Priorités de supervision de la CSSF en matière de finance durable (uniquement en anglais)

Mise à jour mars 2024

The objective of this present document is to give a general overview of the CSSF’s supervisory priorities in the area of sustainable finance.

As the supervisory authority of the financial sector, the CSSF strives to accompany the transition of the financial sector and its players in a proactive way.

The integration of sustainability and adequate consideration of sustainability risks as key drivers of financial strategies is a long-term objective. In support of this ambition, the CSSF’s supervisory priorities in the area of sustainable finance aim at fostering a cohesive implementation of the sustainable finance framework across the financial sector and ensuring the integration of ESG requirements in the CSSF’s supervisory practice.

The regulatory framework in relation to sustainable finance continues to be further enhanced and progressively improved upon. In such an evolving context, and taking into account regulatory developments as well as developing practices, the CSSF will continue implementing its risk-based approach to supervision.

Notwithstanding, the primary responsibility of ensuring compliance with applicable requirements lies with the supervised entities and their board members, who should ensure that the integration of ESG factors in traditional governance, risk management and compliance tools is a focal point within their organisations, and endeavour to make suitable ESG education a priority for themselves and their personnel.

The present document is not to be construed as an exhaustive or definitive list. It rather aims at drawing the attention of the financial sector to a number of prominent matters to be addressed in this area. If deemed necessary, our supervision priorities may be adjusted, and the CSSF’s duties of ongoing prudential supervision may also warrant other ESG-related aspects to come under scrutiny.

Focus areas

Supervisory priorities for credit institutions

(i) Transparency and disclosures

The CSSF will continue to ensure the supervision of disclosure obligations for credit institutions which fall within the scope of Regulation (EU) 2019/2088 on sustainability‐related disclosures in the financial services sector (SFDR) through the long form report, as revised per our Circular CSSF 22/821. The long form report incorporates in the Self-Assessment Questionnaire a dedicated section on sustainability disclosures. Following the entry into application of the SFDR regulatory technical standards (the SFDR RTS), additional off-site reviews of SFDR website disclosures at entity and product level will be performed on a sample basis.

In December 2022, the ITS on prudential disclosures on ESG risks in accordance with Article 449a of Regulation (EU) No 575/2013 were published in the Official Journal. These ITS put forward the tables, templates, and associated instructions that large institutions with securities traded on a regulated market of any Member State must use in order to publicly disclose relevant qualitative information on ESG risks, and quantitative information related to climate.

(ii) Risk management and governance

Climate-related and environmental risks integration and mitigation will remain one of the priorities for the banking sector, as per the SSM’s supervisory priorities for 2023-2025.

Following the two iterations of the self-assessment exercise on climate-related and environmental risks conducted between 2022 and 2024 for a sample of less significant institutions (“LSI”) and third-country branches, the CSSF plans to integrate dedicated questions on climate-related risks integration and governance in the long form report for banks, in order to ensure proper alignment of the banking sector with the CSSF’s expectations set out in Circular CSSF 21/773.

For this purpose, the CSSF also intends, as from 2024, to develop and carry out on-site inspections specifically focused on climate-related and environmental risks.

Further, on-site inspections on governance, business models and credit risks will continue to include aspects with regard to climate-related and environmental risks. On-site inspections on depositary banks will also consider ESG aspects, in line with the ESMA Supervisory Briefing on Sustainability risks and disclosures in the area of investment management published on 31 May 2022.

Credit institutions shall also be made aware that the CSSF is expecting to conduct a sample-based review of the remuneration policies and practices in order to gain an understanding of how such policies have been updated to ensure consistency with the integration of sustainability risks in their governance and business models.

(iii) MiFID rules related to sustainability

Since 2 August 2022, supervised entities that provide investment advisory or discretionary portfolio management services shall collect and take into account the sustainability preferences of their clients in their suitability framework. In addition, when acting as manufacturer and/or distributor of financial instruments, supervised entities have been required to consider sustainability factors in their product governance arrangements since 22 November 2022. In this context, the ESMA guidelines on MiFID II Suitability requirements and the ESMA guidelines on MIFID II product governance requirements, both applicable since 3 October 2023, have been fully integrated in the CSSF’s administrative practice and regulatory approach in accordance with the provisions of Circulars CSSF 23/835 and CSSF 23/840.

As a rule, the CSSF will maintain close contacts with the industry and with professional associations aiming at providing guidance and identify best practices in this area.

In July 2024, ESMA will launch a common supervisory action (“CSA”) focused specifically on the integration of sustainability in firms’ suitability assessment and product governance processes and procedures (see below our calendar of planned supervision exercises). In this context, the CSSF will conduct off- and on-site inspections of a sample of credit institutions and investment firms.

