Situation globale des organismes de placement collectif à la fin du mois d’août 2021 (uniquement en anglais)

Communiqué de presse 21/24

I. Overall situation

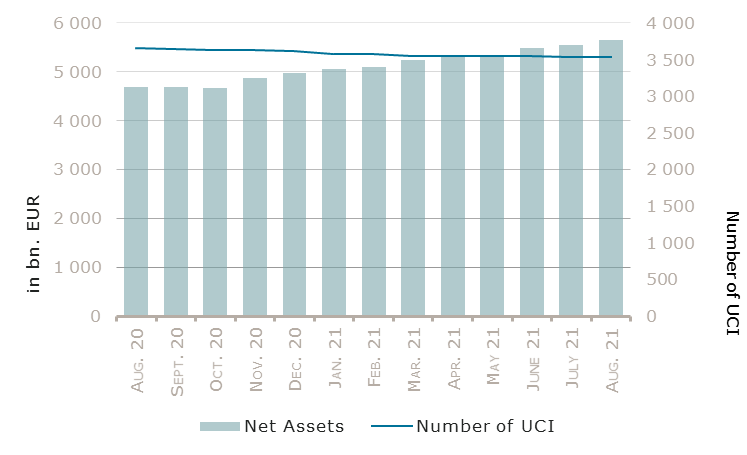

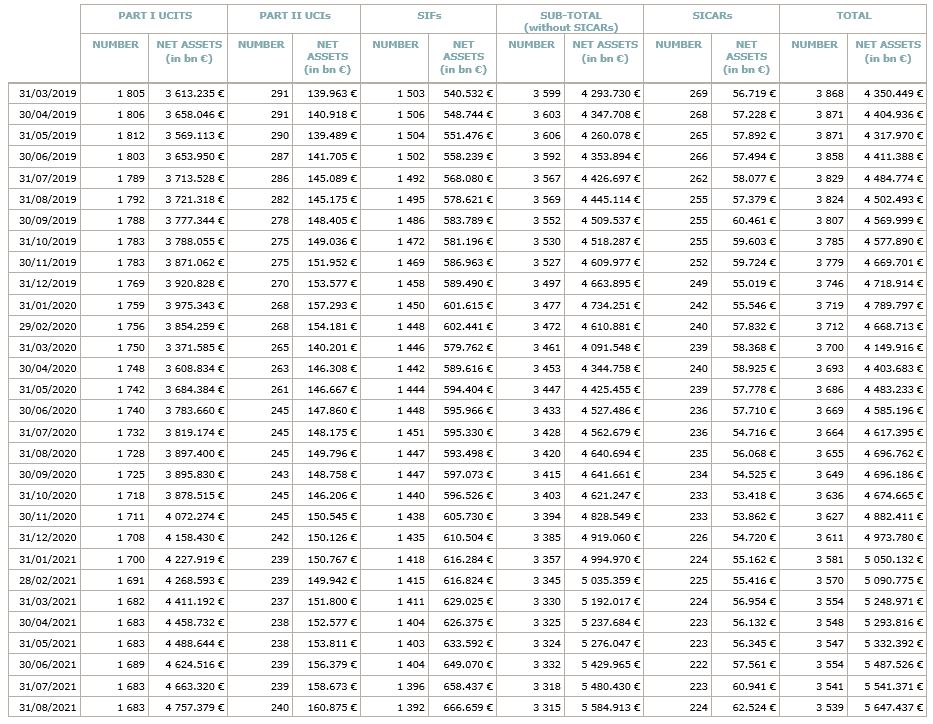

As at 31 August 2021, the total net assets of undertakings for collective investment, comprising UCIs subject to the 2010 Law, specialised investment funds and SICARs, amounted to EUR 5,647.437 billion compared to EUR 5,541.371 billion as at 31 July 2021, i.e. an increase of 1.91% over one month. Over the last twelve months, the volume of net assets rose by 20.24%.

The Luxembourg UCI industry thus registered a positive variation amounting to EUR 106.066 billion in August. This increase represents the sum of positive net capital investments of EUR 38.011 billion (+0.68%) and of the positive development of financial markets amounting to EUR 68.055 billion (+1.23%).

The development of undertakings for collective investment is as follows:

The number of undertakings for collective investment (UCIs) taken into consideration totalled 3,539, against 3,541 the previous month. A total of 2,328 entities adopted an umbrella structure representing 13,247 sub-funds. Adding the 1,211 entities with a traditional UCI structure to that figure, a total of 14,458 fund units were active in the financial centre.

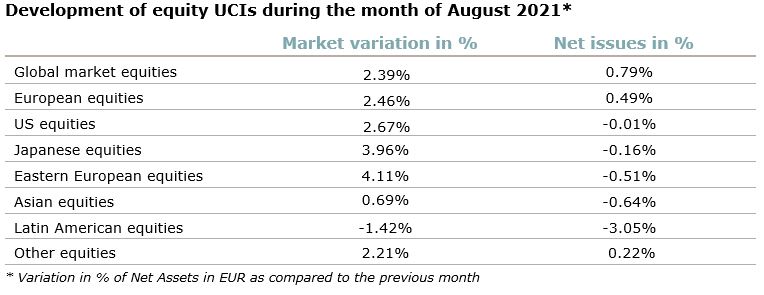

As regards the impact of financial markets on the main categories of undertakings for collective investment and the net capital investment in these UCIs, the following can be said for the month of August:

Concerning developed markets, the European equity UCI category realised a positive performance in a context marked by an ongoing economic recovery, the continuing accommodative monetary policy of the European Central Bank (”ECB”) despite growing inflation and the first transfers of the European Recovery Fund (“Next Generation EU”) to EU Member States. The US equity UCI category finished in positive territory as well, supported by better than anticipated corporate results, the bipartisan infrastructure deal passing the Senate and the comments of the Chair of the US Federal Reserve (“Fed”) at the Jackson Hole meeting which were broadly perceived as dovish, while being consistent with the general expectations on a soon to come tapering of the Fed’s asset purchase program. Despite the surge of new COVID-19 cases in Japan, the Japanese equity UCI category also rose against the backdrop of positive expectations concerning growth and corporate earnings.

