Situation globale des organismes de placement collectif à la fin du mois de janvier 2024 (uniquement en anglais)

Communiqué de presse 24/07

I. Overall situation

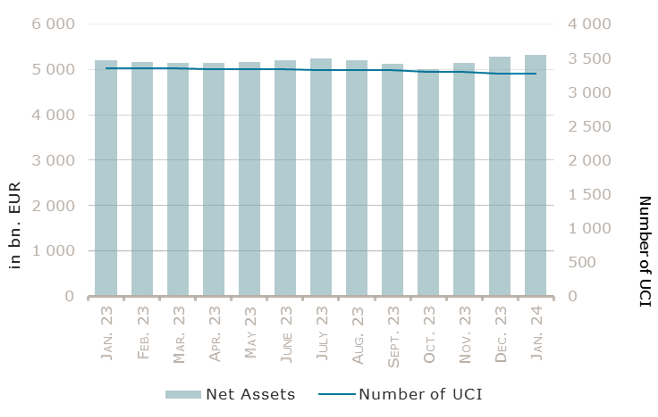

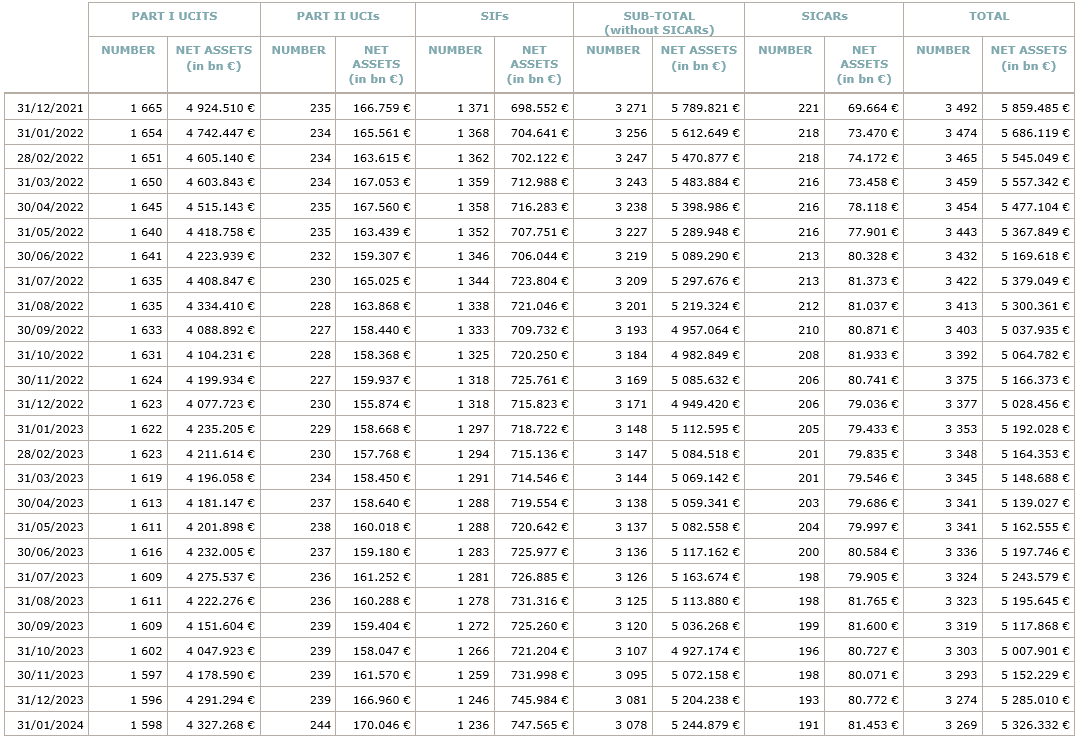

As at 31 January 2024, the total net assets of undertakings for collective investment, comprising UCIs subject to the 2010 Law, specialised investment funds and SICARs, amounted to EUR 5,326.332 billion compared to EUR 5,285.010 billion as at 31 December 2023, i.e. an increase of 0.78% over one month. Over the last twelve months, the volume of net assets increased by 2.59%.

The Luxembourg UCI industry thus registered a positive variation amounting to EUR 41.322 billion in January. This increase represents the sum of negative net capital investments of EUR 5.828 billion (-0.11%) and of the positive development of financial markets amounting to EUR 47.150 billion (+0.89%).

The development of undertakings for collective investment is as follows:

The number of undertakings for collective investment (UCIs) taken into consideration totalled 3,269, against 3,274 the previous month. A total of 2,140 entities adopted an umbrella structure representing 12,827 sub-funds. Adding the 1,129 entities with a traditional UCI structure to that figure, a total of 13,956 fund units were active in the financial centre.

As regards the impact of financial markets on the main categories of undertakings for collective investment and the net capital investment in these UCIs, the following can be said for the month of January.

Equity markets posted further gains in January with several indices reaching record levels during the month, thanks to strong economic data that supported optimism on a soft landing of the economy and by the prospects for profits from Artificial Intelligence. Equity markets finished the month slightly lower after statements from the European Central Bank (ECB) and particularly from the Federal Reserve (Fed), which explicitly pushed back the possibility for a rate cut in March.

