Situation globale des organismes de placement collectif à la fin du mois de janvier 2023 (uniquement en anglais)

Communiqué de presse 23/04

I. Overall situation

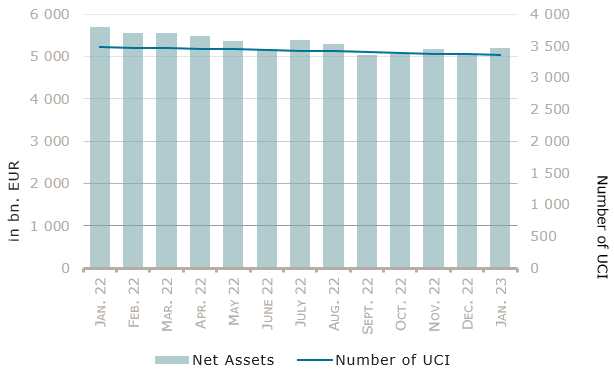

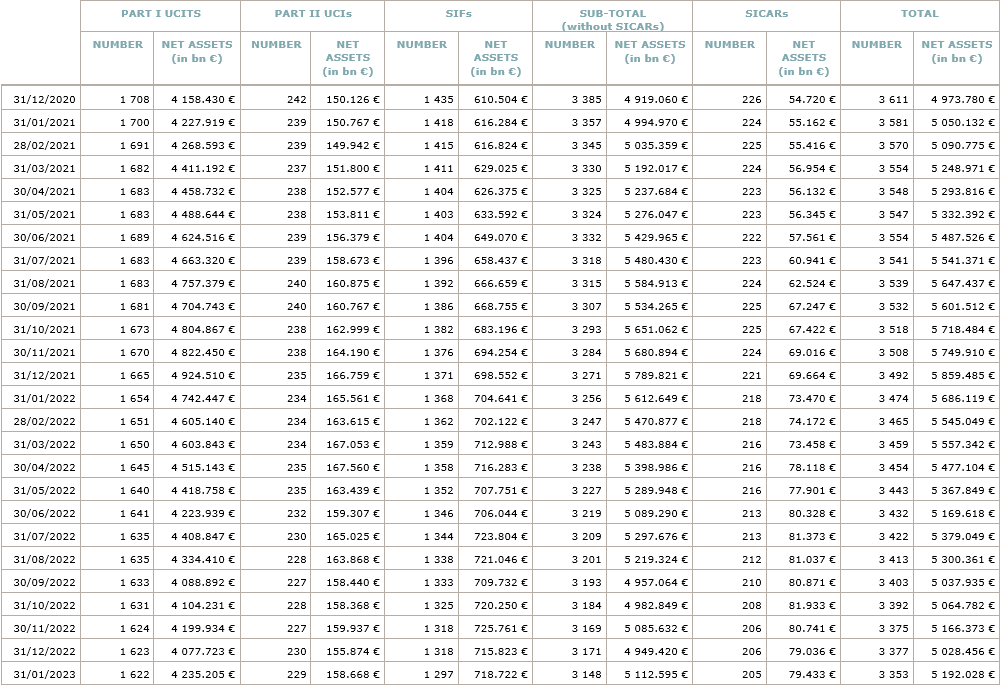

As at 31 January 2023, the total net assets of undertakings for collective investment, comprising UCIs subject to the 2010 Law, specialized investment funds and SICARs, amounted to EUR 5,192.028 billion compared to EUR 5,028.456 billion as at 31 December 2022, i.e. an increase of 3.25% over one month. Over the last twelve months, the volume of net assets decreased by 8.69%.

The Luxembourg UCI industry thus registered a positive variation amounting to EUR 163.572 billion in January. This increase represents the sum of positive net capital investments of EUR 14.277 billion (+0.28%) and of the positive development of financial markets amounting to EUR 149.295 billion (2.97%).

The development of undertakings for collective investment is as follows:

The number of undertakings for collective investment (UCIs) taken into consideration totalled 3,353, against 3,377 the previous month. A total of 2,192 entities adopted an umbrella structure representing 13,117 sub-funds. Adding the 1,161 entities with a traditional UCI structure to that figure, a total of 14,278 fund units were active in the financial centre.

As regards the impact of financial markets on the main categories of undertakings for collective investment and the net capital investment in these UCIs, the following can be said for the month of January.