As for emerging countries, the Asian equity UCI category registered overall a slightly positive performance driven by the easing of restrictions in countries such as Thailand, Philippines and Indonesia and the strong gains on India’s stock market in reaction to a loose monetary policy, while higher infection rates in various other Asian countries as well as the weaker than expected economic data and the continuing regulatory tightening in China weighted on the Asian equity UCI category. The Eastern European equity UCI category followed the upward trend on global equity markets, supported by the better than expected GDP growth in Russia. The Latin American equity UCI category on the other hand fell in August, largely due to a decline of the Brazilian equity market and the depreciation of several Latin American currencies.

In August, the equity UCI categories registered an overall positive net capital investment, mainly driven by inflows in the Global market equity UCI category

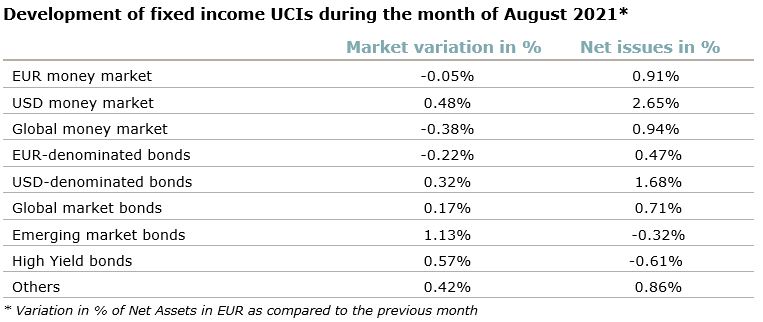

On both sides of the Atlantic, the yields of highly rated government bonds slightly increased (i.e. bond prices fell) against the backdrop of higher inflation, good economic data and the discussions on a tapering of the asset purchase programs of the ECB and the Fed. The yields of corporate bonds followed this upward trend. As a consequence, EUR-denominated bond UCIs ended the month in negative territory, while the slightly negative returns on USD-denominated bonds were overcompensated by the appreciation of the USD against the EUR which resulted in a positive performance of the USD denominated bond UCI category.

Despite interest rate hikes of several Emerging Market Central Banks, the Emerging Market bond UCI category rose, amid the ongoing accommodative monetary policy in the United States, a strong demand for Asian bonds, decreasing spreads and the appreciation of most Emerging Market currencies against the EUR.

In August, fixed income UCI categories registered an overall positive net capital investment. The USD money market UCI category recorded the highest inflows.

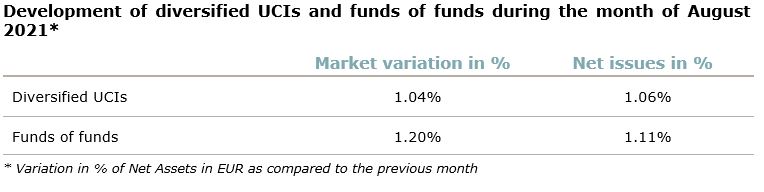

The development of net assets of diversified Luxembourg UCIs and funds of funds is illustrated in the table below:

II. Breakdown of the number and net assets of UCIs

During the month under review, the following six undertakings for collective investment have been registered on the official list:

UCITS Part I 2010 Law:

- UNIINVEST NACHHALTIG 1, 3, Heienhaff, L-1736 Senningerberg

- UNIINVEST NACHHALTIG 2, 3, Heienhaff, L-1736 Senningerberg

- UNIINVEST NACHHALTIG 3, 3, Heienhaff, L-1736 Senningerberg

- VARENNE UCITS, 5, allée Scheffer, L-2520 LUXEMBOURG

UCIs Part II 2010 Law:

- ARCA INVESTMENTS, 15, avenue J-F Kennedy, L-1855 Luxembourg

SICARs:

- COFRA BPEP SICAR, S.À R.L.

The following eight undertakings for collective investment have been deregistered from the official list during the month under review:

UCITS Part I 2010 Law:

- MIX-FONDS INDEX:, 6, rue Lou Hemmer, L-1748 Luxembourg-Findel

- SIMAG INVESTMENT FUNDS, 5, rue Jean Monnet, L-2180 Luxembourg

- SÜDINVEST GLOBAL STRATEGY, 8-10, rue Jean Monnet, L-2180 Luxembourg

- X OF THE BEST – KONSERVATIV, 18, boulevard de la Foire, L-1528 Luxembourg

SIFs:

- BAVARIA SICAV-SIF, 20, rue de la Poste, L-2346 Luxembourg

- BRUELLAN ASSET MANAGEMENT FUND, 12, rue Eugène Ruppert, L-2453 Luxembourg

- LYXOR ALTERNATIVE FLAGSHIPS, 28-32, place de la Gare, L-1616 Luxembourg

- PINEBRIDGE INVESTMENTS FUND SICAV-SIF, 49, avenue J-F Kennedy, L-1855 Luxembourg