Situation globale des organismes de placement collectif à la fin du mois d’octobre 2021 (uniquement en anglais)

Communiqué de presse 21/29

I. Overall situation

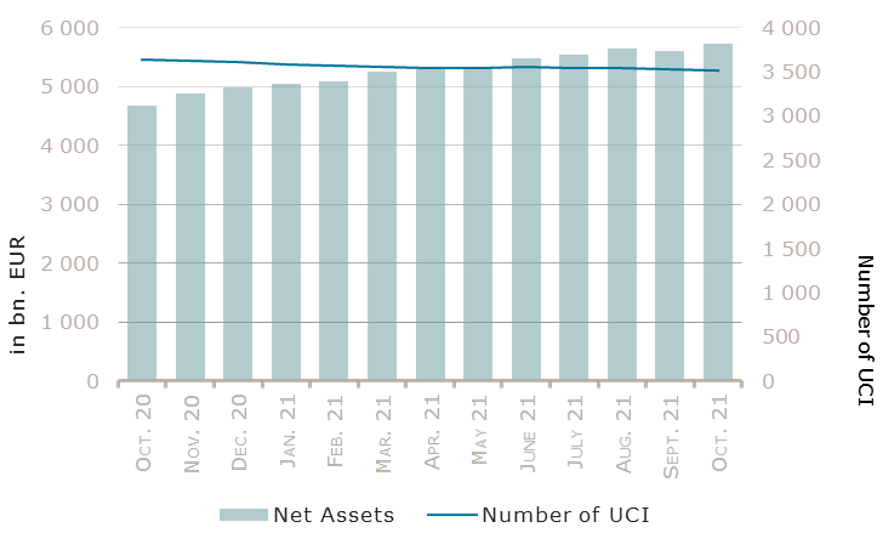

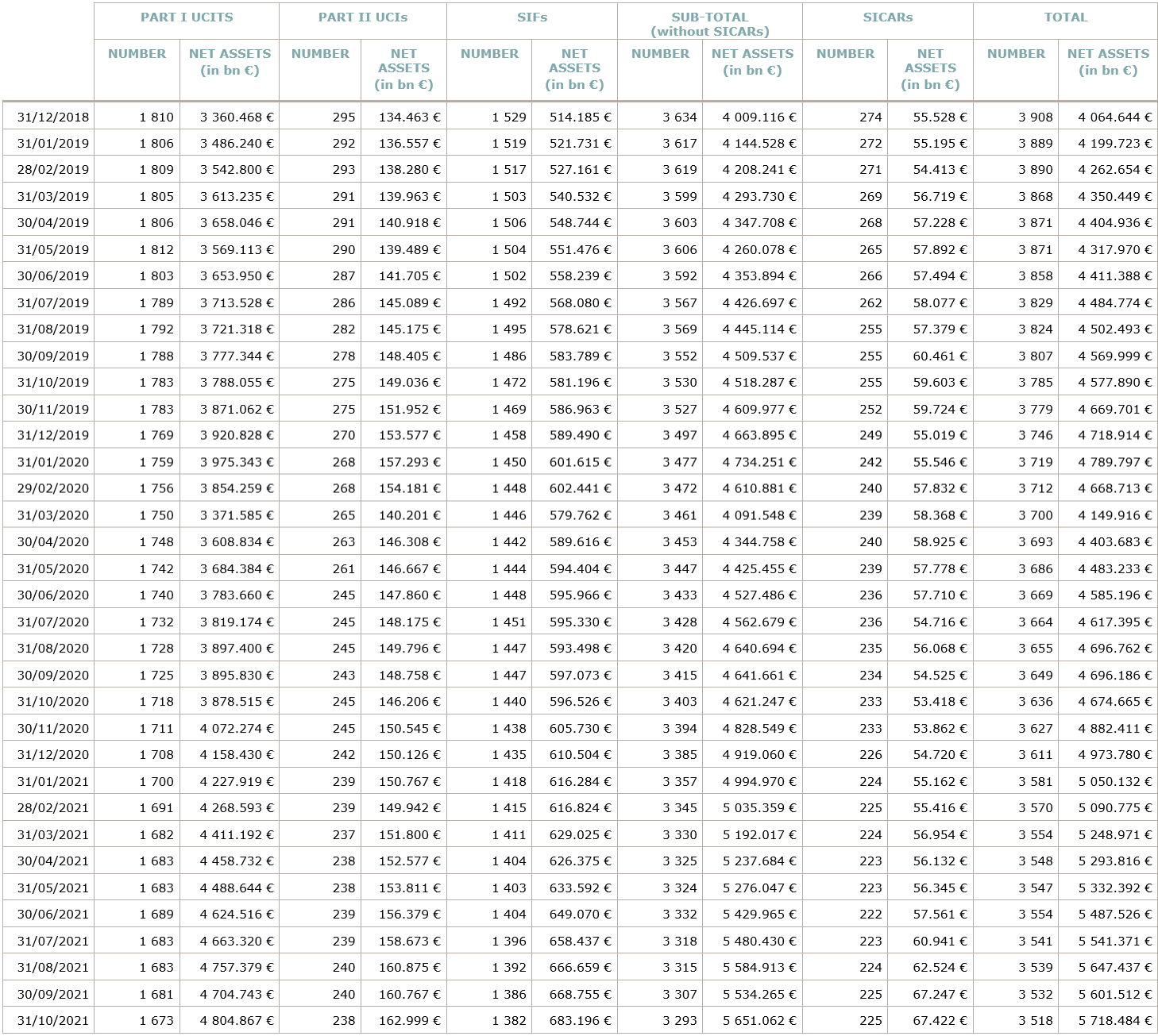

As at 31 October 2021, the total net assets of undertakings for collective investment, comprising UCIs subject to the 2010 Law, specialised investment funds and SICARs, amounted to EUR 5,718.484 billion compared to EUR 5,601.512 billion as at 30 September 2021, i.e. an increase of 2.09% over one month. Over the last twelve months, the volume of net assets rose by 22.33%.

The Luxembourg UCI industry thus registered a positive variation amounting to EUR 116.972 billion in October. This increase represents the sum of positive net capital investments of EUR 31.170 billion (+0.56%) and of the positive development of financial markets amounting to EUR 85.802 billion (+1.53%).

The development of undertakings for collective investment is as follows:

