Situation globale des organismes de placement collectif à la fin du mois de décembre 2021 (uniquement en anglais)

Communiqué de presse 22/02

I. Overall situation

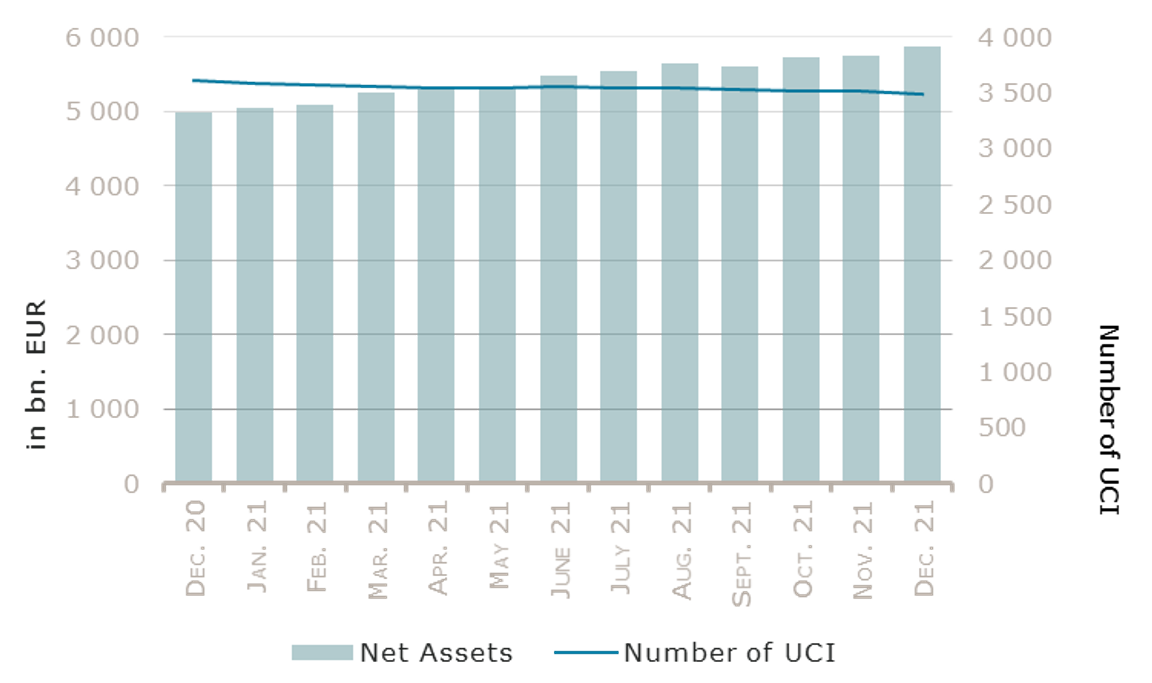

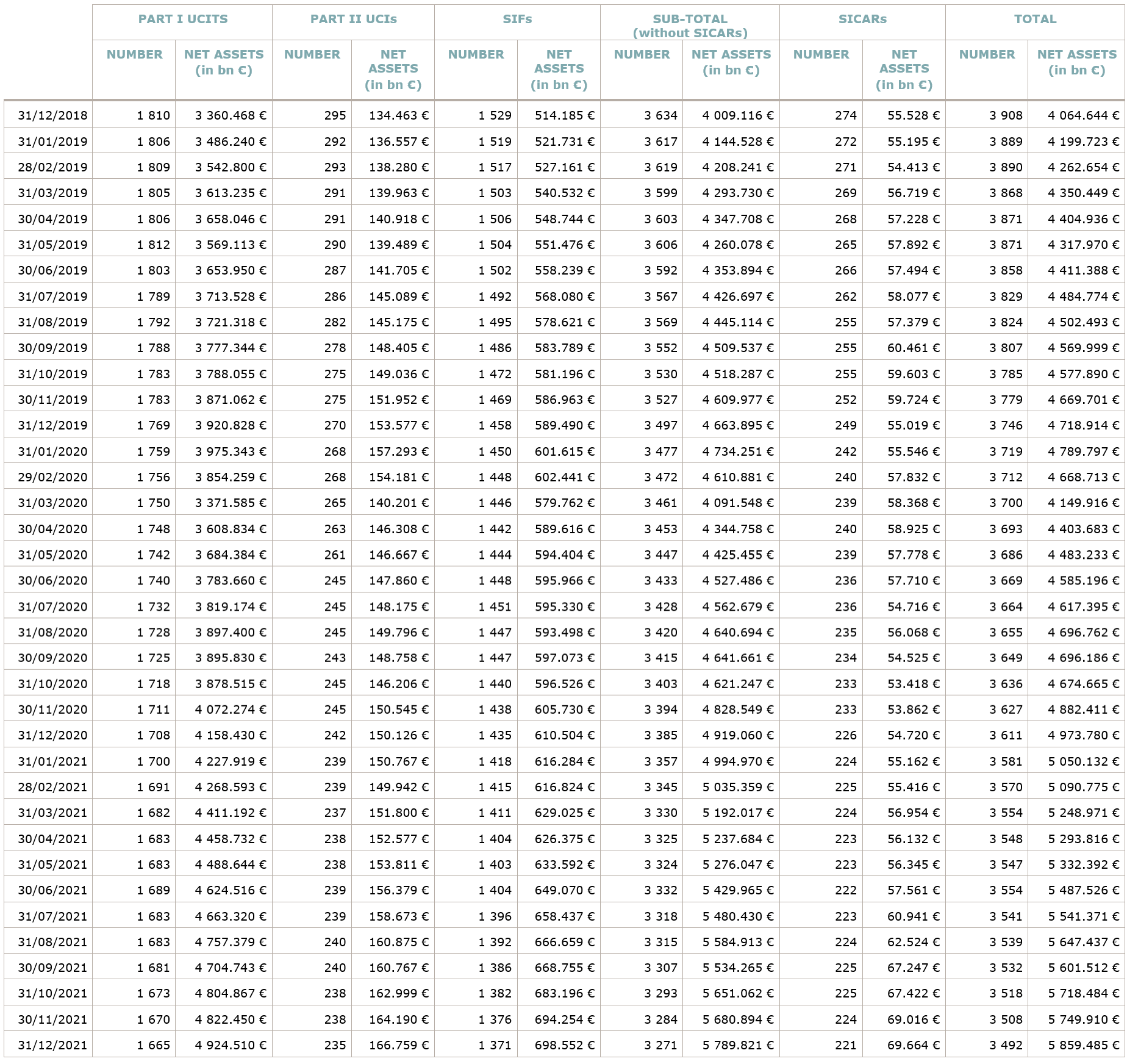

As at 31 December 2021, the total net assets of undertakings for collective investment, comprising UCIs subject to the 2010 Law, specialised investment funds and SICARs, amounted to EUR 5,859.485 billion compared to EUR 5,749.910 billion as at 30 November 2021, i.e. an increase of 1.91% over one month. Over the last twelve months, the volume of net assets rose by 17.81%.

The Luxembourg UCI industry thus registered a positive variation amounting to EUR 109.575 billion in December. This increase represents the sum of positive net capital investments of EUR 32.116 billion (+0.56%) and of the positive development of financial markets amounting to EUR 77.459 billion (+1.35%).

The development of undertakings for collective investment is as follows:

The number of undertakings for collective investment (UCIs) taken into consideration totalled 3,492, against 3,508 the previous month. A total of 2,291 entities adopted an umbrella structure representing 13,244 sub-funds. Adding the 1,201 entities with a traditional UCI structure to that figure, a total of 14,445 fund units were active in the financial centre.

As regards the impact of financial markets on the main categories of undertakings for collective investment and the net capital investment in these UCIs, the following can be said for the month of December.

