Situation globale des organismes de placement collectif à la fin du mois de mars 2024 (uniquement en anglais)

Communiqué de presse 24/12

I. Overall situation

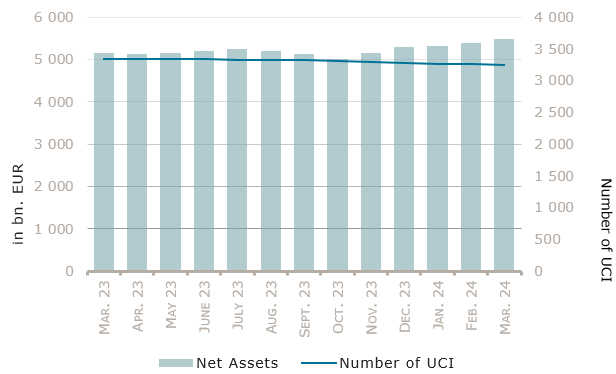

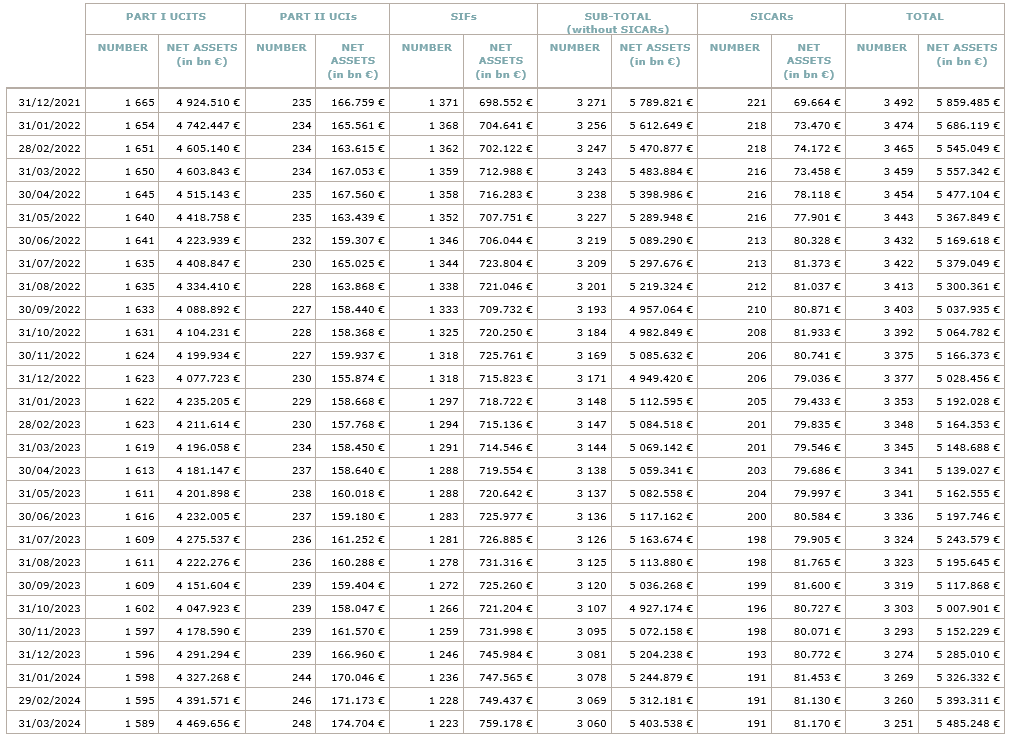

As at 31 March 2024, the total net assets of undertakings for collective investment, comprising UCIs subject to the 2010 Law, specialised investment funds and SICARs, amounted to EUR 5,485.248 billion compared to EUR 5,393.311 billion as at 29 February 2024, i.e. an increase of 1.70% over one month. Over the last twelve months, the volume of net assets increased by 6.54%.

The Luxembourg UCI industry thus registered a positive variation amounting to EUR 91.937 billion in March. This increase represents the sum of positive net capital investments of EUR 1.844 billion (+0.03%) and of the positive development of financial markets amounting to EUR 90.093 billion (+1.67%).

The development of undertakings for collective investment is as follows:

The number of undertakings for collective investment taken into consideration totalled 3,251, against 3,260 the previous month. A total of 2,124 entities adopted an umbrella structure representing 12,777 sub-funds. Adding the 1,127 entities with a traditional UCI structure to that figure, a total of 13,904 fund units were active in the financial centre.

As regards the impact of financial markets on the main categories of undertakings for collective investment and the net capital investment in these UCIs, the following can be said for the month of March.

Equity markets worldwide have maintained a robust bullish momentum, mainly fuelled by dovish stance from central banks officials, thereby confirming the strong gains recorded in the precedent months with developed countries (EU, North America, Japan), overperforming emerging peers. US economic resilience and enthusiasm around AI continue to support US equities while Europe segment benefits from some signs of improving business activity further supported by companies’ earnings above expectations. The Asian market was more contrasted between China sluggish economy and the upward dynamic in countries more specifically exposed to high technology such as South-Korea and Taiwan. Other markets were positively driven by comments surrounding the speed and sequence of the expected monetary policy easing.

In March, all equity UCI categories registered a negative capital investment with outflows.