In a context of progressive slowdown of inflation rates and given market expectations of smaller interest rate hikes, bond yields declined while equity markets developed positively, driven by investors rising risk appetite.

Concerning developed markets, the European equity UCI category registered a positive performance as economic activity decline in Europe was slower than expected, advanced indicators of economic activity slightly improved and inflation further declined. The US equity UCI category also realised a positive performance in January, economic growth being still positive and the Federal Reserve Board (Fed) communication signalling fewer interest rate hikes. The earnings season also started, with some S&P 500 reports beating expectations. The Japanese equity UCI category also rose throughout January, in the context of the depreciation of the Yen and the beginning of the corporate reporting season where early indications also suggested a positive tone.

As for emerging countries, the Asian equity category registered a positive performance as most equity markets in the region rose. The abandon by China of the zero-COVID policy at the end of December, the governments measures to support the economy and the country’s real estate market also contributed to boost investor sentiment. The Eastern European equity UCI category also realized a positive performance, following the trend of the European equity markets. The Latin America UCI category also rose, driven by Mexico, Chile and Peru in a context of rebounding metal prices.

In January, the equity UCI categories registered an overall positive net capital investment.

Development of equity UCIs during the month of January 2023*

|

Market variation in % |

Net issues in % |

|

| Global market equities |

5.04% |

0.27% |

| European equities |

6.36% |

0.02% |

| US equities |

5.25% |

-0.58% |

| Japanese equities |

4.19% |

-0.42% |

| Eastern European equities |

2.30% |

-5.05% |

| Asian equities |

6.95% |

2.65% |

| Latin American equities |

7.27% |

-2.24% |

| Other equities |

5.73% |

1.11% |

* Variation in % of Net Assets in EUR as compared to the previous month

In fixed income UCI markets, with inflation rates on the decline, government bond yields decreased on both sides of the Atlantic, which positively affected bond prices (given the negative relationship between prices and yields).

Concerning the EUR denominated bond UCI category, governments bond yields declined, while inflation rates recede since November. Corporate bonds spreads tightened as the advanced indicators signalled a slight improvement of the economic outlook. Together, these factors contributed to the positive performance of the category.

Concerning the US denominated bond UCI category, the decline in government bond yields and lower spreads for corporate bonds drove the positive performance of the category, more than compensating the depreciation of the USD against the EUR.

Concerning the Emerging Markets Bonds UCI category, China’s economic re-opening, declining U.S. inflation and less hawkish tone from the Federal Reserve all contributed to the rise of the category.

In January, fixed income UCI categories registered an overall positive net capital investment.

Development of fixed income UCIs during the month of January 2023*

|

Market variation in % |

Net issues in % |

|

| EUR money market |

0.16% |

-4.40% |

| USD money market |

-1.44% |

2.85% |

| Global money market |

-0.10% |

2.34% |

| EUR-denominated bonds |

1.94% |

0.87% |

| USD-denominated bonds |

1.55% |

0.08% |

| Global market bonds |

2.17% |

0.22% |

| Emerging market bonds |

2.27% |

1.84% |

| High Yield bonds |

2.58% |

0.69% |

| Others |

1.85% |

0.38% |

* Variation in % of Net Assets in EUR as compared to the previous month

The development of net assets of diversified Luxembourg UCIs and funds of funds is illustrated in the table below:

Development of diversified UCIs and funds of funds during the month of January 2023*

|

Market variation in % |

Net issues in % |

|

| Diversified UCIs |

2.72% |

0.21 % |

| Funds of funds |

1.86% |

-2.06% |

* Variation in % of Net Assets in EUR as compared to the previous month

II. Breakdown of the number and net assets of UCIs

During the month under review, the following seven undertakings for collective investment have been registered on the official list:

UCITS Part I 2010 Law:

- HC UCITS FUND, 5, allée Scheffer, L-2520 Luxembourg

- UNIEURORENTA UNTERNEHMENSANLEIHEN 2028, 3, Heienhaff, L-1736 Senningerberg

- VALENTUM FCP, 4, rue Jean Monnet, L-2180 Luxembourg

SIFs:

- HSF1 FUND FCP-SIF, 8-10, rue Jean Monnet, L-2180 Luxembourg

- PRINCIPAL EUROPEAN DATA CENTRE FUND I SCSP, SICAV-SIF, 8, rue Lou Hemmer, L-1748 Luxembourg-Findel