Concerning developed markets, the European equity UCI category rose amid expectations of strong corporate earnings and a resilient economic recovery, despite concerns about the new Omicron variant and persistent supply chain shortages. The US equity UCI category realised a positive performance as well in December, on the back of good economic data and robust corporate earnings. The Japanese equity UCI category finished the month in positive territory, aided by the partial extension of the Covid-19 support financing program of the Bank of Japan, the anticipated substantial fiscal stimulus package as well as the depreciation of the JPY.

As for emerging countries, the Asian equity UCI category achieved modest gains in overall as the losses in some Asian equity markets such as China, experiencing a market sell-off amid concerns that the emergence of the new Omicron variant could have an adverse impact on global recovery, were offset by Asian equities that were able to rise (e.g. Taiwan, India and Malaysia). The Eastern European equity UCI category moved sideways in December, driven on one hand by a decline of Russian equity markets amid the sharp volatility of oil prices and tensions between the United States and Russia in light of the situation in Ukraine and on the other hand by the positive development of equity markets in Poland and Czech Republic. The Latin American equity UCI category realised a positive performance, under the impulse mainly of strong gains in the Brazilian and Mexican equity markets.

In December, the equity UCI categories registered an overall positive net capital investment, mainly driven by inflows in the Global market equity UCI category.

