Situation globale des organismes de placement collectif à la fin du mois de février 2023 (uniquement en anglais)

Communiqué de presse 23/07

I. Overall situation

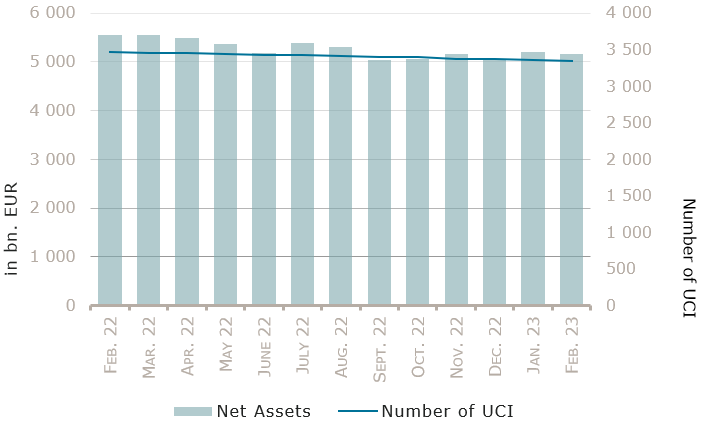

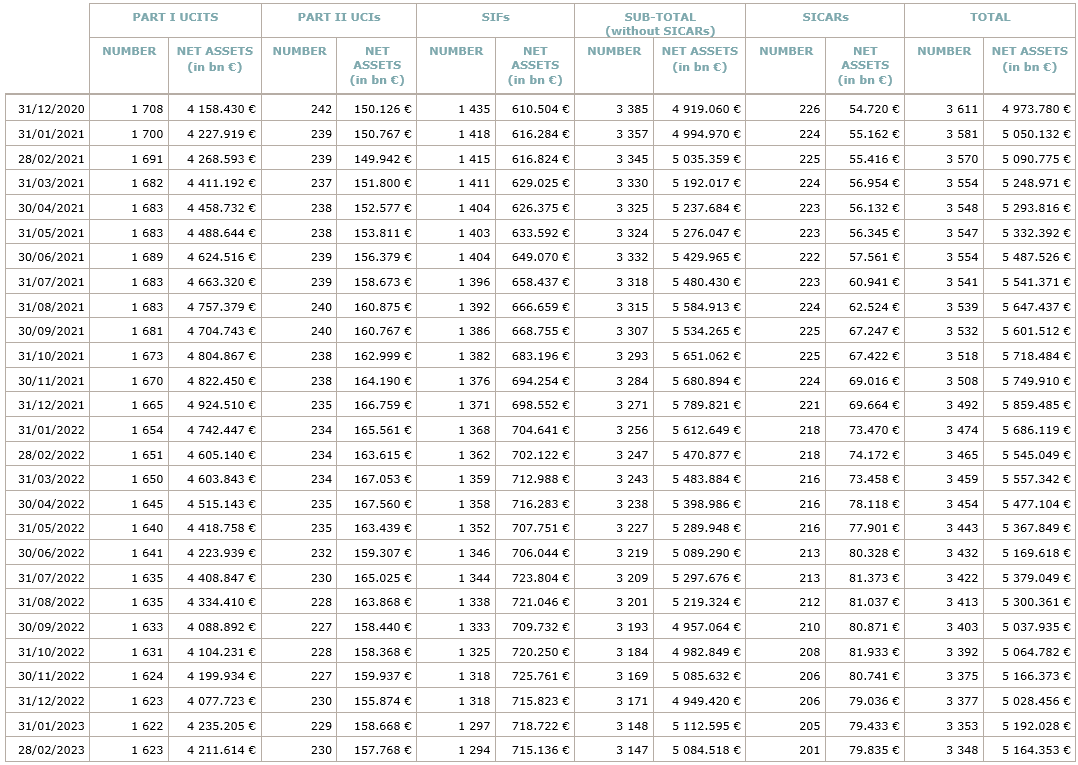

As at 28 February 2023, the total net assets of undertakings for collective investment, comprising UCIs subject to the 2010 Law, specialised investment funds and SICARs, amounted to EUR 5,164.353 billion compared to EUR 5,192.028 billion as at 31 January 2023, i.e. a decrease of 0.53% over one month. Over the last twelve months, the volume of net assets decreased by 6.87%.

