. Overall situation

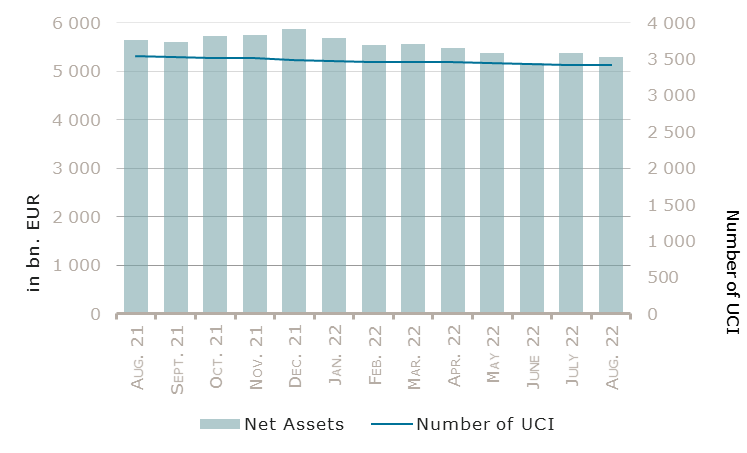

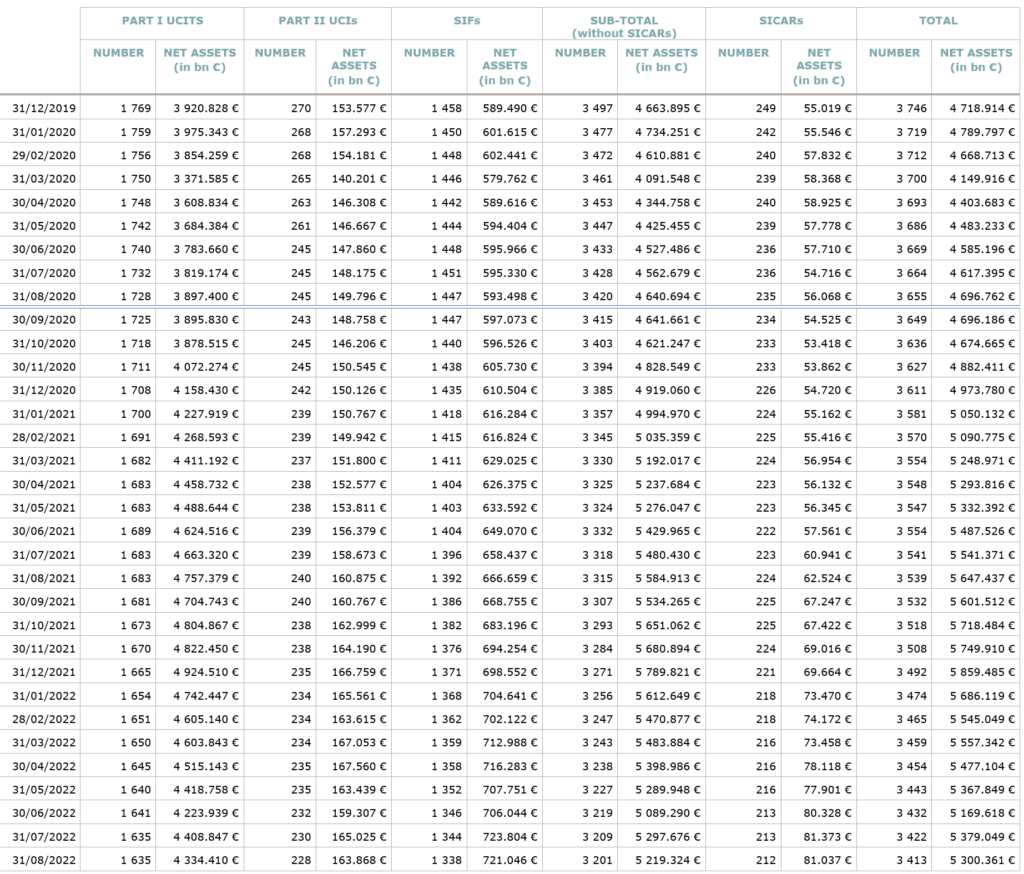

As at 31 August 2022, the total net assets of undertakings for collective investment, comprising UCIs subject to the 2010 Law, specialised investment funds and SICARs, amounted to EUR 5,300.361 billion compared to EUR 5,379.049 billion as at 31 July 2022, i.e. a decrease of 1.46% over one month. Over the last twelve months, the volume of net assets decreased by 6.15%.