Development of equity UCIs during the month of December 2021*

|

Market variation in % |

Net issues in % |

|

| Global market equities |

2.60% |

1.09% |

| European equities |

3.99% |

-0.78% |

| US equities |

2.01% |

0.54% |

|

Japanese equities |

1.25% |

-0.17% |

| Eastern European equities |

0.01% |

-1.49% |

| Asian equities |

0.64% |

-1.11% |

| Latin American equities |

5.94% |

-2.11% |

| Other equities |

2.21% |

-0.40% |

* Variation in % of Net

Concerning the EUR denominated bond UCI category, yields globally raised (i.e. bond prices fell) as the European Central Bank announced in December the end of its Pandemic Emergency Purchase Program (PEPP) program by March 2022, while maintaining a backstop by preserving the possibility of flexible reinvestments of maturing debt instruments acquired via the PEPP programme. Investment grade corporate bonds spreads tightened after reports that the new Omicron variant appeared less lethal. Overall, the EUR denominated bond UCI category realised a negative performance in December.

As for the USD denominated bond UCI category, the US Federal Reserve (Fed) decided to accelerate its tapering measures in light of the high inflation in the United States and the strengthening labour market. Against this backdrop, the yields of USD denominated bonds rose, but the appreciation of the USD against the EUR shifted the USD denominated bond UCI category in positive territory.

The Emerging Market (“EM”) bond UCI category rose as risk sentiment improved in December, despite the US Fed’s announcement to accelerate tapering and interest rate hikes in 2022 and the tightening of monetary policy by many EM Central Banks in reaction to inflationary pressures.

In December, fixed income UCI categories registered an overall positive net capital investment.

Development of fixed income UCIs during the month of December 2021*

|

|

Market variation in % |

Net issues in % |

| EUR money market |

-0.06% |

5.37% |

| USD money market |

0.33% |

-2.50% |

| Global money market |

0.79% |

4.85% |

| EUR-denominated bonds |

-0.52% |

0.64% |

| USD-denominated bonds |

0.24% |

4.85% |

| Global market bonds |

0.20% |

0.40% |

| Emerging market bonds |

1.35% |

1.52% |

| High Yield bonds |

1.32% |

-0.57% |

| Others |

0.22% |

0.31% |

* Variation in % of Net Assets in EUR as compared to the previous month

The development of net assets of diversified Luxembourg UCIs and funds of funds is illustrated in the table below:

Development of diversified UCIs and funds of funds during the month of December 2021*

|

Market variation in % |

Net issues in % |

|

| Diversified UCIs |

1.31% |

0.56% |

| Funds of funds |

0.89% |

0.78% |

* Variation in % of Net Assets in EUR as compared to the previous month

II. Breakdown of the number and net assets of UCIs

During the month under review, the following sixteen undertakings for collective investment have been registered on the official list:

UCITS Part I 2010 Law:

- BERENBERG ABSOLUTE RETURN EUROPEAN EQUITIES, 15, rue de Flaxweiler, L-6776 Grevenmacher

- BERENBERG INTERNATIONAL MICRO CAP, 15, rue de Flaxweiler, L-6776 Grevenmacher

- BERENBERG SUSTAINABLE MULTI ASSET DYNAMIC, 15, rue de Flaxweiler, L-6776 Grevenmacher

- GREENSIDE UCITS FCP, 15, avenue J-F Kennedy, L-1855 Luxembourg

- MBI FUND SICAV, 3, rue Jean Piret, L-2350 Luxembourg

- PREMIUM INVEST CHANCE NACHHALTIGKEIT, Mainzer Landstraße 16, 60325 Frankfurt am Main1

- PREMIUM INVEST CHANCE, Mainzer Landstraße 16, 60325 Frankfurt am Main1

- PREMIUM INVEST ERTRAG NACHHALTIGKEIT, Mainzer Landstraße 16, 60325 Frankfurt am Main1

- PREMIUM INVEST ERTRAG, Mainzer Landstraße 16, 60325 Frankfurt am Main1

- SAUREN FONDS, 4, rue Thomas Edison, L-1445 Luxembourg-Strassen

SIFs:

- ALLIANZ FMO SDG LOAN FUND S.C.A. SICAV-SIF, 6A, route de Trèves, L-2633 Senningerberg

- CURZON CAPITAL PARTNERS 5 LONG-LIFE SCA SICAV-SIF, 42-44, avenue de la Gare, L-1610 Luxembourg

- GENERALI REAL ESTATE LOGISTICS FUND S.C.S., SICAV-SIF, 15, boulevard F.W. Raiffeisen, L-2411 Luxembourg

