Situation globale des organismes de placement collectif à la fin du mois d’octobre 2025 (uniquement en anglais)

Communiqué de presse 25/19

I. Overall situation

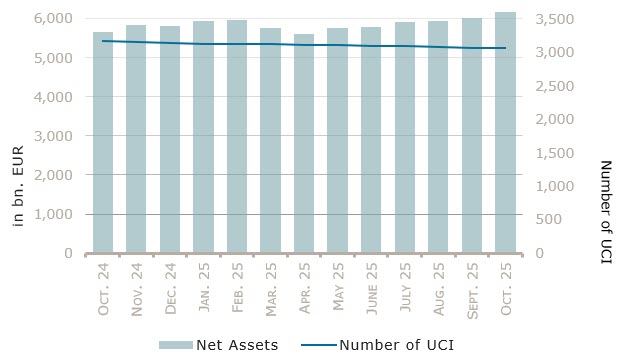

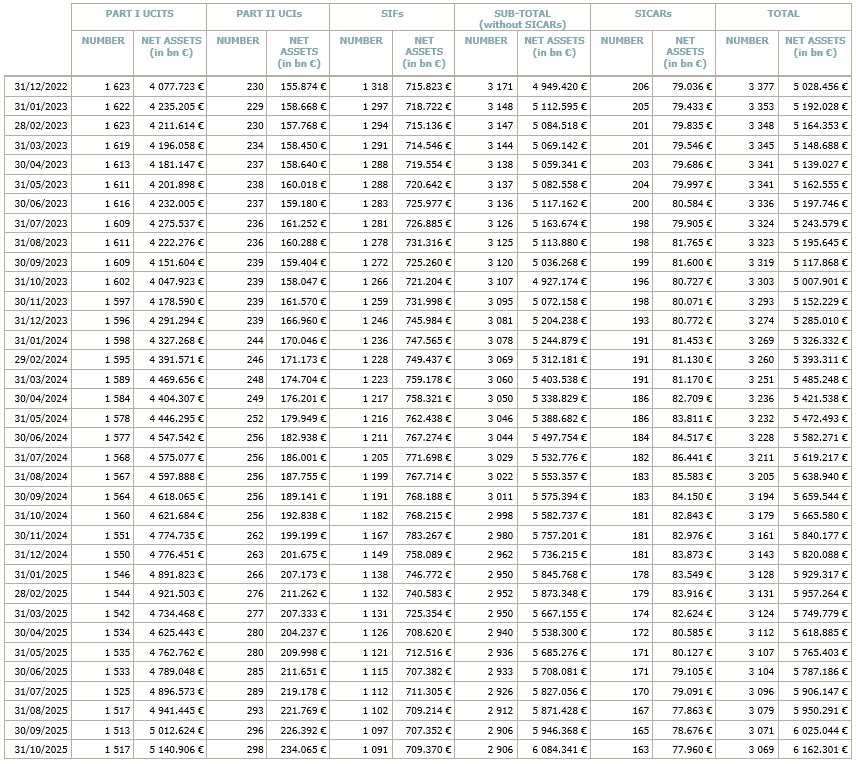

As at 31 October 2025, the total net assets of undertakings for collective investment, comprising UCIs subject to the 2010 Law, specialised investment funds and SICARs, amounted to EUR 6,162.301 billion compared to EUR 6,025.044 billion as at 30 September 2025, i.e. an increase of 2.28% over one month. Over the last twelve months, the volume of net assets increased by 8.77%.

The Luxembourg UCI industry thus registered a positive variation amounting to EUR 137.257 billion in October. This increase represents the sum of positive net capital investments of EUR 22.099 billion (0.37%) and of the positive development of financial markets amounting to EUR 115.158 billion (1.91%).

The development of undertakings for collective investment is as follows:

The number of undertakings for collective investment taken into consideration totalled 3,069, against 3,071 the previous month. A total of 2,050 entities adopted an umbrella structure representing 12,350 sub-funds. Adding the 1,019 entities with a traditional UCI structure to that figure, a total of 13,369 fund units were active in the financial centre.

As regards the impact of financial markets on the main categories of undertakings for collective investment and the net capital investment in these UCIs, the following can be said for the month of October.

The global economic environment was marked by renewed tensions between the US and China concerning notably rare earths, which are essential for artificial intelligence. However, a one-year trade truce was concluded between both countries late in the month resulting in a notable improvement in market sentiment. Against this backdrop, all equity UCIs categories posted substantial monthly gains, once again mostly fuelled by enthusiasm for AI and the broad benefits expected across the AI supply chain. Japanese equities recorded the strongest performance, further supported by the formation of a new government expected to implement expansionary policies favourable to markets. US equities delivered strong gains (with NVIDIA becoming the first company surpassing a market capitalisation of 5 trillion dollars), also helped by a 25-basis points rate cut by the Fed and solid corporate results. In contrast, European and Latin American equities, which are less exposed to AI, delivered comparatively lower performances, though still close to a solid 2%.

In October, equity UCI categories registered an overall positive capital investment from all categories except Global market equities, US equities and Asian equities which incurred outflows.

