Situation globale des organismes de placement collectif à la fin du mois de juin 2022 (uniquement en anglais)

Communiqué de presse 22/19

I. Overall situation

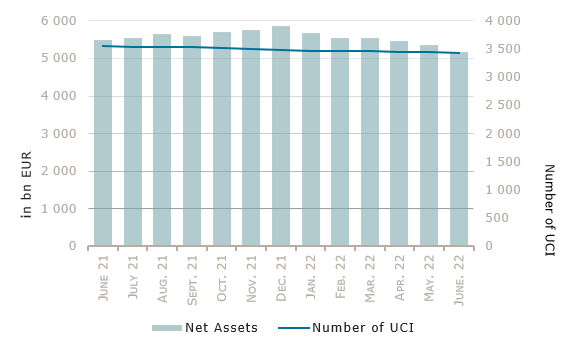

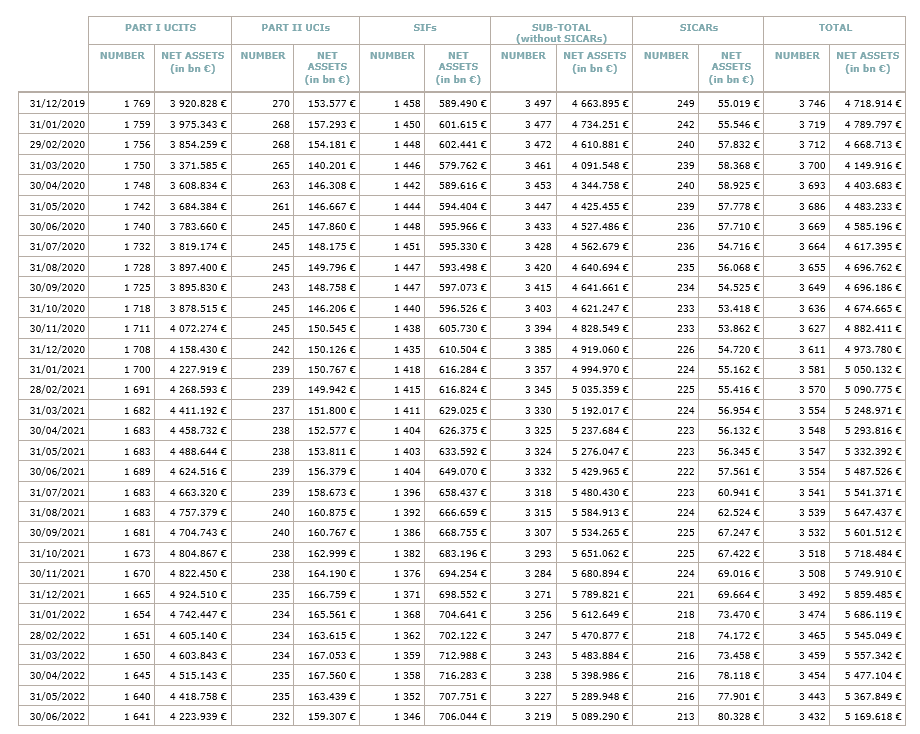

As at 30 June 2022, the total net assets of undertakings for collective investment, comprising UCIs subject to the 2010 Law, specialized investment funds and SICARs, amounted to EUR 5,169.618 billion compared to EUR 5,367.849 billion as at 31 May 2022, i.e. a decrease of 3.69% over one month. Over the last twelve months, the volume of net assets decreased by 5.79%.

The Luxembourg UCI industry thus registered a negative variation amounting to EUR 198.231 billion in June. This decrease represents the sum of negative net capital investments of EUR 25.434 billion (-0.47%) and of the negative development of financial markets amounting to EUR 172.797 billion (-3.22%).

The development of undertakings for collective investment is as follows:

The number of undertakings for collective investment (UCIs) taken into consideration totalled 3,432, against 3,443 the previous month. A total of 2,248 entities adopted an umbrella structure representing 13,179 sub-funds. Adding the 1,184 entities with a traditional UCI structure to that figure, a total of 14,363 fund units were active in the financial centre.

As regards the impact of financial markets on the main categories of undertakings for collective investment and the net capital investment in these UCIs, the following can be said for the month of June.

Concerning developed markets, the European equity UCI category registered a negative performance amid a worsening of most economic indicators in Europe, a decline of consumer confidence and higher inflation. The US equity UCI category also saw a decline in June, as US consumer confidence worsened and activity decelerated in industry and service sectors, while inflation figures remained elevated and long-term interest rates continued to rise. The Japanese equity market fell against the background of worsening manufacturing indicators and the possibility of a US recession.

As for emerging countries, the Asian equity UCI category globally performed positively despite a divergent development in the region, mainly driven by better macroeconomic data in China, an easing of COVID-19 restrictions in China which helped reduce supply problems and the prospect for an easing of Chinese IT related regulation. The Eastern European equity UCI category fell on the back of the persisting geopolitical tensions resulting from the Ukraine crisis as well as of high inflation and rising interest rates weighting on equity prices. The Latin American equity UCI category suffered a steep decline in June, under the impulse of a fall in commodity prices from their recent highs, rising interest rates and weaker domestic currencies. The equity markets of Colombia, Peru and Brazil were among the weakest performers.