The Luxembourg UCI industry thus registered a negative variation amounting to EUR 27.675 billion in February. This decrease represents the sum of positive net capital investments of EUR 2.692 billion (+0.05%) and the negative development of financial markets amounting to EUR 30.367 billion (-0.58%).

The development of undertakings for collective investment is as follows:

The number of undertakings for collective investment (UCIs) taken into consideration totalled 3,348 against 3,353 the previous month. A total of 2,189 entities adopted an umbrella structure representing 13,109 sub-funds. Adding the 1,159 entities with a traditional UCI structure to that figure, a total of 14,268 fund units were active in the financial centre.

As regards the impact of financial markets on the main categories of undertakings for collective investment and the net capital investment in these UCIs, the following can be said for the month of February.

With economic data globally strong, and declining commodity prices, the fears of a recession slightly diminished. Given the concerns around the relative persistence of inflation, new rate hikes were decided by the major central banks at the beginning of the month, with communication signalling that the interest rate peak would be slightly postponed. As a result, equity markets globally declined (with the exception of European markets) and yields were on the rise (i.e. bond markets declined, given the negative relationship between yields and bond prices).

Concerning developed markets, the European equity UCI category was the only equity category to register a positive performance in February. Some advanced indicators of economic activity surprised positively, while the European Commission proposed its new Green Deal Industrial Plan. The US equity UCI category realised a negative performance, partially driven by the statements of the Federal Reserve (Fed), that further rate hikes might be needed given the most recent inflation figures. The Japanese equity UCI category also declined as a result of a weakening yen in a context of rising inflation and mixed quarterly earnings results from late January to mid-February.

As for emerging countries, the Asian equity category ended in negative territory. The negative performance was driven by sharp declines in Thailand, Malaysia and South Korea, but also partly in China and Hong Kong, due to the escalating geopolitical tensions. The Eastern European equity UCI category also realised a negative performance as economic sentiment remains weak in the region. The Latin America UCI category also realised a negative performance due to the political risk in some countries like Brazil and the loss of consumer confidence.

In February, the equity UCI categories registered an overall positive net capital investment.

Development of equity UCIs during the month of February 2023*

|

Market variation in % |

Net issues in % |

|

| Global market equities |

-0.40% |

0.14% |

| European equities |

1.79% |

-0.19% |

| US equities |

-0.16% |

-0.87% |

| Japanese equities |

-1.31% |

-0.55% |

| Eastern European equities |

-11.31% |

-8.61% |

| Asian equities |

-5.16% |

0.72% |

| Latin American equities |

-4.48% |

2.52% |

| Other equities |

-2.40% |

0.50% |

* Variation in % of Net Assets in EUR as compared to the previous month

On both sides of the Atlantic, inflation remains a core concern. The major central banks have proceeded to new rate hikes, that contributed to rising yields.

Concerning the EUR denominated bond UCI category, the European Central Bank (ECB) hiked rates by 50bps in February and announced a further rate hike for their next meeting in March. The rising yields and the widening of corporate bonds spreads both contributed to the overall negative performance of the EUR denominated bond UCI category.

Concerning the USD denominated bond UCI category, the Fed increased its monetary rates by 25bps at the beginning of the month. Following robust economic data, the markets concluded that interest rates would likely need to remain higher for longer. As in Europe, rising credit spreads impacted corporate bonds negatively. The rise of the yields and of the credit spreads more than compensated the appreciation of the USD against the EUR. As a result, the USD denominated bond UCI category realised a negative performance.