The number of undertakings for collective investment (UCIs) taken into consideration totalled 3,518, against 3,532 the previous month. A total of 2,312 entities adopted an umbrella structure representing 13,262 sub-funds. Adding the 1,206 entities with a traditional UCI structure to that figure, a total of 14,468 fund units were active in the financial centre.

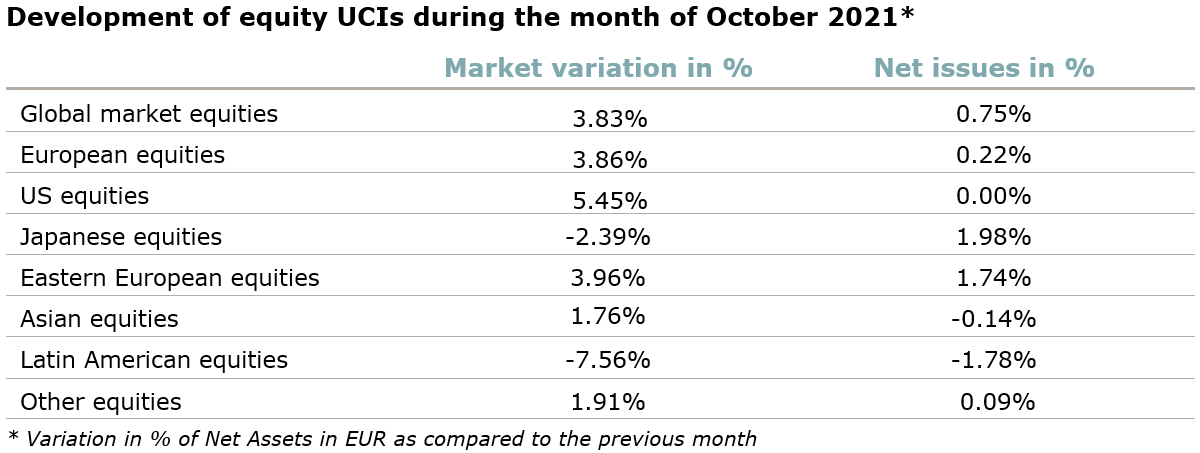

As regards the impact of financial markets on the main categories of undertakings for collective investment and the net capital investment in these UCIs, the following can be said for the month of October:

Concerning developed markets, the European equity UCI category registered a positive performance supported by better than expected corporate earnings and the distributions of the EU Recovery Fund, despite persistent supply chain shortages and high inflation. The US equity UCI category gained in October, on the back of a strong corporate earnings season, the progress made on public infrastructure spending proposals, better economic data and a decrease of new Covid-19 cases. The political changes anticipated by investors in Japan following the appointment of a new prime minister, combined with a strong depreciation of the Yen against the EUR, shifted the Japanese equity UCI category into negative territory.