The Luxembourg UCI industry thus registered a negative variation amounting to EUR 78.688 billion in August. This decrease represents the sum of negative net capital investments of EUR 4.281 billion (-0.08%) and of the negative development of financial markets amounting to EUR 74.407 billion (-1.38%).

The development of undertakings for collective investment is as follows:

The number of undertakings for collective investment (UCIs) taken into consideration totalled 3,413, against 3,422 the previous month. A total of 2,230 entities adopted an umbrella structure representing 13,165 sub-funds. Adding the 1,183 entities with a traditional UCI structure to that figure, a total of 14,348 fund units were active in the financial centre.

As regards the impact of financial markets on the main categories of undertakings for collective investment and the net capital investment in these UCIs, the following can be said for the month of August.

At a global level, the main markets remained volatile. Central banks reaffirmed their determination to bring inflation under control at the cost of downward growth expectation, while the geopolitical tensions around the globe remain elevated.

Concerning developed markets, the European equity UCI category underperformed the main regions with a decrease in August reflecting the high level of inflation, the deterioration of most market indicators, the Ukraine war impact on the energy sector and concerns over the global economy cool down. The US equity UCI category also registered a negative performance as US activity is slowing down and core inflation remains high, keeping the Fed on an aggressive monetary policy stance. The Japanese equity market recorded a positive performance in local currency but negative in euros once reflected the depreciation of the yen.

As for emerging countries, the Asian equity UCI category saw a small increase in August. Gains from India and Indonesia were offset by other countries decline, including South Korea and Singapore, amid concerns over the pursue of the global efforts against soaring inflation. The Chinese equity market remained flat, muted on the one side by the weakening of the domestic demand, the softness of the manufacturing activity, the zero-COVID policy, the weakness of the housing market, and supported on the other side by accommodative fiscal and monetary policies. The Eastern European equity UCI category realised a negative performance due to the uncertainties surrounding the Ukraine crisis and the energy supply for the coming winter. The Latin American equity UCI category outperformed the rest of the market, boosted by Brazil and Chile markets.

In August, the equity UCI categories overall registered a negative net capital investment.

Development of equity UCIs during the month of August 2022*

|

Market variation in % |

Net issues in % |

|

| Global market equities |

-2.21% |

-0.16% |

| European equities |

-4.98% |

-1.02% |

| US equities |

-1.58% |

-0.80% |

| Japanese equities |

-0.08% |

-0.31% |

| Eastern European equities |

-1.09% |

-0.33% |

| Asian equities |

0.35% |

-0.84% |

| Latin American equities |

6.37% |

0.59% |

| Other equities |

-0.10% |

-0.60% |

* Variation in % of Net Assets in EUR as compared to the previous month

In Europe, bond yields sharply rose in August, pushed by expectations of central bank rate hikes and comments from ECB’s board members indicating that monetary policy would need to remain tight for an extended period. In this context of dampened overall sentiment, bond prices, which move inversely to yields, made the EUR denominated bond UCI category globally decline.

Similarly to the EUR denominated bond category, the yields of the USD bond category also increased (i.e. bond prices fell) following the Jackson Hole conference where central bankers reaffirmed their hawkish stance and reiterated the current prioritisation of prices stability over economy’s recessionary issues. The USD denominated bond category however benefitted from a positive conversion factor of the US Dollar against Euro that smoothed the negative impact.

Emerging Market bond UCI category recorded a modest increase, partially driven by China’s loosening of monetary policy and by an earlier implementation of interest rate hikes programs by emerging markets’ central banks.

