Situation globale des organismes de placement collectif à la fin du mois d’octobre 2022 (uniquement en anglais)

Communiqué de presse 22/28

I. Overall situation

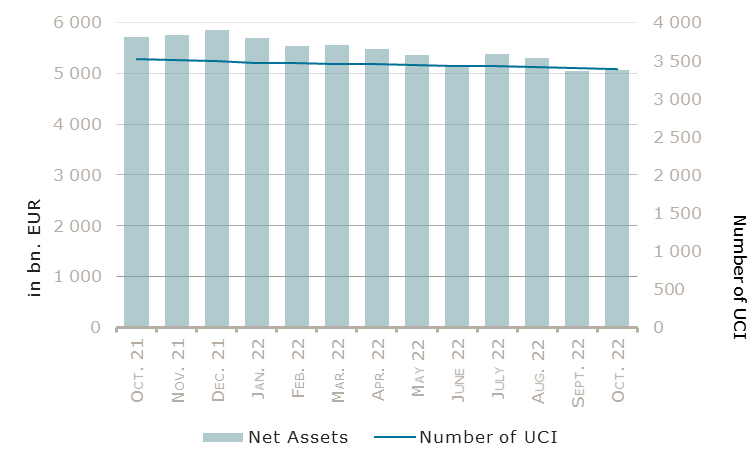

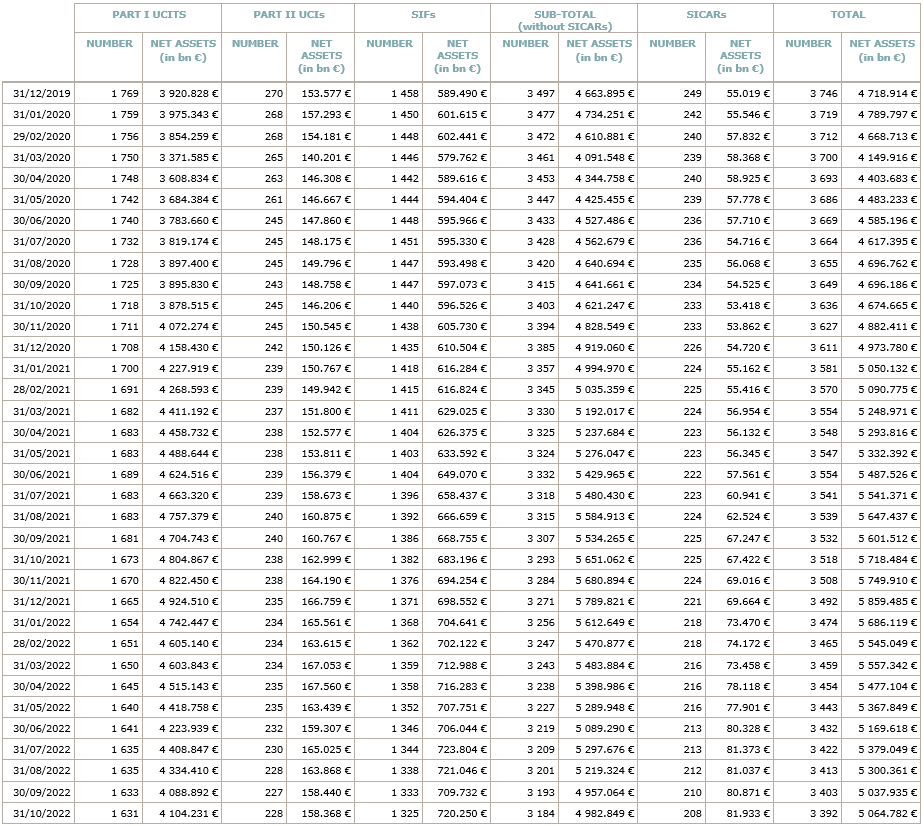

As at 31 October 2022, the total net assets of undertakings for collective investment, comprising UCIs subject to the 2010 Law, specialised investment funds and SICARs, amounted to EUR 5,064.782 billion compared to EUR 5,037.935 billion as at 30 September 2022, i.e. an increase of 0.53% over one month. Over the last twelve months, the volume of net assets decreased by 11.43%.