In that context, the Japanese UCI category registered the best monthly performance, due to its exposure to technology stocks and in spite of a negative currency effect. The other UCI categories also performed well, with US equities benefitting from a favourable currency effect. On the opposite, Asian equity markets reported large losses mostly due to the ongoing economic difficulties in China.

In January, the equity UCI categories registered an overall negative capital investment with the exception of Japanese equities.

Development of equity UCIs during the month of January 2024*

|

Market variation in % |

Net issues in % |

|

| Global market equities |

1.74% |

-1.16% |

| European equities |

1.24% |

-1.06% |

| US equities |

3.26% |

-0.63% |

| Japanese equities |

4.02% |

1.32% |

| Eastern European equities |

1.61% |

-2.43% |

| Asian equities |

-4.11% |

-2.21% |

| Latin American equities |

-2.60% |

-3.49% |

| Other equities |

-0.76% |

-0.91% |

* Variation in % of Net Assets in EUR as compared to the previous month

Fixed income UCIs were negatively affected by the less dovish tones of the ECB and the Fed, which led to a downward reassessment of anticipations of rate cuts.

All the fixed income UCI categories, except EUR-denominated bonds, nevertheless reported positive performances thanks to the appreciation of USD against EUR.

In January, fixed income UCIs registered an overall positive net capital investment.

Development of fixed income UCIs during the month of January 2024*

|

Market variation in % |

Net issues in % |

|

| EUR money market |

0.28% |

-1.91% |

| USD money market |

2.06% |

4.07% |

| Global money market |

0.91% |

0.17% |

| EUR-denominated bonds |

-0.19% |

1.12% |

| USD-denominated bonds |

1.08% |

1.33% |

| Global market bonds |

0.36% |

0.68% |

| Emerging market bonds |

0.25% |

-0.22% |

| High Yield bonds |

1.12% |

0.33% |

| Others |

0.46% |

1.04% |

* Variation in % of Net Assets in EUR as compared to the previous month

The development of net assets of diversified Luxembourg UCIs and funds of funds is illustrated in the table below:

Development of diversified UCIs and funds of funds during the month of January 2024*

|

Market variation in % |

Net issues in % |

|

| Diversified UCIs |

0.95% |

-0.35% |

| Funds of funds |

0.84% |

-0.10% |

* Variation in % of Net Assets in EUR as compared to the previous month

II. Breakdown of the number and net assets of UCIs

During the month under review, the following eight undertakings for collective investment have been registered on the official list:

UCITS Part I 2010 Law:

- DJE CONSTANT MATURITY ITA GOV BOND FUND, 15, rue de Flaxweiler, L-6776 Grevenmacher

- UNIEURORENTA UNTERNEHMENSANLEIHEN 2027 II, 3, Heienhaff, L-1736 Senningerberg

- UNIEURORENTA UNTERNEHMENSANLEIHEN 2030, 3, Heienhaff, L-1736 Senningerberg

UCIs Part II 2010 Law:

- CVC PRIVATE CREDIT FUND S.A. SICAV, Vertigo Building – Polaris, 2-4, rue Eugène Ruppert, L-2453 LUXEMBOURG

- PARTNERS GROUP PRIVATE MARKETS OPPORTUNITIES SICAV, 35D, avenue J-F Kennedy, L-1855 Luxembourg

- SEB ELTIF, 4, rue Peternelchen, L-2370 Howald

- SWISS LIFE FUNDS (LUX) PRIVADO INFRASTRUCTURE S.A., SICAV-ELTIF, 4A, rue Albert Borschette, L-1246 Luxembourg

- UNIPRIVATMARKT INFRASTRUKTUR ELTIF, 3, Heienhaff, L-1736 Senningerberg

The following thirteen undertakings for collective investment have been deregistered from the official list during the month under review:

UCITS Part I 2010 Law:

- ITI FUNDS UCITS ETF SICAV, 4, rue Robert Stumper, L-2557 Luxembourg

SIFs:

- DESCOPEDIA S.C.A., SICAV-SIF, 5, rue Heienhaff, L-1736 Senningerberg

- EURINVEST SICAV – SIF, 12, rue Eugène Ruppert, L-2453 Luxembourg

- HEALTHCARE PROMISE S.C.A., SICAV-SIF, 12, rue Eugène Ruppert, L-2453 Luxembourg

- LUITPOLD SICAV-FIS, 1C, rue Gabriel Lippmann, L-5365 Munsbach

- PANSAFE SICAV-SIF S.A., 204, route de Luxembourg, L-7241 Bereldange

- RADIANT FUND S.C.A. SICAV-FIS, 11, avenue de la Porte-Neuve, L-2227 Luxembourg

- SB PARTNERS SIF SICAV S.A., 62, avenue de la Liberté, L-1930 Luxembourg

- THIRD EYE CAPITAL CREDIT OPPORTUNITIES FUND, 19, rue de Bitbourg, L-1273 Luxembourg

- WEST FUND SICAV-SIF, 18, rue de l’Eau, L-1449 Luxembourg

- YIELCO INFRASTRUKTUR III SCS, SICAV-SIF, 9A, rue Gabriel Lippmann, L-5365 Munsbach

SICARs:

- DAHLIA A SICAR S.C.A., 60, avenue J-F Kennedy, L-1855 Luxembourg

- DAHLIA B SICAR S.C.A., 60, avenue J-F Kennedy, L-1855 Luxembourg