Development of equity UCIs during the month of March 2024*

|

Market variation in % |

Net issues in % |

|

| Global market equities |

2.73% |

-0.29% |

| European equities |

3.25% |

-0.16% |

| US equities |

3.04% |

-0.06% |

| Japanese equities |

3.26% |

-0.28% |

| Eastern European equities |

-0.57% |

-0.64% |

| Asian equities |

1.47% |

-1.63% |

| Latin American equities |

1.86% |

-2.30% |

| Other equities |

2.40% |

-0.40% |

* Variation in % of Net Assets in EUR as compared to the previous month

Fixed income UCI delivered positive performance across all categories, pushed by favourable macroeconomic fundamental and slightly lowering government yields. Credit investors remain mainly dependent to central banks actions in the coming months and March has seen a positive shift in disinflation trend and interest rate cuts expectation where the ECB is now priced as first mover over the Fed in the cuts cycle.

In March, fixed income UCIs registered an overall positive net capital investment due to significant inflows in money market UCI categories except for USD money market.

Development of fixed income UCIs during the month of March 2024*

|

Market variation in % |

Net issues in % |

|

| EUR money market |

0.11% |

4.91% |

| USD money market |

0.22% |

-3.09% |

| Global money market |

0.17% |

2.65% |

| EUR-denominated bonds |

1.05% |

1.71% |

| USD-denominated bonds |

0.68% |

0.06% |

| Global market bonds |

0.82% |

0.14% |

| Emerging market bonds |

1.18% |

0.09% |

| High Yield bonds |

0.66% |

0.93% |

| Others |

0.86% |

0.37% |

* Variation in % of Net Assets in EUR as compared to the previous month

The development of net assets of diversified Luxembourg UCIs and funds of funds is illustrated in the table below:

Development of diversified UCIs and funds of funds during the month of March 2024*

|

Market variation in % |

Net issues in % |

|

| Diversified UCIs |

1.74% |

0.03% |

| Funds of funds |

1.55% |

0.49% |

* Variation in % of Net Assets in EUR as compared to the previous month

II. Breakdown of the number and net assets of UCIs

During the month under review, the following seven undertakings for collective investment have been registered on the official list:

UCITS Part I 2010 Law:

- ALPEN PB, 4, rue Thomas Edison, L-1445 Luxembourg-Strassen

UCIs Part II 2010 Law:

- ACCESS PRIVATE MARKET OPPORTUNITIES ELTIF SICAV, 412F, route d’Esch, L-1471 Luxembourg

- MLOAN FEEDER SICAV, S.A., 12E, rue Guillaume Kroll, L-1882 Luxembourg

- PORTA EQUITY ELTIF, 19, rue Flaxweiler, L-6776 Grevenmacher

SIFs:

- VALESCO REF, 33, Avenue J.F. Kennedy, L-1855 Luxembourg

SICARs:

- ENERIS SICAR S.C.A., 270 Route d’Esch, L-1471 Luxembourg

- KUALI FUND S.C.A., SICAR-EUSEF, 30, Boulevard Royal, L-2449 Luxembourg

The following sixteen undertakings for collective investment have been deregistered from the official list during the month under review:

UCITS Part I 2010 Law:

- CREDIT SUISSE CUSTOM MARKETS, 19, rue de Bitbourg, L-1273 Luxembourg

- GFG FUNDS, 5, rue Jean Monnet, L-2180 Luxembourg

- MYINVESTOR FCP, 4, rue Jean Monnet, L-2180 Luxembourg

- NEXT AM FUND, 60, avenue J-F Kennedy, L-1855 Luxembourg

- SEB FUND 2, 4, rue Peternelchen, L-2370 Howald

- SYSTEMATICA, 17, rue Jean l’Aveugle, L-1148 Luxembourg

- UNIGARANTTOP: EUROPA, 3, Heienhaff, L-1736 Senningerberg

UCIs Part II 2010 Law:

- IGNI, 12, rue Eugène Ruppert, L-2453 Luxembourg

SIFs:

- CEE RENEWABLE FUND S.A. SICAV-FIS, 15, rue de Flaxweiler, L-6776 Grevenmacher

- CEON FUND SICAV SIF SCA, 23, Val fleuri, L-1526 Luxembourg

- EIFFEL DIVERSIFIED FUND FCP-SIF, 5, allée Scheffer, L-2520 Luxembourg

- EIFFEL OPPORTUNITIES FUND FCP-SIF, 5, allée Scheffer, L-2520 Luxembourg

- PORTUGAL VENTURE CAPITAL INITIATIVE, 15, boulevard Friedrich Wilhelm Raiffeisen, L-2411 Luxembourg

- QS REAL ESTATE SELECT EUROPEAN OPPORTUNITIES SLP SICAV-SIF, 22, rue des Bruyères, L-1274 Howald

SICARs:

- DB REAL ESTATE IBERIAN VALUE ADDED I, S.A., SICAR, 68-70, boulevard de la Pétrusse, L-2320 Luxembourg

- PARTNERS GROUP REAL ESTATE SECONDARY 2009 (EURO) S.C.A., SICAR, 35D, avenue J-F Kennedy, L-1855 Luxembourg