Concerning the Emerging Market bond UCI category, the renewed fears of a more persistent inflation and additional rate hikes weighted negatively. Emerging Markets dollar-denominated sovereign debt and Emerging Markets local currency debt both realised a negative performance.

In February, fixed-income UCI categories registered an overall positive net capital investment. The USD Money market UCI category recorded the highest inflows.

Development of fixed-income UCIs during the month of February 2023*

|

Market variation in % |

Net issues in % |

|

| EUR money market |

0.15% |

-1.28% |

| USD money market |

2.07% |

4.83% |

| Global money market |

0.47% |

-3.93% |

| EUR-denominated bonds |

-1.58% |

0.52% |

| USD-denominated bonds |

-1.05% |

-1.01% |

| Global market bonds |

-1.17% |

0.38% |

| Emerging market bonds |

-1.66% |

-0.05% |

| High Yield bonds |

-0.41% |

-0,33% |

| Others |

-0.89% |

-0.06% |

* Variation in % of Net Assets in EUR as compared to the previous month

The development of net assets of diversified Luxembourg UCIs and funds of funds is illustrated in the table below:

Development of diversified UCIs and funds of funds during the month of February 2023*

|

Market variation in % |

Net issues in % |

|

| Diversified UCIs |

-0.74% |

-0.19% |

| Funds of funds |

-0.22% |

-0.28% |

* Variation in % of Net Assets in EUR as compared to the previous month

II. Breakdown of the number and net assets of UCIs

During the month under review, the following seven undertakings for collective investment were registered on the official list:

UCITS Part I 2010 Law:

- EURINVEST LUXCITS, 12, rue Eugène Ruppert, L-2453 Luxembourg

- GLOBAL INVESTMENT NW SICAV, 15, avenue J-F Kennedy, L-1855 Luxembourg

- UNINACHHALTIG AKTIEN DIVIDENDE, 3, Heienhaff, L-1736 Senningerberg

- UNINACHHALTIG AKTIEN WASSER, 3, Heienhaff, L-1736 Senningerberg

UCIs Part II 2010 Law:

- LUXEMBOURG EARTH IMPACT FUND, 5, Hoehenhof, L-1736 Senningerberg

- MLOAN SICAV, S.A., 12E, rue Guillaume Kroll, L-1882 Luxembourg

SIFs:

- RO AGRICULTURE II INVESTMENT SICAV-SIF, 2, rue Edward Steichen, L-2540 Luxembourg

The following twelve undertakings for collective investment were deregistered from the official list during the month under review:

UCITS Part I 2010 Law:

- ABERDEEN STANDARD SICAV III, 35A, avenue J-F Kennedy, L-1855 Luxembourg

- INVESTMENT SOLUTIONS BY EPSILON, 28, boulevard Kockelscheuer, L-1821 Luxembourg

- THEME INVESTING, 6, rue Gabriel Lippmann, L-5365 Munsbach

- US EQUITY PEARLS, 1C, rue Gabriel Lippmann, L-5365 Munsbach

SIFs:

- CATELLA S.A., SICAV-SIF, 33, rue de Gasperich, L-5826 Hesperange

- OLYMPIA LUX, 60, avenue J-F Kennedy, L-1855 Luxembourg

- PLATINUM I SICAV, 5, allée Scheffer, L-2520 Luxembourg

- PRADERA EUROPEAN RETAIL FUND, 11-13, boulevard de la Foire, L-1528 Luxembourg

SICARs:

- CONVERGING EUROPE FUND III (SCS) SICAR, 16, rue Eugène Ruppert, L-2453 Luxembourg

- CREDIT SUISSE GLOBAL INFRASTRUCTURE SCA SICA, 5, rue Jean Monnet, L-2180 Luxembourg

- QS DIRECT SI 2 S.C.A., SICAR, 22, rue des Bruyères, L-1274 Howald

- QS GEO PEP S.C.A., SICAR, 22, rue des Bruyères, L-1274 Howald