In addition, the CSSF will keep conducting MiFID on-site inspections covering sustainability-related obligations in the areas of product governance, suitability assessments, conflicts of interest, information to clients and internal control functions. Besides, the MiFID on-site inspection team will update its internal control plan to cover the SFDR product disclosure requirements applying to supervised entities providing discretionary portfolio management services to conduct on-site inspections in this area.

Supervisory priorities for the asset management industry

The CSSF will continue to monitor Investment Fund Managers’ (IFMs) compliance with the sustainability-related provisions as set forth under the SFDR, the SFDR RTS and Regulation (EU) 2020/852 (the Taxonomy Regulation). In so doing, the CSSF will take due consideration of the principles and guidance laid down in the ESMA Supervisory Briefing on Sustainability risks and disclosures in the area of investment management published on 31 May 2022. The CSSF will integrate any additional regulatory developments on the topic in its supervisory approach.

The CSSF will focus on the following priority areas in accordance with a risk-based approach:

(i) Organisational arrangements of IFMs, including the integration of sustainability risks by financial market participants

SFDR requires IFMs to comply with a set of rules regarding the integration of sustainability risks in their activities and outlines related mandatory website disclosures in this regard. The CSSF expects IFMs’ organisational arrangements to take due account of the integration of sustainability risks, notably in terms of human resources and governance, investment decision or advice processes, remuneration and risk management processes and policies and management of conflicts of interest as required under SFDR. The verification of the integration of those provisions in the IFMs’ organisational arrangements will remain an integral part of the CSSF supervisory approach.

(ii) Verification of the compliance of pre-contractual and periodic disclosures

SFDR, the SFDR RTS and the Taxonomy Regulation lay down transparency requirements regarding the provision of sustainability-related information in pre-contractual and periodic documentation of financial products. In this respect, the CSSF will continue to assess the compliance of pre-contractual and periodic disclosures of investment funds with the SFDR regulatory provisions.

(iii) Verification of the consistency of information in fund documentation and marketing material

The CSSF will continue to assess and verify that sustainability-related disclosures made are consistent across the fund documentation and marketing material.

(iv) Verification of the compliance of product website disclosures

The CSSF will continue to verify that IFMs comply with their obligations relating to the publication and maintenance on their website of SFDR related information for the investment funds they manage.

(v) Portfolio analysis

In line with the requirements of the Supervisory Briefing, the CSSF will undertake supervisory actions to ensure that portfolio holdings reflect the name, the investment objective, the strategy, and the characteristic displayed in the documentation to investors.

The CSSF has published in August 2023 a report on the outcome of a Thematic Review it has performed on the implementation of sustainability-related provisions in the investment industry (the “Thematic Review”). The objective of the Thematic Review, which notably relates to all of the above CSSF supervisory priorities in the asset management sector, was to inform the industry about the main observations the CSSF has made in the context of its offsite and onsite supervisory work on the topic and about the related recommendations for improvements in view of the applicable regulatory requirements. The report notably clarifies that the CSSF expects IFMs, in the context of their ongoing assessment of their compliance with the sustainability-related requirements, to also take due account of the results of this Thematic Review and take, if applicable, the necessary corrective measures.

In addition, on 6 July 2023, ESMA has announced the launch of a CSA with National Competent Authorities across the European Union on the integration of sustainability risks and disclosures in the asset management sector. The CSA follows a two-stage process, the first stage focusing more closely on greenwashing risks and the second phase on the integration of sustainability risks and factors in the organisational arrangements of UCITS Managers and AIFMs and on the transparency disclosures at IFM and product level.

The CSSF has launched the first phase of this CSA in August 2023. The second phase of this CSA will be launched in Q1 2024. The subsequent publication of the reports in this regard will follow its course, ESMA planning to draft its final report in Q1 2025.

The CSSF will continue to use the information collected in its dedicated SFDR IFM, pre-contractual and periodic data collection exercises in its supervisory work. The CSSF reminds IFMs that it remains their responsibility to ensure that the information provided to the CSSF in those different data collection exercises is being kept up to date at any point in time. The CSSF will conduct further thematic on-site inspections on the integration of sustainability-related provisions by IFMs in their organisation. As well, in line with the SFDR FAQ and the CSSF communiqués on SFDR, the CSSF will continue to provide clarifications to the industry as the need may be.

Finally, the CSSF draws the attention of IFMs that ESMA has published a Public statement on Guidelines of funds’ names on 14 December 2023. This Public Statement provides information on the forthcoming ESMA guideline on funds‘ names using ESG or sustainability -related terms and will likely impact the asset management regulatory landscape in the near future once the date of application of these Guidelines will be confirmed.