- LAIMFIS INVESTMENT FUND SCSP, SICAV-SIF, 17, boulevard Raiffeisen, building Bijou, L-2411 Luxembourg

- PKE PRIVATE EQUITY CHF SICAV-SIF, 15, boulevard F.W. Raiffeisen, L-2411 Luxembourg

- VIQR LUX 1 FUND SCA SICAV-SIF, 14, rue Edward Steichen, L-2540 Luxembourg

The following thirty-two undertakings for collective investment have been deregistered from the official list during the month under review:

UCITS Part I 2010 Law:

- AC INVEST, 9A, rue Gabriel Lippmann, L-5365 Munsbach

- ARCUS JAPAN LONG/SHORT FUND, 33, rue de Gasperich, L-5826 Hesperange

- BANKIA AM INTERNATIONAL FUNDS SICAV, 2-4, rue Eugène Ruppert, L-2453 Luxembourg

- CLAIRINVEST, 5, allée Scheffer, L-2520 Luxembourg

- D/S STRATEGIE AUSGEWOGEN, 15, rue de Flaxweiler, L-6776 Grevenmacher

- DEKA-RENTEN: EURO 3-7 CF, 6, rue Lou Hemmer, L-1748 Luxembourg-Findel

- DEKA-RENTENGLOBAL ROLL-OVER, 6, rue Lou Hemmer, L-1748 Luxembourg-Findel

- DWS TÜRKEI, 2, boulevard Konrad Adenauer, L-1115 Luxembourg

- ETHNA-CARES, 16, rue Gabriel Lippmann, L-5365 Munsbach

- NEXTAM PARTNERS, 5, allée Scheffer, L-2520 Luxembourg

- NPB SICAV, 4, rue Thomas Edison, L-1445 Luxembourg-Strassen

- PREVAL FUNDS SICAV, 5, rue Jean Monnet, L-2180 Luxembourg

- SÖDERBERG & PARTNERS SICAV II, 33, rue de Gasperich, L-5826 Hesperange

- UNIEURORENTA EM 2021, 3, Heienhaff, L-1736 Senningerberg

- UNIEURORENTA UNTERNEHMENSANLEIHEN EM 2021, 3, Heienhaff, L-1736 Senningerberg

UCIs Part II 2010 Law:

- DEKA-S RENDITE 1/2008 (5 JAHRE ROLL-OVER), 6, rue Lou Hemmer, L-1748 Findel

- PROMETHEUS AI, 9A, rue Gabriel Lippmann, L-5365 Munsbach

- SF (LUX) GLOBAL PROPERTY FUND, 43, boulevard du Prince Henri, L-1724 Luxembourg

SIFs:

- CAM VENTURE CAPITAL EUROPE PLUS, 2, boulevard de la Foire, L-1528 Luxembourg

- CANDRIAM ALTERNATIVE, 5, allée Scheffer, L-2520 Luxembourg

- CAPMAN MEZZANINE V FUND FCP-SIF, 1B, Heienhaff, L-1736 Senningerberg

- COMPAGNIE FINANCIÈRE ST. EXUPÉRY SICAV-SIF, 25A, boulevard Royal, L-2449 Luxembourg

- FUNDO DE INVESTIMENTO PRIVADO – ANGOLA S.C.A., SICAV-SIF, 75, Parc d’activités, L-8308 Capellen

- GLOBUS EQUITY SICAV SIF, 42, rue de la Vallée, L-2661 Luxembourg

- IPC-PORTFOLIO INVEST XVIII, 4, rue Thomas Edison, L-1445 Luxembourg-Strassen

- LOONIE FUND 2 FCP, 2, rue Hildegard von Bingen, L-1282 Luxembourg

- MIN S.C.A., FIS, 15, boulevard Friedrich Wilhelm Raiffeisen, L-2411 Luxembourg

- VALOR SIF, 25A, boulevard Royal, L-2449 Luxembourg

- VCM MEZZANINE SICAV-FIS III, 2, boulevard de la Foire, L-1528 Luxembourg

SICARs:

- COSICAR S.C.A. SICAR, 44, avenue J. F. Kennedy, L-1855 Luxembourg

- FIVE ARROWS SECONDARY OPPORTUNITIES III FEEDER S.C.A. SICAR, 33, rue Sainte Zithe, L-2763 Luxembourg

- VENTECH CHINA II SICAR, 3, rue Gabriel Lippmann, L-5365 Munsbach

1 Undertaking for collective investment for which the designated management company was authorised by the competent authorities of another Member State in accordance with Directive 2009/65/EC.