Publication de la loi du 20 mai 2021 transposant la Directive CRD V (uniquement en anglais)

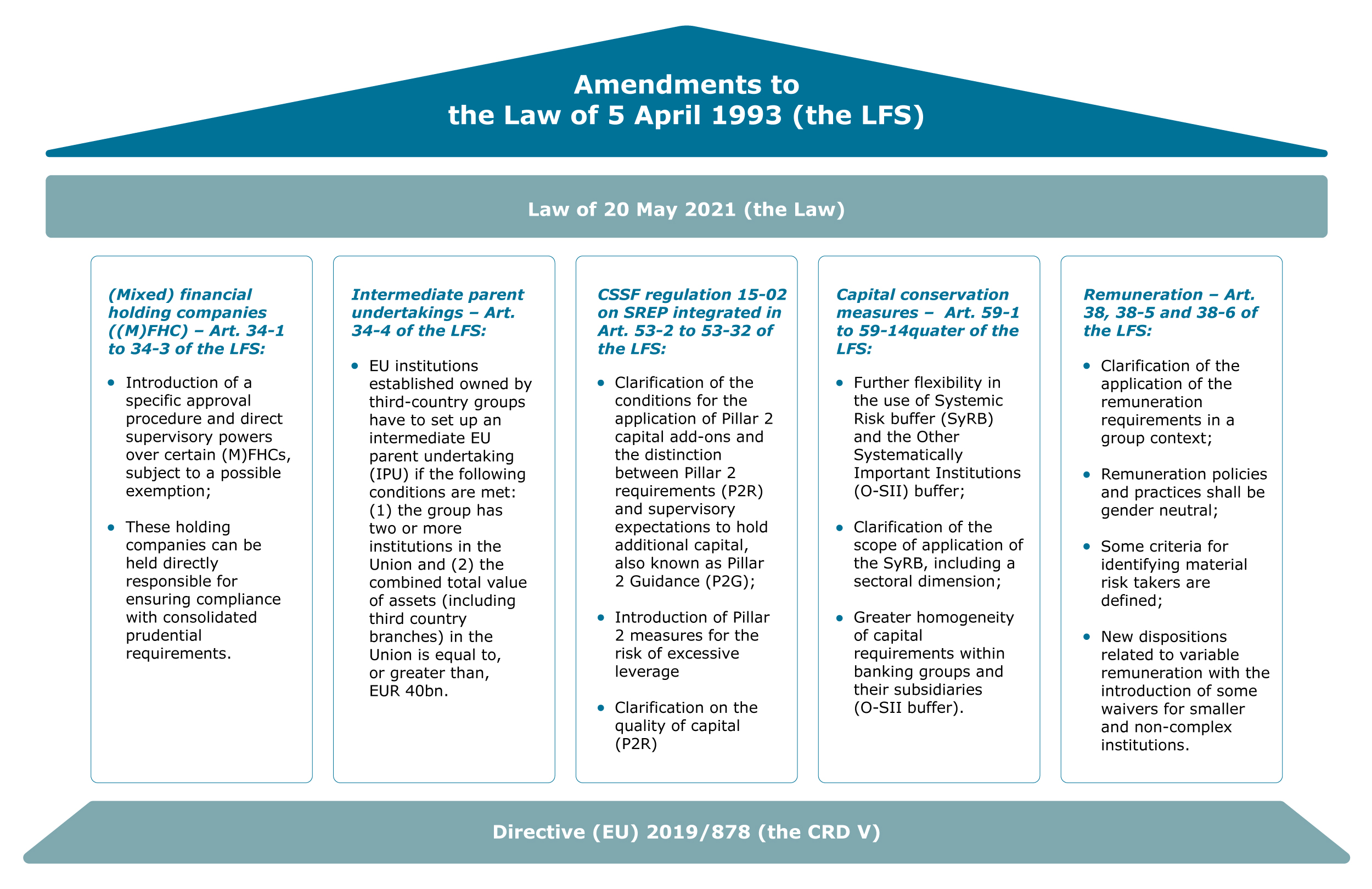

The CSSF would like to inform the public of the publication of the law of 20 May 2021 (the Law), which, among others, transposes Directive (EU) 2019/878 of 20 May 2019 amending Directive 2013/36/EU as regards exempted entities, financial holding companies, mixed financial holding companies, remuneration, supervisory measures and powers and capital conservation measures (CRD V) and amends the law of 5 April 1993 on the financial sector (LFS).

In this context, the CSSF would like to draw the public’s attention more specifically to the following developments under or in connection with the Law:

a) New approval process for financial holding companies and mixed financial holding companies (Art. 34-1 to 34-3 of the LFS)

Articles 34-1 to 34-3 of the LFS introduce a new approval process for and direct supervisory powers over certain (mixed) financial holding companies ((M)FHCs). The aim of this procedure is to ensure that such holding companies can be held directly responsible for ensuring compliance with consolidated prudential requirements stemming from CRD V and Regulation (EU) No 575/2013 (CRR). (M)FHCs are however not subject to additional prudential requirements on an individual basis.