The Luxembourg UCI industry thus registered a positive variation amounting to EUR 26.847 billion in October. This increase represents the sum of negative net capital investments of EUR 12.501 billion (-0.25%) and of the positive development of financial markets amounting to EUR 39.348 billion (+0.78%).

The development of undertakings for collective investment is as follows:

The number of undertakings for collective investment (UCIs) taken into consideration totalled 3,392, against 3,403 the previous month. A total of 2,212 entities adopted an umbrella structure representing 13,163 sub-funds. Adding the 1,180 entities with a traditional UCI structure to that figure, a total of 14,343 fund units were active in the financial centre.

As regards the impact of financial markets on the main categories of undertakings for collective investment and the net capital investment in these UCIs, the following can be said for the month of October.

October saw a partial recovery of most UCI equity categories, despite a context marked by the Ukraine crisis, high inflation, recession fears and rising interest rates. Credit spreads narrowed while bond yields slightly continued to rise.

Concerning developed markets, the European equity UCI category registered a positive performance, supported by measures taken by European governments to dampen the impact of the energy crisis and by more dovish European Central Bank (ECB) statements induced by a deteriorating economic outlook. Concerning the US equity UCI category, despite activity indicators also worsened in the United States and inflation stayed at a high level, the US equity category also realised a positive performance in October. The Japanese equity UCI category, facing a stronger internal demand, having a lower inflation than most other developed markets and being supported by an accommodative monetary policy, finished the month in positive territory.

As for emerging countries, the Asian equity category realised an overall negative performance in a context marked by the ongoing strict zero-COVID policy in China, the atony of its property market and by the reappointment of the president Xi, while South Korea, the Philippines and India recorded gains. The Eastern European equity UCI category realised a positive performance as the region followed the upward trend of the European equity markets. The Latin American equity UCI category was the best performing UCI category in October due to lower inflation expectation and more positive growth outlook.

In October, the equity UCI categories registered overall a negative net capital investment.

Development of equity UCIs during the month of October 2022*

| Market variation in % | Net issues in % | |

| Global market equities | 3.23% | -0.27% |

| European equities | 5.65% | -0.77% |

| US equities | 5.54% | -0.22 % |

| Japanese equities | 0.56% | -0.53% |

| Eastern European equities | 2.82% | -0.11% |

| Asian equities | -9.55% | -1.74 % |

| Latin American equities | 8.78% | -0.37% |

| Other equities | -1.24% | -1.19% |

* Variation in % of Net Assets in EUR as compared to the previous month

Given the level of inflation, close to 10%, the ECB decided to raise again its policy interest rates by 75bps. While the rise was anticipated by the market and the ECB communication perceived as more dovish, the yields rose only marginally and credit spread narrowed. Overall the EUR denominated bond UCI category realised a positive performance in October.

The situation was relatively similar for the US denominated bond UCI category, with a slight rise of the yields and a narrowing of credit spreads. The deterioration of the economic outlook and the slowdown of the real estate market were perceived as correlates of a potentially less hawkish attitude of the Federal Reserve Bank (Fed). Despite the good performance of the high yield bonds segment, the US denominated bond UCI category recorded a loss, partially driven by the depreciation of the USD against the EUR.

The Emerging Market bond UCI category declined in October, due to the tightening of financial conditions in a rising rate environment and to the weaker global growth.

In October, fixed income UCI categories registered an overall positive net capital investment. The global money market UCI category recorded the highest inflows.

Development of fixed income UCIs during the month of October 2022*

|

Market variation in % |

Net issues in % |

|

| EUR money market |

0.04% |

3.27% |

| USD money market |

-1.63% |

-0.29% |

| Global money market |

0.93% |

8.74% |

| EUR-denominated bonds |

0.20% |

-0.81% |

| USD-denominated bonds |

-1.94% |

-0.40% |

| Global market bonds |

-1.79% |

0.75% |

| Emerging market bonds |

-1.60% |

-3.24% |

| High Yield bonds |

0.58% |

-2.73% |

| Others |

1.89% |

-1.05% |

* Variation in % of Net Assets in EUR as compared to the previous month

The development of net assets of diversified Luxembourg UCIs and funds of funds is illustrated in the table below.

