Situation globale des organismes de placement collectif à la fin du mois de juin 2020 (uniquement en anglais)

Communiqué de presse 20/16

I. Overall situation

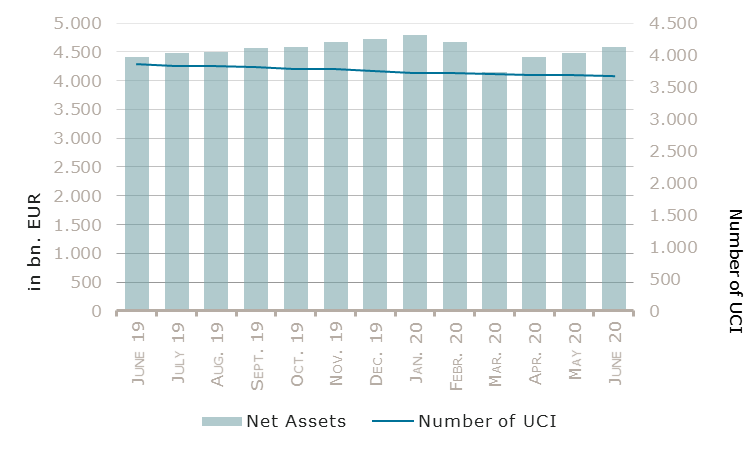

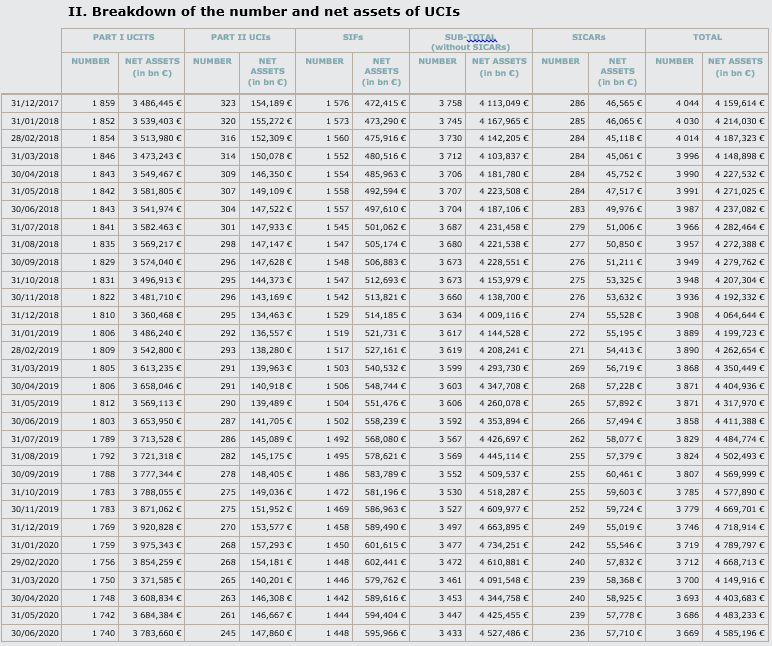

As at 30 June 2020, the total net assets of undertakings for collective investment, comprising UCIs subject to the 2010 Law, specialized investment funds and SICARs, amounted to EUR 4.585,196 billion compared to EUR 4.483,233 billion as at 31 May 2020, i.e. an increase of 2,27% over one month. Over the last twelve months, the volume of net assets rose by 3,94%.

The Luxembourg UCI industry thus registered a positive variation amounting to EUR 101,963 billion in June. This increase represents the sum of positive net capital investments of EUR 36,447 billion (+0,81%) and of the positive development of financial markets amounting to EUR 65,516 billion (+1,46%).

The development of undertakings for collective investment is as follows:

The number of undertakings for collective investment (UCIs) taken into consideration totalled 3.669, as against 3.686 the previous month. A total of 2.402 entities adopted an umbrella structure representing 13.445 sub-funds. Adding the 1.267 entities with a traditional UCI structure to that figure, a total of 14.712 fund units were active in the financial centre.