- SAFEPORT LOICK GREEN INVESTMENTS FUND SA, SICAV-SIF, 2, rue Edward Steichen, L-2540 Luxembourg

- UBS (LUX) PRIVATE EQUITY GROWTH V SCSP SICAV-SIF, 15, boulevard F.W. Raiffeisen, L-2411 Luxembourg

The following thirty-one undertakings for collective investment have been deregistered from the official list during the month under review:

UCITS Part I 2010 Law:

- ASSENAGON ULTIMATE RETURN, 1B, Heienhaff, L-1736 Senningerberg

- BLUEORCHARD UCITS, 31, Z.A. Bourmicht, L-8070 Bertrange

- LS FUND, 11-13, boulevard de la Foire, L-1528 Luxembourg

- STARS, 4, rue Thomas Edison, L-1445 Luxembourg-Strassen

- VR NÜRNBERG (IPC), 4, rue Thomas Edison, L-1445 Luxembourg-Strassen

SIFs:

- ATLAS SICAV-FIS, 80, route d’Esch, L-1470 Luxembourg

- CQS AIGUILLE DU CHARDONNET FF S.C.A. SICAV-SIF, 20, rue de la Poste, L-2346 Luxembourg

- CQS AIGUILLE DU CHARDONNET MF S.C.A. SICAV-SIF, 20, rue de la Poste, L-2346 Luxembourg

- CRESCENDO PRESERVATION & INCOME FUND SICAV SIF S.A., 46A, avenue J-F Kennedy, L-1855 Luxembourg

- ELITE’S EXCLUSIVE COLLECTION, 5, allée Scheffer, L-2520 Luxembourg

- IBERIAN LAND FUND SICAV-SIF SA, 6A, rue Gabriel Lippmann, L-5365 Munsbach

- ITHAKA SICAV FIS, 4, rue Thomas Edison, L-1445 Luxembourg-Strassen

- LONGHORN REF X INTERNATIONAL INVESTMENTS, 42-44, avenue de la Gare, L-1610 Luxembourg

- LOONIE FUND 10 FCP, 2, rue Hildegard von Bingen, L-1282 Luxembourg

- LOONIE FUND 11 FCP, 2, rue Hildegard von Bingen, L-1282 Luxembourg

- LOONIE FUND 12 FCP, 2, rue Hildegard von Bingen, L-1282 Luxembourg

- LOONIE FUND 13 FCP, 2, rue Hildegard von Bingen, L-1282 Luxembourg

- LOONIE FUND 15 FCP, 2, rue Hildegard von Bingen, L-1282 Luxembourg

- LOONIE FUND 4 FCP, 2, rue Hildegard von Bingen, L-1282 Luxembourg

- LOONIE FUND 6 FCP, 2, rue Hildegard von Bingen, L-1282 Luxembourg

- LOONIE FUND 7 FCP, 2, rue Hildegard von Bingen, L-1282 Luxembourg

- LOONIE FUND 8 FCP, 2, rue Hildegard von Bingen, L-1282 Luxembourg

- NOX CORE RE FUND SICAV-SIF, 1C, rue Gabriel Lippmann, L-5365 Munsbach

- ODYSSEY FUND – SICAV SIF, 15, avenue J-F Kennedy, L-1855 Luxembourg

- PRIME REAL ESTATE FUND SCA SICAV-SIF, 13A, Fausermillen, L-6689 Mertert

- QWAZAR CAPITAL S.A., SICAV-FIS, 5, rue Jean Monnet, L-2180 Luxembourg

- SUSTAINABILITY – FINANCE – REAL ECONOMIES SICAV-SIF, 11-13, boulevard de la Foire, L-1528 Luxembourg

- SVG-LUXINVEST SCS SICAF-SIF, 2, rue Edward Steichen, L-2540 Luxembourg

- SVL-LUXINVEST SCS SICAF-SIF, 2, rue Edward Steichen, L-2540 Luxembourg

- SWISS LIFE REAL ESTATE FUNDS (LUX) II S.C.A., SICAV-SIF, 4A, rue Albert Borschette, L-1246 Luxembourg

SICARs:

- ICECAPITAL NORDIC SECONDARY FUND S.C.A., SICAR, 5, avenue Gaston Diderich, L-1420 Luxembourg