In August, fixed income UCI categories registered an overall negative net capital investment.

Development of fixed income UCIs during the month of August 2022*

|

Market variation in % |

Net issues in % |

|

| EUR money market |

-0.10% |

-2.60% |

| USD money market |

2.03% |

3.80% |

| Global money market |

-0.94% |

-3.29% |

| EUR-denominated bonds |

-3.61% |

0.68% |

| USD-denominated bonds |

-0.79% |

0.52% |

| Global market bonds |

-1.26% |

0.30% |

| Emerging market bonds |

0.94% |

-0.45% |

| High Yield bonds |

-0.80% |

-0.77% |

| Others |

-3.06% |

-0.94% |

* Variation in % of Net Assets in EUR as compared to the previous month

The development of net assets of diversified Luxembourg UCIs and funds of funds is illustrated in the table below:

Development of diversified UCIs and funds of funds during the month of August 2022*

|

Market variation in % |

Net issues in % |

|

| Diversified UCIs |

-1.65% |

0.10% |

| Funds of funds |

-0.52% |

0.64% |

* Variation in % of Net Assets in EUR as compared to the previous month

II. Breakdown of the number and net assets of UCIs

During the month under review, the following five undertakings for collective investment have been registered on the official list:

UCITS Part I 2010 Law:

- AXA IM CASH, 49, avenue J-F Kennedy, L-1855 Luxembourg1

- ESG-AM FUND, 5, rue Jean Monnet, L-2180 Luxembourg

- UNIINSTITUTIONAL MULTI ASSET NACHHALTIG, 3, Heienhaff, L-1736 Senningerberg

- WERTE FONDS MÜNSTERLAND KLIMA, 3, Heienhaff, L-1736 Senningerberg

SIFs:

- EIP ENERGY-TRANSITION INFRASTRUCTURE 2022 SICAV-SIF, 7, avenue du Swing, L-4361 Esch-sur-Alzette

The following fourteen undertakings for collective investment have been deregistered from the official list during the month under review:

UCITS Part I 2010 Law:

- CMT, 4, rue Thomas Edison, L-1445 Luxembourg-Strassen

- MILLENNIUM BANQUE PRIVÉE GLOBAL FUNDS, 5, allée Scheffer, L-2520 Luxembourg

- SPARKASSE WUPPERTAL DEFENSIV, 6, rue Lou Hemmer, L-1748 Luxembourg-Findel

- SPARKASSE WUPPERTAL TREND GLOBAL, 6, rue Lou Hemmer, L-1748 Luxembourg-Findel

UCIs Part II 2010 Law:

- DEKA PRIVATE BANKING PORTFOLIO STRATEGIE, 6, rue Lou Hemmer, L-1748 Findel

- SPARKASSE WUPPERTAL VERMÖGENSVERWALTUNG, 6, rue Lou Hemmer, L-1748 Findel

SIFs:

- GRAND ROCK FUNDS S.A., 25A, boulevard Royal, L-2449 Luxembourg

- LUXEMBOURG CAPITAL S.A., 13, avenue de la Porte-Neuve, L-2227 Luxembourg

- MC INVEST, 5, allée Scheffer, L-2520 Luxembourg

- PROCAPITAL INVESTMENT S.A., SICAV-FIS, 1C, rue Gabriel Lippmann, L-5365 Munsbach

- THE BLOSSOM ELTIF, 146, boulevard de la Pétrusse, L-2330 Luxembourg

- VALUE PORTFOLIO, 2, rue Jean Monnet, L-2180 Luxembourg

- VERIANOS REAL ESTATE MEZZANINE FUND 1 SICAV-SIF, 2, place François-Joseph Dargent, L-1413 Luxembourg

SICARs:

- PARTNERS GROUP GLOBAL MEZZANINE 2007 S.C.A., SICAR, 35D, avenue J-F Kennedy, L-1855 Luxembourg

1 Rectification concerning July 2022.