Development of equity UCIs during the month of October 2025*

|

Market variation in % |

Net issues in % |

|

| Global market equities |

3.11% |

-0.17% |

| European equities |

1.93% |

1.18% |

| US equities |

3.72% |

-0.06% |

| Japanese equities |

3.89% |

0.66% |

| Eastern European equities |

2.45% |

0.34% |

| Asian equities |

2.65% |

-0.11% |

| Latin American equities |

1.65% |

1.15% |

| Other equities |

3.89% |

0.48% |

* Variation in % of Net Assets in EUR as compared to the previous month

During the month, the Fed implemented a second consecutive 25-basis points rate cut despite divisions among voting members, amplified by incomplete economic data due to the prolonged US government shutdown. In Europe, the ECB maintained its policy stance, as widely expected. Bond markets benefitted from a fall in yields, both in the US and Europe, while credit spreads remained broadly stable, despite significant volatility during the month, notably due to concerns following the collapse of two large US companies. Favourable currency movements also supported performance, particularly the appreciation of the US dollar against the euro (reversing its downward trend of the previous months). Against this backdrop, all fixed income UCI categories delivered positive monthly returns.

In October, fixed income UCIs registered an overall positive net capital investment from all categories except USD money market, USD-denominated bonds and Global market bonds which incurred outflows.

Development of fixed income UCIs during the month of October 2025*

|

Market variation in % |

Net issues in % |

|

| EUR money market |

0.14% |

1.41% |

| USD money market |

1.71% |

-0.73% |

| Global money market |

0.02% |

1.91% |

| EUR-denominated bonds |

0.71% |

2.25% |

| USD-denominated bonds |

1.34% |

-0.04% |

| Global market bonds |

0.80% |

-0.21% |

| Emerging market bonds |

1.83% |

0.72% |

| High Yield bonds |

0.69% |

0.23% |

| Others |

1.06% |

1.80% |

* Variation in % of Net Assets in EUR as compared to the previous month

The development of net assets of diversified Luxembourg UCIs and funds of funds is illustrated in the table below:

Development of diversified UCIs and funds of funds during the month of October 2025*

|

Market variation in % |

Net issues in % |

|

| Diversified UCIs |

2.01% |

0.59% |

| Funds of funds |

1.77% |

0.17% |

* Variation in % of Net Assets in EUR as compared to the previous month

II. Breakdown of the number and net assets of UCIs

During the month under review, the following twelve undertakings for collective investment have been registered on the official list:

UCITS Part I 2010 Law:

- BAYERNINVEST LUX, 6B, rue Gabriel Lippmann, L-5365 Munsbach

- BEAUCLERC FUNDS, 2, rue d’Alsace, L-1122 Luxembourg

- DESCARTES UCITS FUND, 4, rue Peternelchen, L-2370 Howald

- FERI LABELLED BOND FUND, 5, Heienhaff, L-1736 Senningerberg

- FIDUKA, 4, rue Thomas Edison, L-1445 Strassen

- GATE CM FUND SICAV, 5, allée Scheffer, L-2520 Luxembourg

- KAROLL, 19, rue de Bitbourg, L-1273 Luxembourg

- RECKONER CAPITAL, 19, rue de Bitbourg, L-1273 Luxembourg

- VINCI COMPASS SICAV, 3, rue Jean Piret, L-2350 Luxembourg

UCI part II 2010 Law :

- ADAMS STREET SICAV SA, 49, Avenue J.F. Kennedy, L-1855 Luxembourg

- GLS ELTIF, 4, rue Thomas Edison, L-1445 Strassen

SIFs:

- OREIMA IV, 12, rue du Château d’Eau, L-3364 Leudelange

The following fourteen undertakings for collective investment have been deregistered from the official list during the month under review:

UCITS Part I 2010 Law:

- REZCO SICAV, 49, avenue John F. Kennedy, L-1855 Luxembourg

- RESPONSABILITY IMPACT UCITS (LUX), 5, rue Jean Monnet, L-2180 Luxembourg

- DEVON EQUITY FUNDS SICAV, 6H, route de Trèves, L-2633 Senningerberg

- DEKA-USA AKTIEN SPEZIAL, 6, rue Lou Hemmer, L-1748 Senningerberg

- BAYERNINVEST EURO, 6, rue Gabriel Lippmann, L-5365 Munsbach

SIFs:

- SKOPOS IMPACT FUND SICAF-SIF, 6, route de Trèves, L-2633 Senningerberg

- SKOPOS IMPACT FUND II SICAV-SIF, SCA, 6, route de Trèves, L-2633 Senningerberg

- SAPHIR CAPITAL INVESTMENT FUND, 2, rue d’Alsace, L-1122 Luxembourg

- ROBECO INSTITUTIONAL SOLUTIONS FUND, 6, route de Trèves, L-2633 Senningerberg

- PRIVACCESS II, 60, avenue John F. Kennedy, L-1855 Luxembourg

- HELENE FUND, 3, rue Gabriel Lippmann, L-5365 Munsbach

- ABERDEEN EUROPEAN RESIDENTIAL OPPORTUNITIES FUND, 35A, avenue John F. Kennedy, L-1855 Luxembourg

SICARs:

- DB PWM PRIVATE MARKETS I SCA-SICAR, 1c, rue Gabriel Lippmann, L-5365 Munsbach

- GPF CAPITAL I S.C.A. SICAR, 56, Grand-Rue, L-1660 Luxembourg