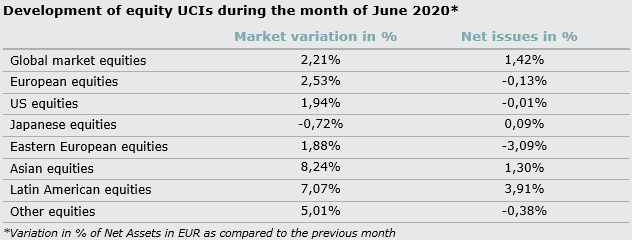

As regards, on the one hand, the impact of financial markets on the main categories of undertakings for collective investment and, on the other hand, the net capital investment in these UCIs, the following can be said for the month of June:

Equity markets continued to develop positively, mainly supported by the global easing of lockdown measures, the extension of monetary and budgetary policy measures and better economic indicators. These movements did profit the equity UCI categories in the developed and emerging market countries, the exception being the Japanese equity category for which the depreciation of the Yen against the EUR shifted the category into negative territory. The largest gains were recorded for the Asian and the Latin American equities, this despite a renewed intensification of the US-China tensions and divergent pandemic developments in various countries of Latin America.

In June, equity UCI categories registered an overall positive net capital investment.

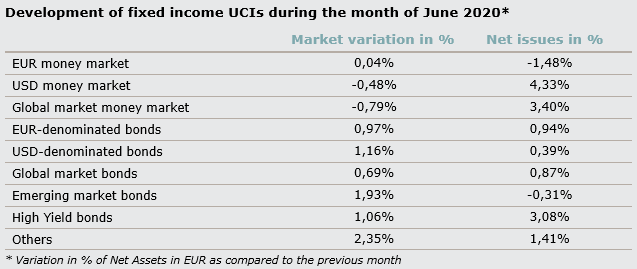

In Europe, the extension (volume and duration) by the European Central Bank (ECB) of its pandemic emergency purchase program (PEPP), its targeted longer-term refinancing operations to euro area banks as well as the proposal for an EU-wide recovery fund supported the European bond market and profited notably to lower-rated Government bonds of peripheral countries pushing related yields lower. Prices also moved up for corporate bonds profiting from an increased demand in an overall positive market environment. As a consequence, EUR-denominated bond UCIs ended the month in positive territory.

In the United States, US Treasury yields remained overall stable in a context marked by resurgent risk appetite of investors. The purchase by the Federal Reserve (Fed) of U.S. corporate bonds since June supported that market segment pushing yields lower. On that basis, USD-denominated bond UCIs recorded an overall value increase, partly compensated by the depreciation of the USD against the EUR.

The emerging markets UCI category further recovered in a positive market environment with renewed appetite for riskier assets, reduced risk premiums on these bonds and reductions of key interest rates by many central banks of emerging countries, despite idiosyncratic risks persisting in some emerging economies.

In June, fixed income UCI categories registered an overall positive net capital investment, the largest inflows being seen for USD and Global money market funds as well as High Yield bonds.

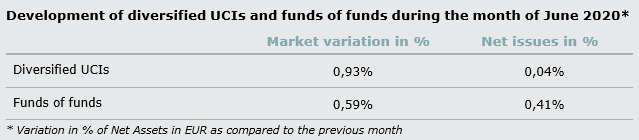

The development of net assets of diversified Luxembourg UCIs and funds of funds is illustrated in the table below:

During the month under review, the following ten undertakings for collective investment have been registered on the official list:

UCITS Part I 2010 Law:

- ARC ALPHA, 1C, rue Gabriel Lippmann, L-5365 Munsbach

- ARERO – DER WELTFONDS – NACHHALTIG, 2, boulevard Konrad Adenauer, L-1115 Luxembourg

- ATONRÂ SICAV, 106, route d’Arlon, L-8210 Mamer

- EURIZON NEXT, 8, avenue de la Liberté, L-1930 Luxembourg

- PREMIUM SAVINGS SOLUTIONS, 8-10, rue Jean Monnet, L-2180 Luxembourg

- UNIINSTITUTIONAL STRUCTURED CREDIT HIGH GRADE, 308, route d’Esch, L-1471 Luxembourg