Supervisory priorities for investment firms

(i) Transparency and Disclosures

As regards the disclosure obligations applicable under SFDR to investment firms providing investment advice and portfolio management services, the framework of the long form report applicable to investment firms has been revised to realign it with the supervisory and prudential points of focus of the CSSF.

In order to allow for a gradual implementation, the revised framework will become applicable in a staggered manner: for the financial year ending 31 December 2023, all Class 2 IFs incorporated under Luxembourg law, including their branches and certain Class 3 IFs will be required to submit the revised long form report, whereas all other investment firms will remain subject to Circular CSSF 03/113. For financial years ending after 31 December 2023, all investment firms will have to submit the revised long form report in accordance with Circular CSSF 24/853.

Further information can be found in our communication dated 6 February 2024 relating to the publication of Circular CSSF 24/853 on the revised long form report for investment firms.

(ii) Risk management and governance

The CSSF will continue to implement a gradual approach to its supervision of ESG risks for investment firms, prioritising the recognition of ESG risks in investment firms’ strategies and governance arrangements. Circular CSSF 20/758 on administration, internal governance and risk management will be updated in due course.

(iii) MiFID rules related to sustainability

The CSSF’s supervisory priorities for investment firms will mirror those for credit institutions as described above for credit institutions.

Supervisory priorities for issuers

As in previous years, ESMA, together with the European national accounting enforcers, including the CSSF, identified European common enforcement priorities (the “ECEPs”) for the 2023 annual reports to which particular attention will be paid when monitoring and assessing the application of the relevant reporting requirements.

Climate and other environmental matters have been identified as a priority for both IFRS financial statements and non-financial statements. In that context, the CSSF has published, on 8 January 2024, a communication which outlines its enforcement priorities for the 2023 annual reports published by issuers subject to the Transparency Law.

In addition, the entry into force of Directive (EU) 2022/2464 (better known as the Corporate Sustainability Reporting Directive or the “CSRD”) as from 1 January 2024 for the annual reports published in 2025 for issuers currently reporting under the NFRD will require significant preparation from issuers to implement the new requirement. As the entry into force of the CSRD is phased over the next few years, the range of issuers falling within the scope of the CSRD will ultimately be much broader than that of issuers currently falling within the scope of the NFRD. To support issuers in the implementation of these requirements, the CSSF has published, on 2 February 2024, a gap analysis which provides a preliminary understanding of the gap that remains to be addressed by issuers with regards to the transition from the NFRD to the CSRD in terms of sustainability disclosures.

International cooperation in sustainable finance

The CSSF’s role

Given the international, far-reaching, and cross-cutting scope of sustainable finance, an important part of the CSSF’s role is to ensure the representation of Luxembourg in national, European and international groups driving initiatives relating directly or indirectly to sustainable finance.

The CSSF supports the European Supervisory Authorities (the “ESAs”) and international bodies such as the Basel Committee on Banking Supervision (BCBS), the European Financial Reporting Advisory Group (EFRAG), the International Sustainability Standards Board (ISSB), and the Network for Greening the Financial System (NGFS) in promoting the coherence, cohesiveness, and consistency of the sustainable finance framework.

In that context, the CSSF will continue to cooperate with the relevant European and international bodies to aim for the clarification of a number of fundamental concepts, including supporting the European Commission’s work in ensuring the consistency of initiatives in the area of international disclosures.

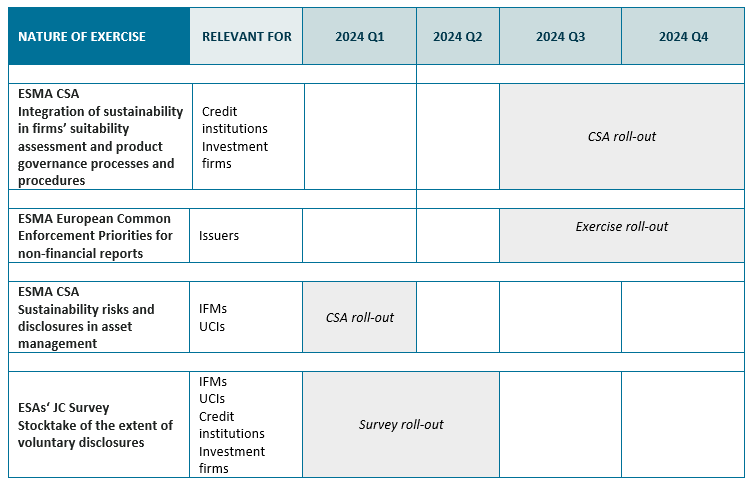

Schedule of supervision exercises at the initiative of the European authorities

Based on the tentative calendar available at the time of the present communication, the CSSF would like to provide a simplified overview of supervision exercises in the area of sustainable finance, as planned by the ESAs and based on available information to date: