Situation globale des organismes de placement collectif à la fin du mois de mars 2021 (uniquement en anglais)

Communiqué de presse 21/09

I. Overall situation

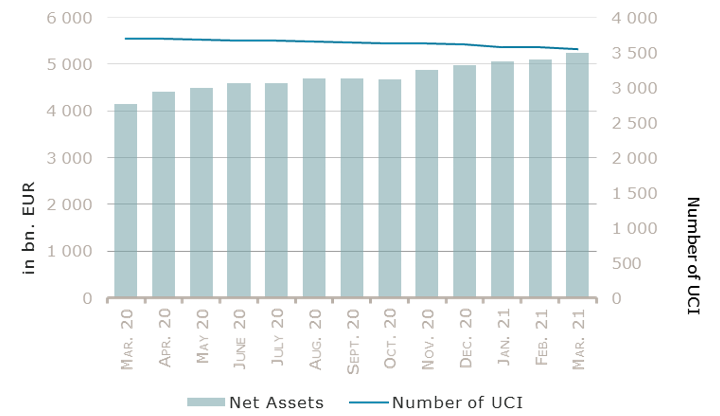

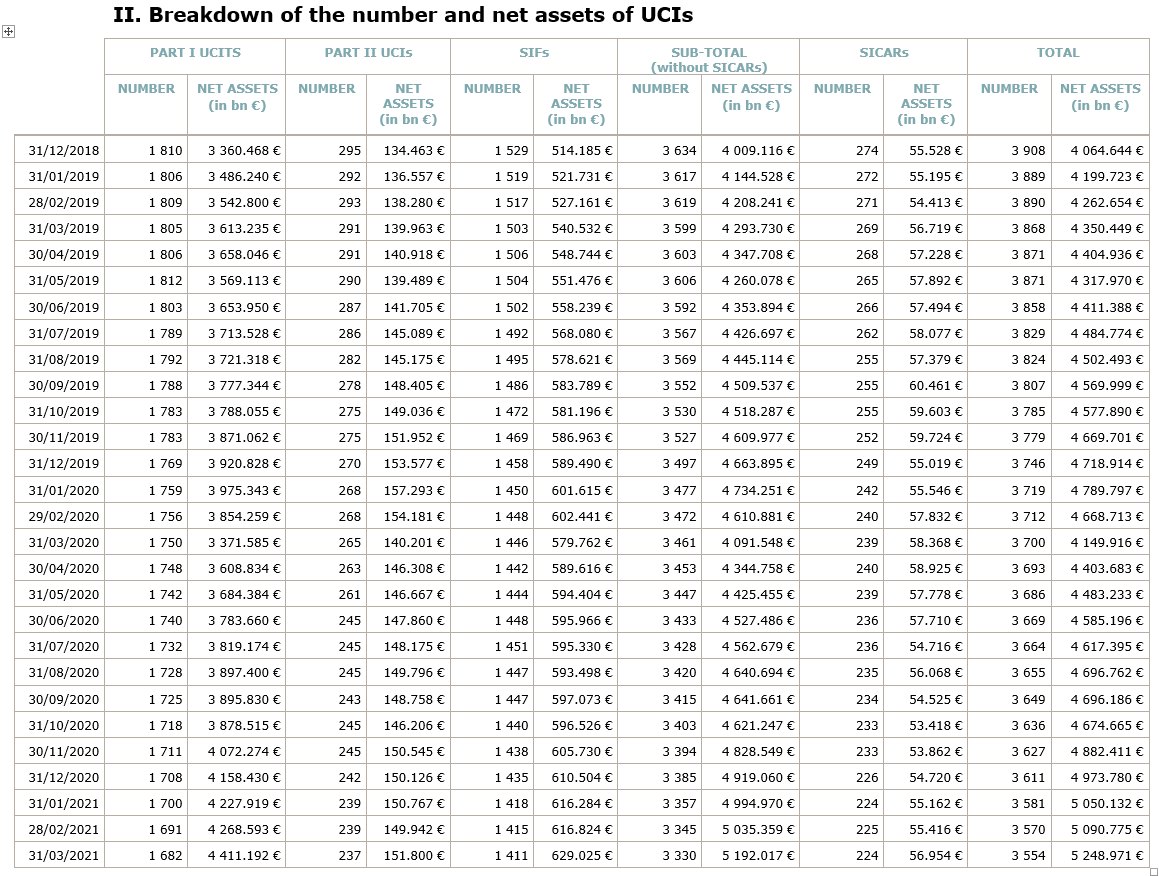

As at 31 March 2021, the total net assets of undertakings for collective investment, comprising UCIs subject to the 2010 Law, specialised investment funds and SICARs, amounted to EUR 5,248.971 billion compared to EUR 5,090.775 billion as at 28 February 2021, i.e. an increase of 3.11% over one month. Over the last twelve months, the volume of net assets rose by 26.48%.

The Luxembourg UCI industry thus registered a positive variation amounting to EUR 158.196 billion in March. This increase represents the sum of positive net capital investments of EUR 46.758 billion (+0.92%) and of the positive development of financial markets amounting to EUR 111.438 billion (+2.19%).

The development of undertakings for collective investment is as follows:

The number of undertakings for collective investment (UCIs) taken into consideration totalled 3,554, against 3,570 the previous month. A total of 2,347 entities adopted an umbrella structure representing 13,341 sub-funds. Adding the 1,207 entities with a traditional UCI structure to that figure, a total of 14,548 fund units were active in the financial centre.

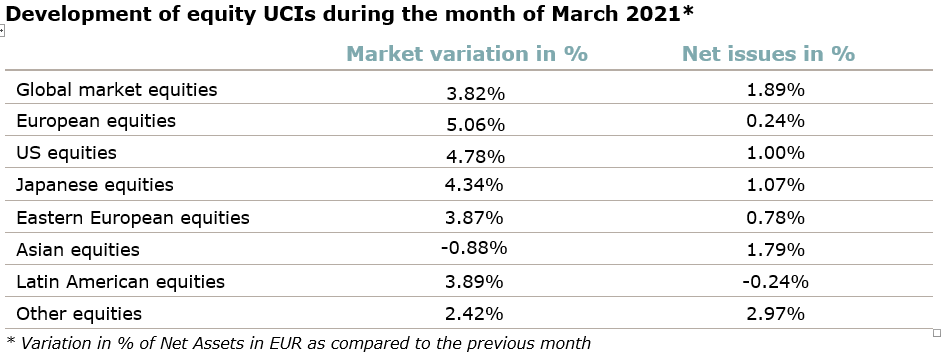

As regards the impact of financial markets on the main categories of undertakings for collective investment and the net capital investment in these UCIs, the following can be said for the month of March:

Equity markets globally rose in a context marked by improved global macroeconomic data and continuous fiscal and monetary policy support, with the exception of Asian equity markets.

Concerning developed markets, the European equity UCI category gained under the impulse of positive macroeconomic indicators amid hopes of global economic recovery, the preparation of the “Next Generation EU” fund and the European Central Bank (ECB) signalling an extended accommodative monetary policy, despite growing infection rates and concomitant regional lockdowns as well as a slow vaccine roll-out in the EU. A rapid deployment of the COVID19 vaccines in the US, improved economic indicators, the prospect of extensive fiscal stimulus packages as well as the appreciation of the USD against the EUR shifted the US equity UCI category into positive territory. The Japanese equity UCI category rose as well during the month of March on the basis of robust economic data and the continued low interest rate policy of the Bank of Japan (BOJ).

As for emerging countries, the Asian equity UCI category overall registered a negative performance amid rising bond yields in the United States making investments in emerging markets less attractive, a slight weakening of the growth dynamic in China as well as profit-taking operations in Chinese equity markets. The Eastern European equity UCI category gained on the grounds notably of better macro data and increasing oil prices, supporting the Russian equity market as well as the Polish and Czech equity markets. The Latin American equity UCI category generated a robust return driven by higher commodity prices and improved economic prospects in global, notwithstanding political uncertainties in Brazil, inflation problems in Mexico and a diverging development of emerging market currencies.

In March, the equity UCI categories registered an overall positive net capital investment.

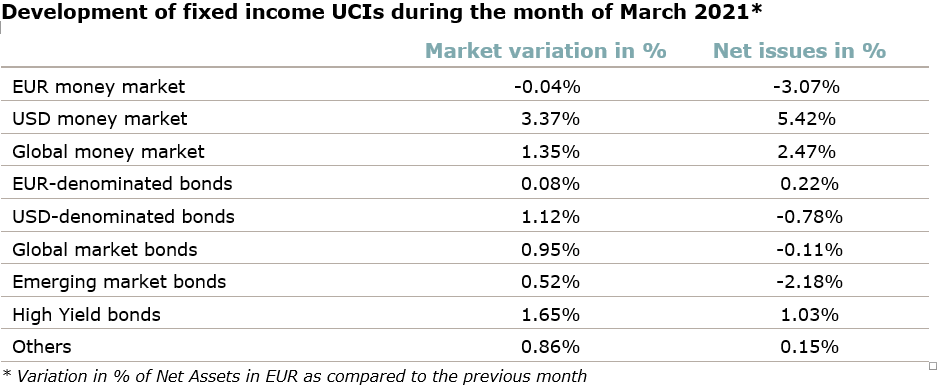

For the month under review, the yields of government bonds continued increasing on both sides of the Atlantic.

As for EUR-denominated government bonds, against the background of rising infection rates in Europe and the announcement of the European Central Bank to extend its Pandemic Purchase Emergency Program (PEPP) in order to keep the financing cost for European corporates at a low level, the yields of European government bonds only slightly increased (i.e. bond prices decreased) whereas the yields of investment grade corporate bonds moved sideways while their risk premiums slightly compressed. Overall the performance of the EUR-denominated bond UCI category remained virtually flat.

Concerning the USD-denominated bond UCI category, the substantial fiscal and infrastructure programs planned by the US government led to higher growth and inflation anticipations and as a result to rising long-term US government bonds yields, in spite of the US Federal Reserve (FED) signalling a continued loose monetary policy. While US corporate bond yields followed this upward trend, the strong appreciation of the USD against the EUR nevertheless shifted the USD-denominated bond UCI category into positive territory.

The Emerging market bond UCI category saw a small gain in the month under review, around the rising yields in the United States, idiosyncratic risks in some emerging markets and a divergent evolution of emerging market currencies.

In March fixed income UCI categories registered an overall positive net capital investment, mainly driven by the important net inflows in the USD money market UCI category.

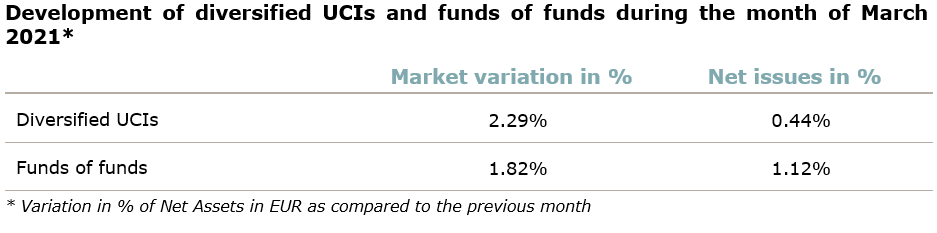

The development of net assets of diversified Luxembourg UCIs and funds of funds is illustrated in the table below:

II. Breakdown of the number and net assets of UCIs

During the month under review, the following two undertakings for collective investment have been registered on the official list:

UCITS Part I 2010 Law:

- AURÉUS INVESTMENTS, 2, rue Edward Steichen, L-2540 Luxembourg

- MILLENNIUM BANQUE PRIVÉE GLOBAL FUNDS, 5, allée Scheffer, L-2520 Luxembourg

The following eighteen undertakings for collective investment have been deregistered from the official list during the month under review:

UCITS Part I 2010 Law:

- ALLIANZ FINANZPLAN 2020, Bockenheimer Landstraße 42-44, D-60232 Frankfurt am Main[1]

- DEKA-OPTIRENT 2Y(II), 6, rue Lou Hemmer, L-1748 Luxembourg-Findel

- DEKA-WORLDTOPGARANT 1, 6, rue Lou Hemmer, L-1748 Luxembourg-Findel

- DEKA-WORLDTOPGARANT 2, 6, rue Lou Hemmer, L-1748 Luxembourg-Findel

- ERTRAGSRETURNPORTFOLIO, 1C, rue Gabriel Lippmann, L-5365 Munsbach

- EUROPA ONE, 22, boulevard Royal, L-2449 Luxembourg

- UNIGARANT: NORDAMERIKA (2021), 3, Heienhaff, L-1736 Senningerberg

- UNIGARANTTOP: EUROPA IV, 3, Heienhaff, L-1736 Senningerberg

- UNIINSTITUTIONAL LOCAL EM BONDS, 3, Heienhaff, L-1736 Senningerberg

- UNIOPTIMUS -NET-, 3, Heienhaff, L-1736 Senningerberg

- UNIRAK NORDAMERIKA, 3, Heienhaff, L-1736 Senningerberg

UCIs Part II 2010 Law:

- CRONOS FUNDS (LUX), 43, boulevard Prince Henri, L-1724 Luxembourg

- SICAV PATRIMOINE INVESTISSEMENTS, 15, avenue J-F Kennedy, L-1855 Luxembourg

SIFs:

- AIM REAL ASSETS S.C.A. SICAV-SIF, 15, boulevard Friedrich Wilhelm Raiffeisen, L-2411 Luxembourg

- ALLIANCEBERNSTEIN INSTITUTIONAL INVESTMENTS, 2-4, rue Eugène Ruppert, L-2453 Luxembourg

- CULROSS FUNDS S.A., SICAV-SIF, 58, rue Charles Martel, L-2134 Luxembourg

- FYSIS FUND II SICAV-SIF S.C.A, 412F, route d’Esch, L-2086 Luxembourg

SICARs:

- EUROPEAN PRIVATE EQUITY PORTFOLIO S.A., SICAR, 6, rue Gabriel Lippmann, L-5365 Munsbach

[1] Undertaking for collective investment for which the designated management company was authorised by the competent authorities of another Member State in accordance with Directive 2009/65/EC.