UCIs Part II 2010 Law:

- –

SIFs:

- COMPASS GLOBAL MANAGEMENT FCP-SIF, 121, avenue de la Faïencerie, L-1511 Luxembourg

- EUROPEAN PROPERTY INVESTORS SPECIAL OPPORTUNITIES 5 SCSP – SICAV – SIF, 6C, rue Gabriel Lippmann, L-5365 Munsbach

- INVESTMENT ACCESS I SICAV SIF, 33A, avenue J-F Kennedy, L-1855 Luxembourg

- PRIDE FCP SIF 2020-3, 5, rue Aldringen, L-1118 Luxembourg

SICARs:

- –

The following twenty-seven undertakings for collective investment have been deregistered from the official list during the month under review:

UCITS Part I 2010 Law:

- ACTIAM (L), 60, avenue J-F Kennedy, L-1855 Luxembourg

- ADVANTAGE, 2, rue d’Alsace, L-1122 Luxembourg

- CHINA LION FUND UCITS, 6B, route de Trèves, L-2633 Senningerberg

- D&R AMWAL GCC SICAV, 4, rue Thomas Edison, L-1445 Strassen

- FDH PATRIMOINE, 9, boulevard Prince Henri, L-1724 Luxembourg

- H & A WANDELANLEIHEN EUROPA, 1C, rue Gabriel Lippmann, L-5365 Munsbach

- SELLA CAPITAL MANAGEMENT, 30, boulevard Royal, L-2449 Luxembourg

- TÜRKISFUND, 5, allée Scheffer, L-2520 Luxembourg

UCIs Part II 2010 Law:

- MOSAIC TRADING, 15, avenue J-F Kennedy, L-1855 Luxembourg

- UNIGARANT: ROHSTOFFE (2020), 308, route d’Esch, L-1471 Luxembourg

SIFs:

- ABERDEEN EUROPEAN SECONDARIES PROPERTY FUND OF FUNDS, 35A, avenue J-F Kennedy, L-1855 Luxembourg

- ABERDEEN INDIRECT PROPERTY PARTNERS, 35A, avenue J-F Kennedy, L-1855 Luxembourg

- ALTERCAP II, 412F, route d’Esch, L-1471 Luxembourg

- ALTERCAP II-B, 412F, route d’Esch, L-1471 Luxembourg

- ARMADA CAPITAL SICAV SIF, 28-32, place de la Gare, L-1616 Luxembourg

- CAJAS ESPAÑOLAS DE AHORROS SICAV, 60, avenue J-F Kennedy, L-1855 Luxembourg

- CAPITALIS S.C.A., SICAV-SIF, 1B, rue Jean Piret, L-2350 Luxembourg

- COLUMBIA THREADNEEDLE SICAV-SIF, 31, Z.A. Bourmicht, L-8070 Bertrange

- IPC-PORTFOLIO INVEST V, 4, rue Thomas Edison, L-1445 Luxembourg-Strassen

- MADRAGUE CAPITAL S.C.A. SICAV-SIF, 20, rue de la Poste, L-2346 Luxembourg

- MCP PRIVATE CAPITAL FUND I, 412F, route d’Esch, L-2086 luxembourg

- MUGC/ASHMORE LATIN AMERICA USD BOND FUND, 287-289, route d’Arlon, L-1150 Luxembourg

- RUTHENIUM FUND S.A., SICAV-SIF, 5, allée Scheffer, L-2520 Luxembourg

- SOUTH ONE FUND, 287-289, route d’Arlon, L-1150 Luxembourg

SICARs:

- LBREP II EUROPE S.A R.L., SICAR, 42-44, avenue de la Gare, L-1610 Luxembourg

- PUCCINI S.C.A., SICAR, 412F, route d’Esch, L-2086 Luxembourg

- SU TURKISH PRIVATE EQUITY OPPORTUNITIES I, S.C.A., SICAR, 15, avenue J-F Kennedy, L-1855 Luxembourg