As for emerging countries, the Asian equity UCI category generated a robust return in overall, mainly driven by positive corporate earnings, a recovery of the Chinese property sector and an continuing decline in the number of new Covid-19 cases in many Asian countries, although higher inflation and the continuing tensions between the United States and China were weighting on investor sentiment. The Eastern European equity UCI category globally rose, largely due to higher energy prices supporting the Russian equity markets and the appreciation of the Russian rouble against the EUR. The Latin American equity UCI category fell sharply in October under the impetus of the losses on Brazilian and Mexican equity markets as well as the political uncertainties in some countries of the region.

In October, the equity UCI categories registered an overall positive net capital investment, mainly driven by inflows in the Global market equity UCI category.

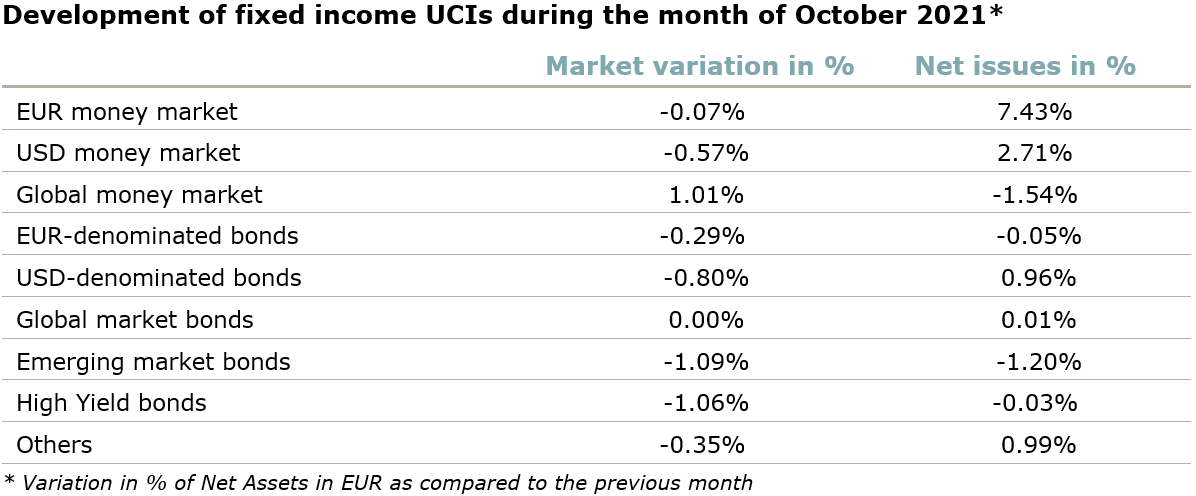

On both sides of the Atlantic, the yields of highly rated governments bonds globally rose (i.e. bond prices fell) amid an elevated inflation, resulting in investor expectations of a less accommodative monetary policy stance going forward. The US Federal Reserve indicated that they would possibly withdraw monetary policy accommodation in light of rising inflationary pressures, while the ECB postponed their decision on how to conduct asset purchases following the end of the Pandemic Emergency Purchase Programme (PEPP) until December. On the budgetary side, the US Congress managed to avoid a shutdown by fixing a new deadline in December. Against this backdrop, the yields of US investment grade (IG) corporate bonds followed the upward trend of highly rated governments bonds, while the yields of EUR IG corporate bonds decreased moderately. Overall, the EUR and USD denominated bond UCI categories finished the month in negative territory. The depreciation of the USD against the EUR further exacerbated the negative performance of the USD denominated bond UCI category.

The emerging market bond UCI category fell in October on the grounds of rising inflation and yields, a divergent development of emerging market currencies and idiosyncratic risks, despite the growth recovery in emerging markets and increasing oil prices.

In October, fixed income UCI categories registered an overall positive net capital investment, mainly driven by the EUR and USD money market UCI categories.

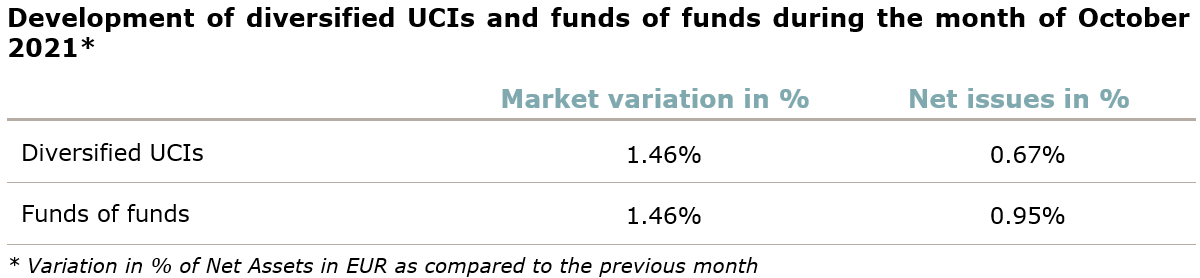

The development of net assets of diversified Luxembourg UCIs and funds of funds is illustrated in the table below:

