Situation globale des organismes de placement collectif à la fin du mois de juin 2021 (uniquement en anglais)

Communiqué de presse 21/18

I. Overall situation

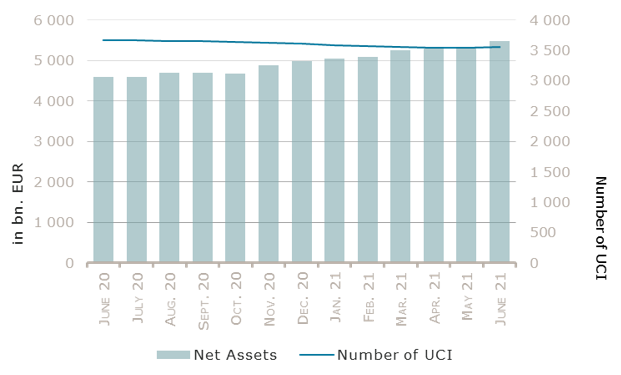

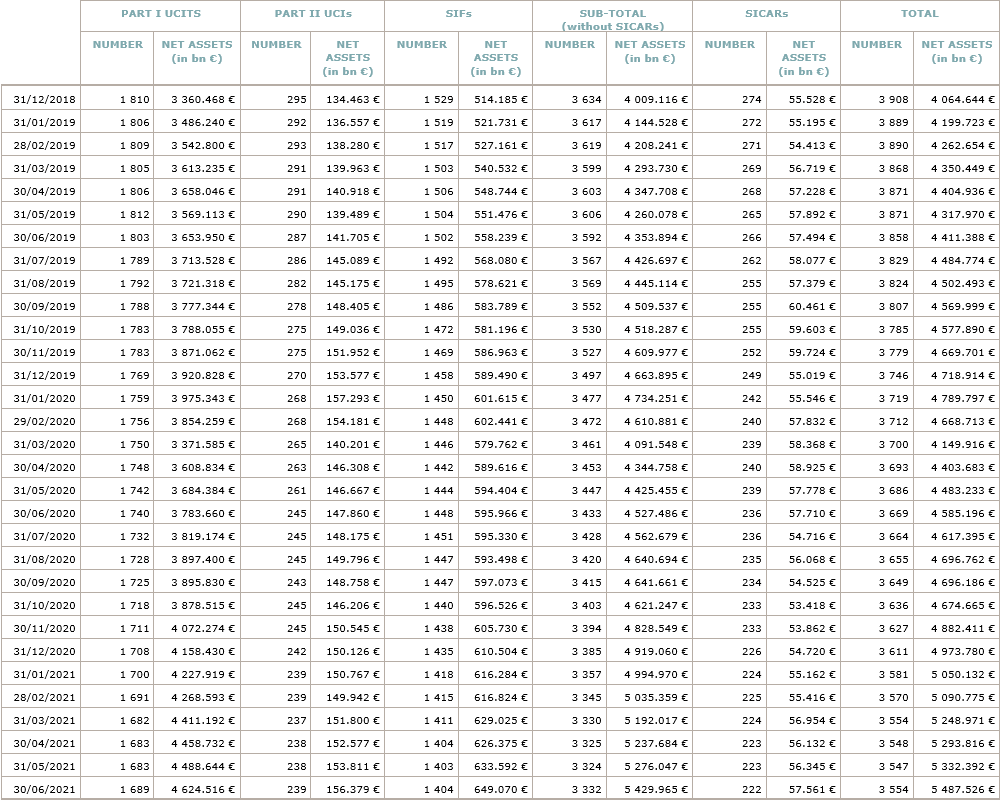

As at 30 June 2021, the total net assets of undertakings for collective investment, comprising UCIs subject to the 2010 Law, specialised investment funds and SICARs, amounted to EUR 5,487.526 billion compared to EUR 5,332.392 billion as at 31 May 2021, i.e. an increase of 2.91% over one month. Over the last twelve months, the volume of net assets rose by 19.68%.

The Luxembourg UCI industry thus registered a positive variation amounting to EUR 155.134 billion in May. This increase represents the sum of positive net capital investments of EUR 47.881 billion (+0.90%) and of the positive development of financial markets amounting to EUR 107.253 billion (+2.01%).

The development of undertakings for collective investment is as follows:

The number of undertakings for collective investment (UCIs) taken into consideration totalled 3,554, against 3,547 the previous month. A total of 2,341 entities adopted an umbrella structure representing 13,248 sub-funds. Adding the 1,213 entities with a traditional UCI structure to that figure, a total of 14,461 fund units were active in the financial centre.