The new approval procedure applies both to existing and newly established (M)FHCs.

According to the Law, (M)FHCs shall seek an approval and submit the application file and the supporting documentation to the competent authority in charge of the supervision of the group on a consolidated basis and, where the (M)FHC is established in a different Member State, also to the competent authority of the Member State where the (M)FHC is established. In this latter case, both the consolidating supervisor and the competent authority of the Member State where the (M)FHC is established shall reach a joint decision to approve the (M)FHC.

Please note however that, where the (M)FHC is established in the Banking Union and is part of a significant group subject to the direct supervision of the European Central Bank (ECB), the application file and the supporting documentation are to be provided to the ECB exclusively, which is competent to grant the approval.

Please note that there are situations where a (M)FHC is not required to be approved, in particular when it does not engage in taking management, operational or financial decisions affecting the group or its subsidiaries that are institutions or financial institutions. Such exemption is however subject to the fulfilment of a number of conditions set out in the Law. In this case, a (M)FHC shall nonetheless apply for an exemption from approval and provide the supporting documentation to the same competent authorit(y)(ies) as stated above.

In accordance with article 67 of the LFS, (M)FHCs already existing on 27 June 2019 can benefit from a transitional period but are required to apply for approval (or for an exemption) by 28 June 2021.

For any question relating to (M)FHCs, please contact: crd_referentiel@cssf.lu

b) Intermediate EU parent undertaking – Art. 34-4 of the LFS

According to article 34-4 of the LFS, institutions established in the EU and owned by third-country groups (TCGs) are now required to set up an intermediate parent undertaking (IPU) if the TCG has two or more institutions in the EU with a combined total value of assets equal to or greater than EUR 40 billion. For the purpose of calculating such threshold, TCGs shall include the assets of their third-country branches authorised in the EU (though third-country branches are not required to become branches of the EU institutions under the IPU).

The general rule is that TCGs should in principle set-up one single IPU, which may be a credit institution or a (M)FHC that has been granted approval in accordance with article 34-2 of the LFS.

In accordance with article 68 of the LFS, TCGs which met the EUR 40 billion threshold as of 27 June 2019 have until 30 December 2023 to set up an IPU.

Finally, the CSSF would like to draw the attention of the public to the forthcoming EBA Guidelines on the monitoring of the threshold for establishing an intermediate EU parent undertaking. These guidelines will specify the methodology for computing the EUR 40 billion threshold.

For any question relating to IPUs, please contact: crd_referentiel@cssf.lu

c) CSSF Regulation N° 15-02

The existing provisions of the CSSF Regulation N° 15-02 relating to the supervisory review and evaluation process (SREP) that applies to CRR institutions, including to Luxembourg branches of such institutions incorporated in a third country, are now fully integrated into the LFS.

The Law clarifies in particular the conditions for the application of Pillar 2 capital add-ons and the distinction between Pillar 2 requirements (P2R) and supervisory expectations to hold additional capital, also known as Pillar 2 Guidance (P2G). In addition, the Law introduces the application of Pillar 2 measures for the risk of excessive leverage (LR-P2R and LR-P2G) and the composition of capital for P2R is clarified.

For any question relating to the SREP, please contact: srep@cssf.lu

d) Capital conservation measures

Although the capital conservation measures are not fundamentally amended by the Law, further flexibility is provided in the use of Systemic Risk buffer (SyRB) and the Other Systematically Important Institutions (O-SII) buffer. Regarding the SyRB, there are two major changes introduced: (i) a clarified scope of application in the sense that the SyRB addresses systemic risks, to the extent that these are not already covered by the capital buffers for systemically important institutions (G-SIIs/O-SIIs) or the countercyclical capital buffer (CCyB), and (ii) the sectoral dimension of the SyRB. The SyRB can either apply to all exposures or to a sectoral subgroup of exposures, e.g. residential or commercial real estate exposures. Finally, the SyRB can apply to all banks or to one or more subsets of banks.

The changes to the O-SII buffer aim at providing a level playing field for EU banks and ensure greater homogeneity of capital requirements within banking groups and their subsidiaries. The changes include an increase of the overall buffer rate to 3% as well as an increase of the cap for subsidiaries.

For any question relating to the capital conservation measures, please contact: macropru@cssf.lu

e) Remuneration

The criteria for identifying material risk takers defined under article 38-5(2) of the LFS should be read in conjunction with the criteria defined in the Commission Delegated Regulation (EU) 2021/923.

New dispositions related to variable remuneration have been introduced in article 38-6 of the LFS. Articles 38-6(2) and (3) of the LFS introduce some waivers for smaller and non-complex institutions in the application of a limited number of remuneration requirements. The EBA Guidelines on sound remuneration policies, which are currently under revision, and in particular its section 4 on proportionality shall be taken into account when applying such waivers.

Articles 38(5) and (6) of the LFS clarify the application of the remuneration requirements in a group context and in particular with regard to institutions that are subject to a specific remuneration framework.

Finally, according to the Law, remuneration policies and practices shall now be gender neutral.

For any question relating to the remuneration requirements, please contact: remuneration@cssf.lu