Development of diversified UCIs and funds of funds during the month of October 2022*

|

Market variation in % |

Net issues in % |

|

| Diversified UCIs |

0.94% |

-0.79% |

| Funds of funds |

0.47% |

-0.03% |

* Variation in % of Net Assets in EUR as compared to the previous month

II. Breakdown of the number and net assets of UCIs

During the month under review, the following seven undertakings for collective investment have been registered on the official list:

UCITS Part I 2010 Law:

- APIARIST UCITS, 15, avenue J-F Kennedy, L-1855 Luxembourg

- DP PATRIMONIAL, 12, rue Eugène Ruppert, L-2453 Luxembourg

- MOVETOGETHER SICAV, 4, rue Thomas Edison, L-1445 Strassen

- TALENTS UCITS FUND, 56, rue d’Anvers, L-1130 Luxembourg

UCIs Part II 2010 Law:

- BLACKSTONE PRIVATE EQUITY STRATEGIES FUND (MASTER) FCP, 2-4, rue Eugène Ruppert, L-2453 Luxembourg

- BLACKSTONE PRIVATE EQUITY STRATEGIES FUND SICAV, 11-13, boulevard de la Foire, L-1528 Luxembourg

- BSK ΑVALUE FONDS, 1C, rue Gabriel Lippmann, L-5365 Munsbach

The following eighteen undertakings for collective investment have been deregistered from the official list during the month under review:

UCITS Part I 2010 Law:

- DEUTSCHLAND ETHIK 30 AKTIENINDEXFONDS UCITS ETF, 4, rue Thomas Edison, L-1445 Strassen

- FREDERIK G., 19-21, route d’Arlon, L-8009 Strassen

- GBM ASSET MANAGEMENT SICAV, 16, boulevard Royal, L-2449 Luxembourg

- INTERMONTE SICAV, 5, allée Scheffer, L-2520 Luxembourg

- MULTI-STRATEGY PORTFOLIO, 80, route d’Esch, L-1470 Luxembourg

- TIBERIUS GOLD- UND METALLAKTIENFONDS, 1C, rue Gabriel Lippmann, L-5365 Munsbach

UCIs Part II 2010 Law:

- LEUDELANGE FUND, 33A, avenue J-F Kennedy, L-1855 Luxembourg

- NAGELMACKERS PRIVILEGE, 5, allée Scheffer, L-2520 Luxembourg

SIFs:

- APF ABSOLUTE RETURN STRATEGIES FUND, 49, avenue J-F Kennedy, L-1855 Luxembourg

- CREON ENERGY FUND S.C.A., SICAV-SIF, 6, rue Eugène Ruppert, L-2453 Luxembourg

- EULERPHI S.C.A. SICAV-SIF, 18, boulevard Royal, L-2449 Luxembourg

- FAP FUND S.C.SP., SICAV-SIF, 1C, rue Gabriel Lippmann, L-5365 Munsbach

- LEVEL ONE INVESTMENTS S.A., 23, Val Fleuri, L-1526 Luxembourg

- LIC US GROWTH FUND SICAV-FIS, 5, rue Heienhaff, L-1736 Senningerberg

- OBERON CREDIT INVESTMENT FUND II SCA SICAV-SIF, 15, boulevard Friedrich Wilhelm Raiffeisen, L-2411 Luxembourg

- PURE SICAV-SIF S.A., 2, rue d’Arlon, L-8399 Windhof

SICARs:

- FONSICAR S.A., SICAR, 33a, avenue John F. Kennedy, L-1855 Luxembourg

- NPEI LUX S.A. SICAR, 17, boulevard F.W. Raiffeisen, L-2411 Luxembourg