II. Breakdown of the number and net assets of UCIs

During the month under review, the following eight undertakings for collective investment have been registered on the official list:

UCITS Part I 2010 Law:

- BLACKPOINT, 4, rue Thomas Edison, L-1445 Luxembourg-Strassen

- FORESIGHT SICAV, 3, rue Gabriel Lippmann, L-5365 Munsbach

- INNOVATIVE INVESTMENT FUNDS SOLUTIONS, 5, allée Scheffer, L-2520 Luxembourg

UCIs Part II 2010 Law:

- PARTNERS GROUP DIRECT EQUITY II ELTIF SICAV, 35D, avenue J-F Kennedy, L-1855 Luxembourg

SIFs:

- EPHRAÏM SICAV SIF S.A., 1B, rue Jean Piret, L-2350 Luxembourg

- INTERNATIONAL II SIF SICAF, 2, rue Jean Bertholet, L-1233 Luxembourg

- WEST STREET REAL ESTATE INVESTMENT PARTNERS SIF, 14, rue Edward Steichen, L-2540 Luxembourg

SICARs:

- RESILIENCE PARTNERS FUND II S.C.A., SICAR, 15, boulevard F.W. Raiffeisen, L-2411 Luxembourg

The following twenty-two undertakings for collective investment have been deregistered from the official list during the month under review:

UCITS Part I 2010 Law:

- AMPEGA CROSSOVERPLUS RENTENFONDS, Charles-de-Gaulle-Platz 1, 50679 Köln1

- BANTLEON ANLEIHENFONDS, 33A, avenue J-F Kennedy, L-1855 Luxembourg

- BANTLEON OPPORTUNITIES, 33A, avenue J-F Kennedy, L-1855 Luxembourg

- DEKALUX-DEUTSCHLAND, 6, rue Lou Hemmer, L-1748 Luxembourg-Findel

- DEKALUX-EUROPA, 6, rue Lou Hemmer, L-1748 Luxembourg-Findel

- DEKALUX-USA, 6, rue Lou Hemmer, L-1748 Luxembourg-Findel

- DWS FLEXPENSION, 2, boulevard Konrad Adenauer, L-1115 Luxembourg

- GET CAPITAL QUANT GLOBAL EQUITY FONDS, Charles-de-Gaulle-Platz 1, 50679 Köln1

- MILLER HOWARD SICAV, 106, route d’Arlon, L-8210 Mamer

- PLUTOS KANA NEB, 94B, Waistrooss, L-5440 Remerschen

- SPARKASSE HGP:, 6, rue Lou Hemmer, L-1748 Luxembourg-Findel

UCIs Part II 2010 Law:

- ERSEL SICAV, 5, allée Scheffer, L-2520 Luxembourg

- GFI CHINA INVESTMENT FUND, 60, avenue J-F Kennedy, L-1855 Luxembourg

- MPF AKTIEN STRATEGIE ZERTIFIKATE, 3, rue Gabriel Lippmann, L-5365 Munsbach

SIFs:

- EURO ASIA CONSUMER FUND II, 94, rue du Kiem, L-1857 Luxembourg

- FRANKLIN TEMPLETON REAL ESTATE FUNDS, 8A, rue Albert Borschette, L-1246 Luxembourg

- GGP FINANCIAL OPPORTUNITIES, FCP-SIF, 11, rue Beaumont, L-1219 Luxembourg

- LA FRANCAISE IC FUND, SICAV-FIS, 60, avenue J-F Kennedy, L-1855 Luxembourg

- MIRABAUD LUXEMBOURG SIF, 15, avenue J-F Kennedy, L-1855 Luxembourg

- PICTET INSTITUTIONAL, 15, avenue J-F Kennedy, L-1855 Luxembourg

- RASMALA ALTERNATIVE INVESTMENT FUNDS, 88, Grand-Rue, L-1660 Luxembourg

SICARs:

- TECHNOLOGY IN CENTRAL AND EASTERN EUROPE S.C.A. SICAR, 8, rue Lou Hemmer, L-1748 Senningerberg

1 Undertaking for collective investment for which the designated management company was authorised by the competent authorities of another Member State in accordance with Directive 2009/65/EC.