In June, the equity UCI categories overall registered a negative net capital investment.

Development of equity UCIs during the month of June 2022*

| Market variation in % | Net issues in % | |

| Global market equities | -5.87% | 0.04% |

| European equities | -8.08% | -1.35% |

| US equities | -5.85% | -0.84% |

| Japanese equities | -4.83% | -1.47% |

| Eastern European equities | -2.49% | 1.13% |

| Asian equities | 3.43% | 0.72% |

| Latin American equities | -14.78% | -1.26% |

| Other equities | -3.93% | -0.73% |

* Variation in % of Net Assets in EUR as compared to the previous month

Concerning the EUR denominated bond UCI category, yields increased (i.e. bond prices fell) amid the continuing tightening of monetary policy by the European Central Bank (“ECB”), high inflation figures and recession fears. While the spreads of lower-rated government bonds of peripheral countries decreased on news of a dedicated anti-fragmentation tool announced by the ECB and the use of flexible reinvestments in the context of the ECB pandemic emergency purchase programme (PEPP), investment grade corporate bond yields increased against a backdrop of inflation fears and gas shortages. Overall, the EUR denominated bond UCI category finished the month in negative territory.

On the other side of the Atlantic, USD bond yields increased in a context marked by the decision of the US Federal Reserve (“Fed”) to raise interest rates by 75 basis points and a widening of USD corporate bond spreads. The resulting decrease of USD bond prices, partly compensated by the appreciation of the USD against the EUR, shifted the USD denominated bond UCI category into negative territory.

The Emerging Market bond UCI category fell sharply in June, as emerging market bonds were under pressure following a combination of a more aggressive monetary policy tightening of the US Fed, high inflation, rising interest rates, earning revisions and slower global growth.

In June, fixed income UCI categories registered an overall negative net capital investment.

Development of fixed income UCIs during the month of June 2022*

| Market variation in % | Net issues in % | |

| EUR money market | -0.16% | 1.62 % |

| USD money market | 3.13% | 3.53% |

| Global money market | -0.42% | -3.61% |

| EUR-denominated bonds | -2.97% | -1.20% |

| USD-denominated bonds | -0.53% | 0.88% |

| Global market bonds | -2.63% | -1.49% |

| Emerging market bonds | -3.94% | -1.89% |

| High Yield bonds | -5.23% | -3.01% |

| Others | -2.23% | -1.13% |

* Variation in % of Net Assets in EUR as compared to the previous month

The development of net assets of diversified Luxembourg UCIs and funds of funds is illustrated in the table below:

Development of diversified UCIs and funds of funds during the month of June 2022*

| Market variation in % | Net issues in % | |

| Diversified UCIs | -3.53% | -0.37% |

| Funds of funds | -1.92% | 0.31% |

* Variation in % of Net Assets in EUR as compared to the previous month

II. Breakdown of the number and net assets of UCIs

During the month under review, the following three undertakings for collective investment have been registered on the official list:

UCITS Part I 2010 Law:

- DEKA-GLOBALE AKTIEN VALUE, 6, rue Lou Hemmer, L-1748 Findel

- ODDO BHF LEADING GLOBAL TRENDS, 6, rue Gabriel Lippmann, L-5365 Munsbach

- UNITHEMEN AKTIEN, 3, Heienhaff, L-1736 Senningerberg

The following fourteen undertakings for collective investment have been deregistered from the official list during the month under review:

UCITS Part I 2010 Law:

- MILLENIUM GARANT 80, 60, avenue J-F Kennedy, L-1855 Luxembourg

- UC AXIOM GLOBAL COCO BONDS UCITS ETF, 8-10, rue Jean Monnet, L-2180 Luxembourg

- UNIINSTITUTIONAL INTEREST RATES MARKET NEUTRAL, 3, Heienhaff, L-1736 Senningerberg

UCIs Part II 2010 Law:

- SEB CREDIT OPPORTUNITY, 4, rue Peternelchen, L-2370 Howald

- UNICAPITAL INVESTMENTS V, 40, avenue Monterey, L-2163 Luxembourg

SIFs:

- AB COMMERCIAL REAL ESTATE DEBT SECONDARY MARKET FUND IV, SICAV-SIF S.C.SP., 2-4, rue Eugène Ruppert, L-2453 Luxembourg

- BAYVK R2 LUX S.A., SICAV-FIS, 15, rue de Flaxweiler, L-6776 Grevenmacher

- KIEGER FUND II, 33, rue de Gasperich, L-5826 Howald- Hesperange

- MOMENTUM PRIVATE EQUITY FEEDER FUND SICAV-SIF, 6H, route de Trèves, L-2633 Senningerberg

- MOMENTUM PRIVATE EQUITY SICAV-SIF, 6H, route de Trèves, L-2633 Senningerberg

- QUADRUM SICAV-SIF S.C.A., 25A, boulevard Royal, L-2449 Luxembourg

SICARs:

- BIP VENTURE PARTNERS S.A., 1, rue des Coquelicots, L-1356 Luxembourg

- CINEMA S.C.A., SICAR, 25A, boulevard Royal, L-2449 Luxembourg

- L CATTERTON REAL ESTATE I SICAR, 40, avenue Monterey, L-2163 Luxembourg