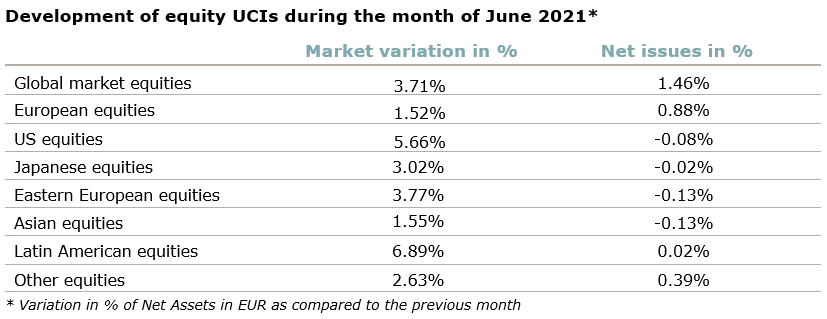

As regards the impact of financial markets on the main categories of undertakings for collective investment and the net capital investment in these UCIs, the following can be said for the month of June:

Equity markets rose in June, aided by the accelerating roll-out of COVID-19 vaccines, good economic data and the ongoing accommodative monetary policies of major central banks.

Concerning developed markets, the European equity UCI category recorded a positive performance in a context marked by good macroeconomic data, the European Commission signing off on the first recovery plans from EU member states which will receive funding from the Next Generation EU fund and the steady progress made in the vaccination rollout across the EU. The US equity UCI category rallied in June on the back of improved macroeconomic perspectives, the ongoing monetary policy support of the US Federal Reserve (Fed) despite some concerns relating to the evolution of inflation figures as well as the appreciation of the USD against the EUR. Benefiting from a weakening of the yen against the USD which provided some support for export-oriented Japanese companies and the continued monetary policy support measures of the Bank of Japan, the Japanese equity UCI category finished the month in positive territory.

As for emerging countries, the Eastern European and Latin American equity UCI categories enjoyed strong gains in June, on the grounds of an improving macroeconomic outlook in these regions and increasing commodity prices. In comparison, the Asian equity UCI category realised smaller positive returns overall amid more mitigated macroeconomic data and the proliferation of the more contagious Delta variant in some Asian countries, while the ongoing accommodative monetary policies of the US Fed and the US infrastructure package, albeit limited in size, supported Asian equity markets.

In June, the equity UCI categories registered an overall positive net capital investment, mainly driven by inflows in the Global market equity UCI category.

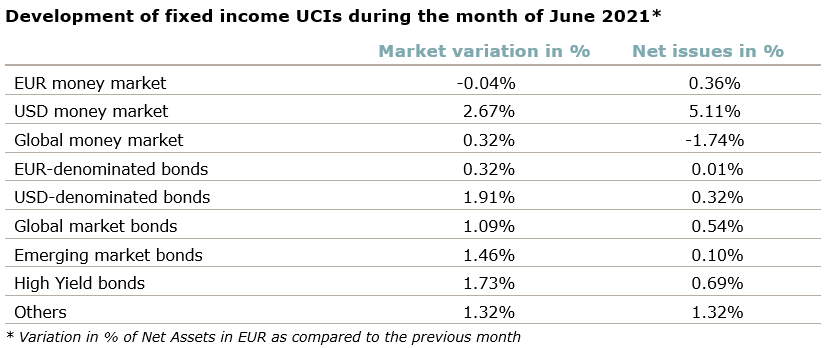

Despite higher inflation rates on both sides of the Atlantic, the US Fed and ECB maintained for the time being their expansive monetary policies as they expect the high inflation levels to be temporary in nature. In this context, the ECB announced continuing and even extending its Pandemic Emergency Purchase Program (“PEPP”). Against this backdrop, the yields of government and corporate bonds fell (i.e. bond prices increased) and the EUR und USD-denominated bond UCI categories finished in positive territory, whereas the performance of the latter category was bolstered by the appreciation of the USD against the EUR.

The Emerging market bonds UCI category rose in June, aided by net inflows in emerging markets resulting from increased investor demand, rising commodity prices, the tightening of spreads on emerging market bonds and a strong appreciation of some emerging market currencies, despite higher inflation and interest rate rises by several emerging market central banks.

In June, fixed income UCI categories registered an overall positive net capital investment. The USD money market UCI category recorded the highest inflows.

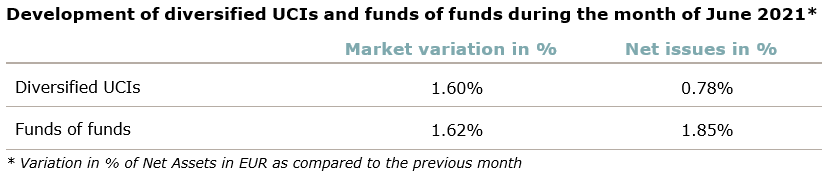

The development of net assets of diversified Luxembourg UCIs and funds of funds is illustrated in the table below:

II. Breakdown of the number and net assets of UCIs

During the month under review, the following nineteen undertakings for collective investment have been registered on the official list:

UCITS Part I 2010 Law:

- ADELIO UCITS FUND, 3, rue Jean Piret, L-2350 Luxembourg

- DEKA-KÜNSTLICHE INTELLIGENZ, 6, rue Lou Hemmer, L-1748 Findel

- DEKA-NACHHALTIGKEIT AKTIEN DEUTSCHLAND, 6, rue Lou Hemmer, L-1748 Findel

- DEKA-NACHHALTIGKEIT AKTIEN EUROPA, 6, rue Lou Hemmer, L-1748 Findel

- DEKA-NACHHALTIGKEIT AKTIEN NORDAMERIKA, 6, rue Lou Hemmer, L-1748 Findel

- EUROEQUITYFLEX, 9A, rue Gabriel Lippmann, L-5365 Munsbach

- SEDCO CAPITAL GLOBAL UCITS, 5, rue Jean Monnet, L-2180 Luxembourg

- SYQUANT UCITS FUNDS, 2-4, rue Eugène Ruppert, L-2453 Luxembourg

- VONTOBEL FCP-UCITS, 33, rue de Gasperich, L-5826 Howald-Hesperange

UCIs Part II 2010 Law:

- BLACKSTONE EUROPEAN PROPERTY INCOME FUND (MASTER) FCP, 2-4, rue Eugène Ruppert, L-2453 Luxembourg

- BLACKSTONE EUROPEAN PROPERTY INCOME FUND SICAV, 11-13 Boulevard de la Foire, L-1528 Luxembourg

- GLOBAL ARBITRAGE STRATEGIE, 15, rue de Flaxweiler, L-6776 Grevenmacher

SIFs:

- CANCORPEUROPE S.A., SICAV-SIF, 23 avenue Monterey, L-2163 Luxembourg

- EURAZEO CAPITAL IV A SCSP SICAV-SIF, 25C, boulevard Royal, L-2449 Luxembourg

- EURAZEO CAPITAL IV B SCSP SICAV-SIF, 25C, boulevard Royal, L-2449 Luxembourg

- EURAZEO CAPITAL IV C SCSP SICAV-SIF, 25C, boulevard Royal, L-2449 Luxembourg

- EURAZEO CAPITAL IV D SCSP SICAV-SIF, 25C, boulevard Royal, L-2449 Luxembourg

- GO EUROPE SLP II, SCSP SICAV-SIF, 20, rue de la Poste, L-2346 Luxembourg

- INVESTINVENT FUNDS SICAV-SIF, 33A, avenue J-F Kennedy, L-1855 Luxembourg

The following twelve undertakings for collective investment have been deregistered from the official list during the month under review:

UCITS Part I 2010 Law:

- ALPINA FOUNDATION INVESTMENTS, 2, rue Gabriel Lippmann, L-5365 Munsbach

- FPSPI SICAV, 5, allée Scheffer, L-2520 Luxembourg

- IW4ME, 37A, avenue J-F Kennedy, L-1855 Luxembourg

UCIs Part II 2010 Law:

- MPF AKTIEN STRATEGIE EUROPA, 3, rue Gabriel Lippmann, L-5365 Munsbach

- PETERCAM HORIZON L, 12, rue Eugène Ruppert, L-2453 Luxembourg

SIFs:

- DIRECT LENDING FUND I FEEDER (LUX), 412F, route d’Esch, L-2086 Luxembourg

- NEW TRENDS FCP-FIS, 3, rue Jean Piret, L-2350 Luxembourg

- POLUNIN DISCOVERY FUNDS, 49, avenue J-F Kennedy, L-1855 Luxembourg

- SKY HARBOR GLOBAL LOAN OPPORTUNITIES FUND SICAV-SIF, 6, route de Trèves, L-2633 Senningerberg

- SOLANUM SICAV-FIS, 33A, avenue J-F Kennedy, L-1855 Luxembourg

- VPV INVEST FCP-FIS, 3, Heienhaff, L-1736 Senningerberg

SICARs:

- CIPIO PARTNERS FUND VI S.C.S., SICAR, 12E, rue Guillaume Kroll, L-1882 Luxembourg